The typical argument for stocks is that with higher interest rates (10Y US Treasuries yields), the higher the discounting rate for future cash flows, hence the lower the present value, and thus current stock prices should be lower.

Which is what we are seemingly currently facing right now with higher 10Y UST yields rising over the last few months from 3.2% to 4.5%+.

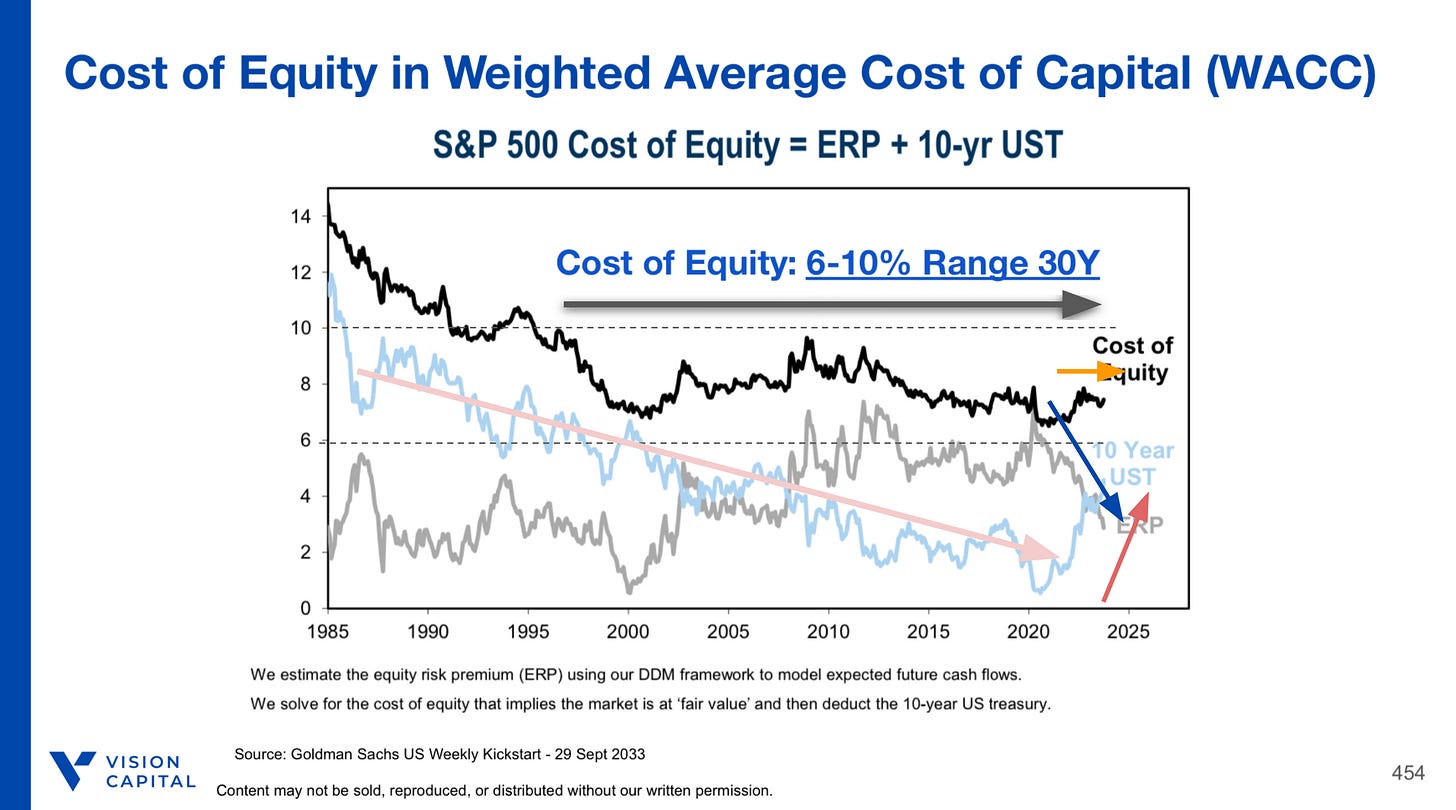

But instead looking at a historical chart below of the 40+ years, despite the most recent rise in 10Y UST yields, the Equity Risk Premium (ERP) which is the stock market returns less risk-free rate, has actually fallen, and the Cost of Equity only ending up flat / marginally higher.

What few realise is that moves in the Equity Risk Premium is somewhat counter cyclical to the the risk-free rate (i.e. 10Y UST), resulting in a far more muted moves up or down in the Cost of Equity, which explains in the Cost of Equity being 6-10% range-bound over the last 40 years despite decreasing interest rates (i.e. 10Y UST).

Add to that, most of the companies we choose to own have net cash (more cash than debt), that actually net benefits from rising interest rates, earning more interest income from cash, than paying interest expense on debt.

One can keep adjusting the discounting rate daily on a business whose fortunes does not fluctuate daily, and seemingly become a contributor to Mr Market’s crazy emotions just like most.

Or one can instead choose to focus on the business instead, finding great, growing durable, profitable, quality, businesses that keep compounding, to own for a long time, and use a through-cycle discounting rate / valuation multiples to value our businesses instead.

We prefer to focus on the latter, and hope more of you join us.

Bringing back Vision Investing

Due to a strong waitlist of students, I decided to bring back the second cohort of Vision Investing course where I teach live in person via Zoom over six 2.5 hour sessions over 2.5 weeks from 20 Nov 2023 - 5 Dec 2023, how to invest better in single stocks.

You will get to learn together with your peers over intense sessions, and do a final company presentation to put your learnings into practice, and get real-time feedback.

This is only for the committed, the ones who will be attending every single class, and playing with their hearts out 110% each time. You will learn everything you can about investing from me, from over 300+ hours of time to create over 700+ presentation slides of teaching materials just for you.

50% of the net proceeds will be investing in a Giving Back Fund, and of which 20% of the annual gains will be donated to worthy philanthropic causes. You get to learn and are able to give back as well at the same time.

For more information, you can find out more here. You can apply a limited time-only 15% discount code “VISION15” at checkout limited to the first 20 sign-ups.

4 Oct 2023 | Eugene Ng | Vision Capital Fund | eugene.ng@visioncapitalfund.co

Find out more about Vision Capital Fund.

You can read my prior Annual Letters for Vision Capital here. If you like to learn more about my new journey with Vision Capital Fund, please email me.

Follow me on Twitter/X @EugeneNg_VCap

Check out our book on Investing, “Vision Investing: How We Beat Wall Street & You Can, Too”. We truly believe the individual investor can beat the market over the long run. The book chronicles our entire investment approach. It explains why we invest the way we do, how we invest, what we look out for in the companies, where we find them, and when we invest in them. It is available for purchase via Amazon, currently available in two formats: Paperback and eBook.

Join my email list for more investing insights. Note that it tends to be ad hoc and infrequent, as we aim to write timeless, not timely, content.Thanks for reading Vision Investing Viewpoints! Subscribe for free to receive new posts and support my work.