A story of investing with 4 charts of the S&P 500 since 1984 over 40 years: daily, monthly, annual and accumulated total returns from Koyfin

1 | Daily Returns of the S&P 500

It is going to be bloody noisy, and you don’t know on any given day whether is it going to be up or down, it is more like a coin toss.

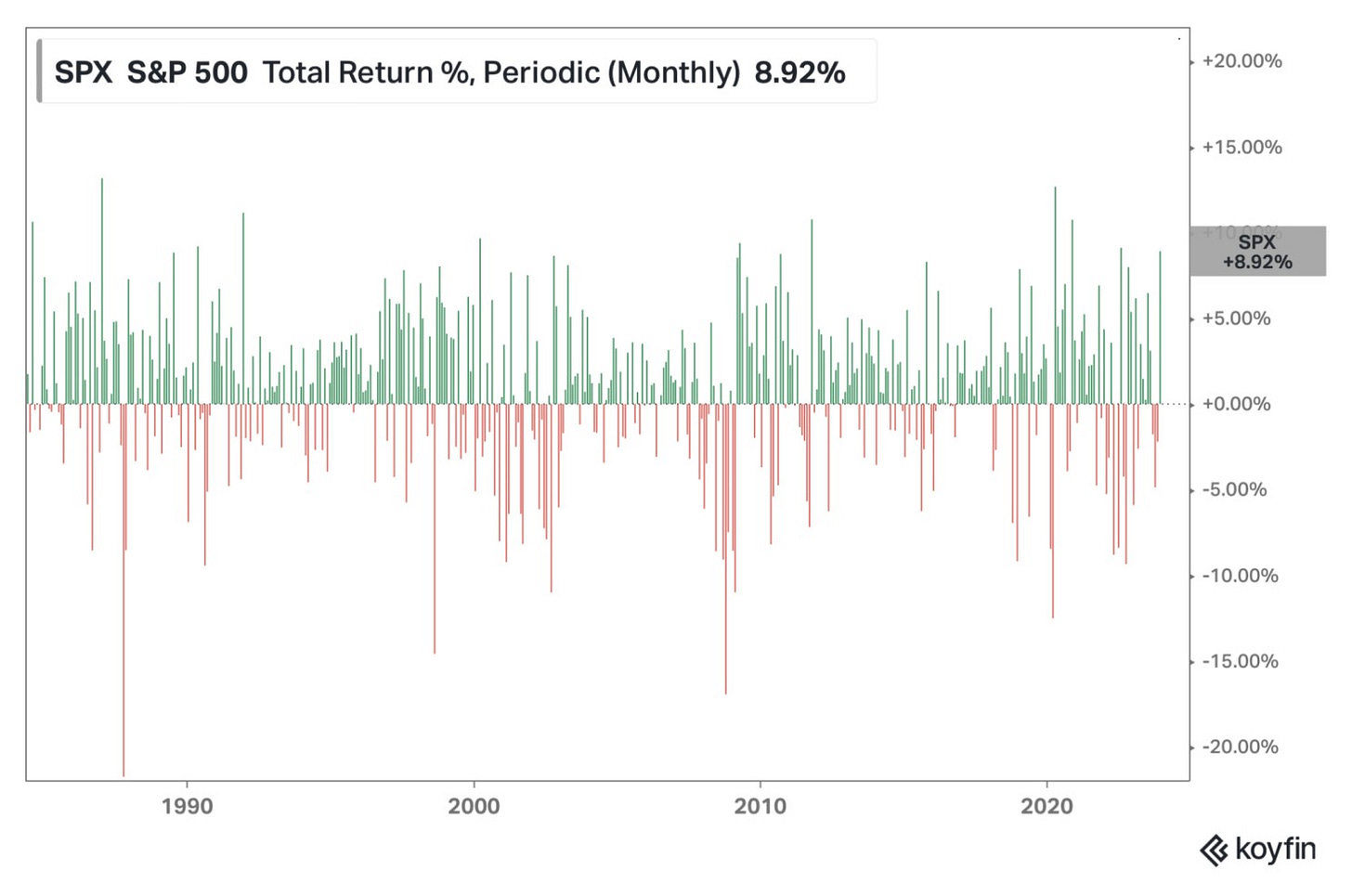

2 | Monthly Returns of the S&P 500

Monthly is less volatile than daily, but still very noisy.

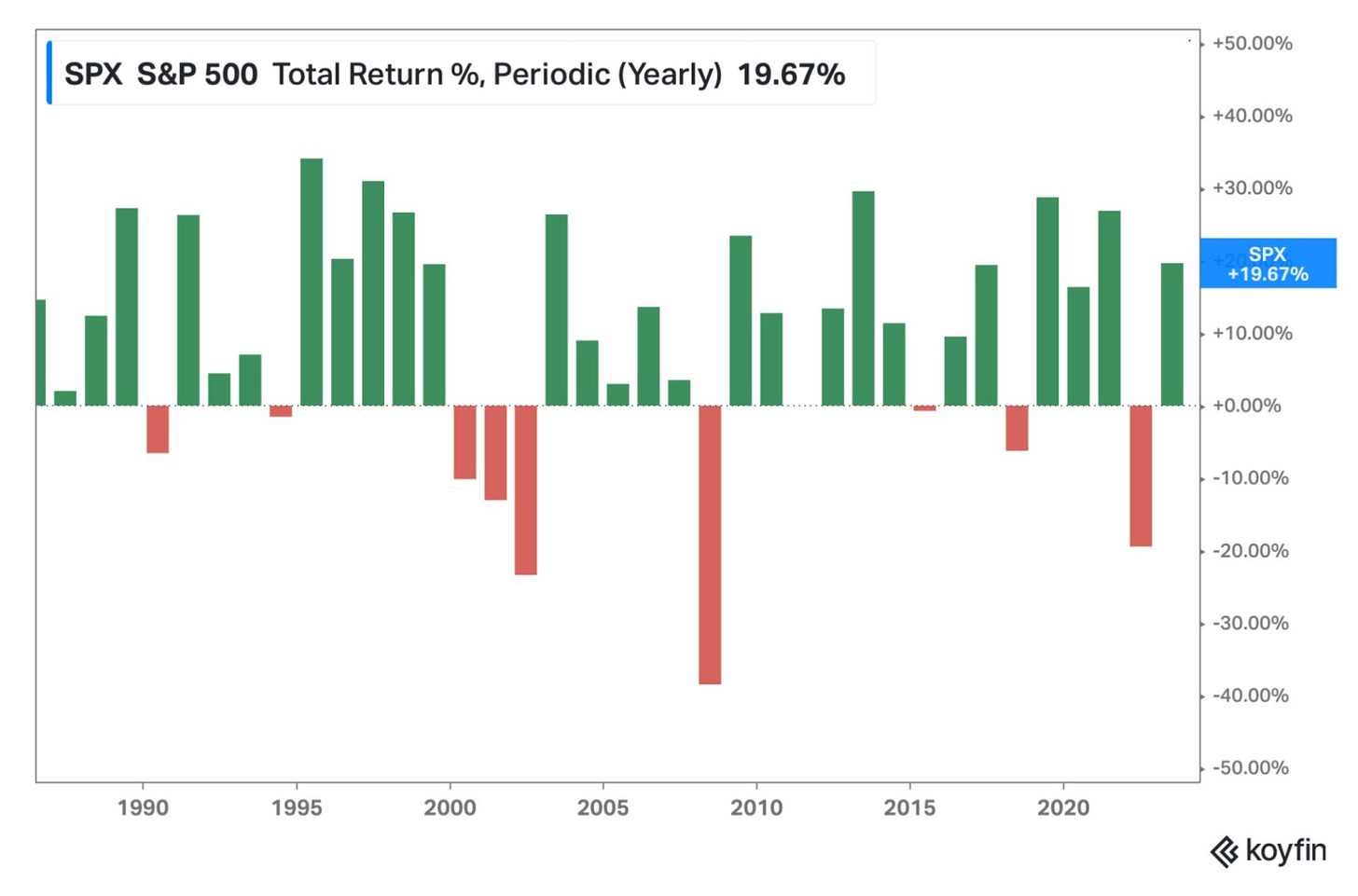

3 | Yearly Returns of the S&P 500

Annual returns are less noisy, with far more up years than down years, but there are still some occasional large drawdowns every few years.

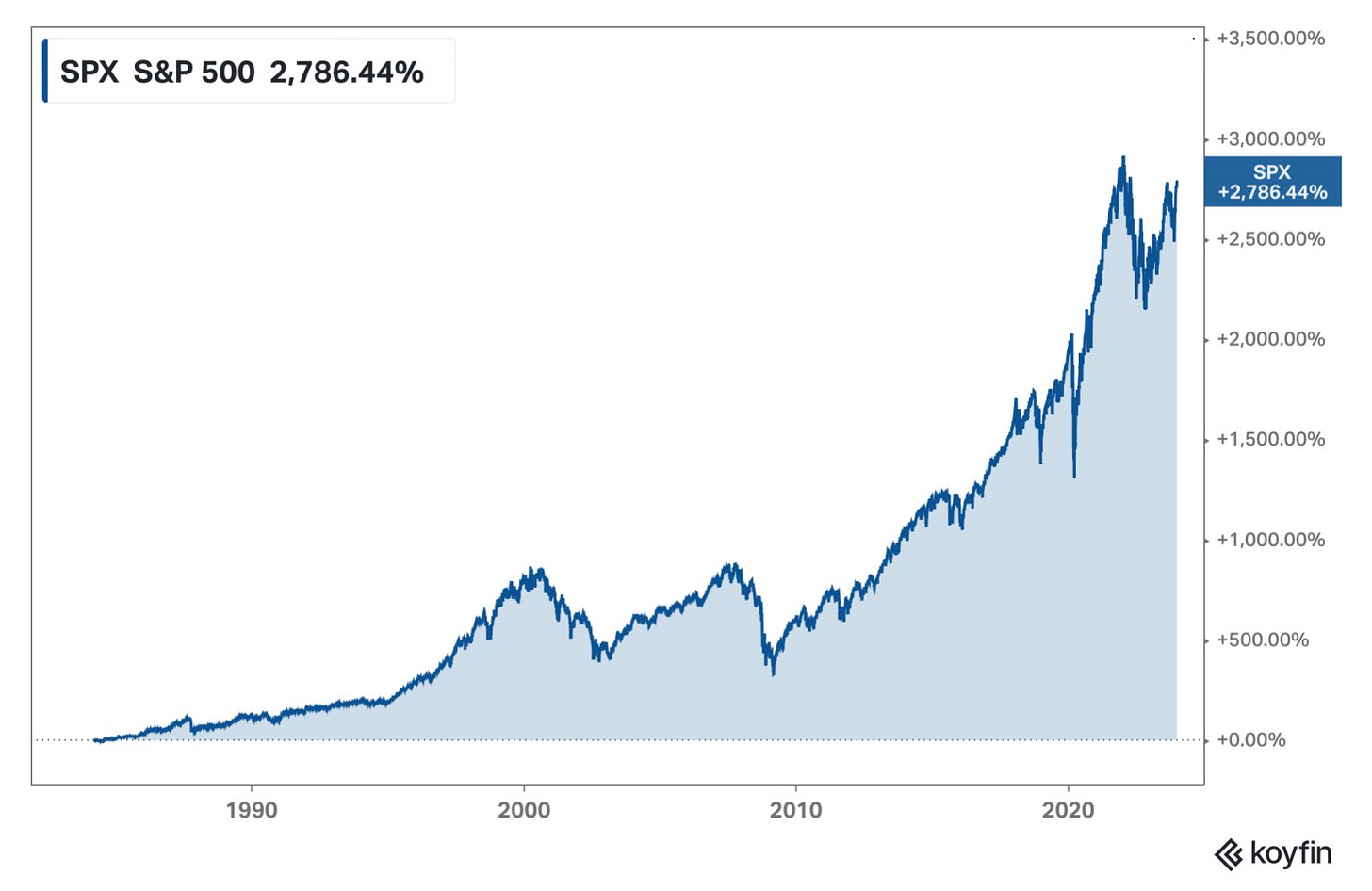

4 | Total Returns of the S&P 500

In investing, there is going to be a lot of ups and downs.

Seek to be one who can differentiate from the noise, be patient to hold through time, and excited to add during sell-offs, it can be hugely rewarding.

Seek to be one of these very few.

Charts are created using Koyfin, a platform that I love to use to find quick financials of the companies we invest in, and highly recommend.

For those interested, you can sign up for Koyfin here with a 15% discount.

02 Dec 2023 | Eugene Ng | Vision Capital Fund | eugene.ng@visioncapitalfund.co

Find out more about Vision Capital Fund.

You can read my prior Annual Letters for Vision Capital here. If you like to learn more about my new journey with Vision Capital Fund, please email me.

Follow me on Twitter/X @EugeneNg_VCap

Check out our book on Investing, “Vision Investing: How We Beat Wall Street & You Can, Too”. We truly believe the individual investor can beat the market over the long run. The book chronicles our entire investment approach. It explains why we invest the way we do, how we invest, what we look out for in the companies, where we find them, and when we invest in them. It is available for purchase via Amazon, currently available in two formats: Paperback and eBook.

Join my email list for more investing insights. Note that it tends to be ad hoc and infrequent, as we aim to write timeless, not timely, content.