Long-term stock investing is not a coin toss

It is not symmetrical, the average is not the median.

The average is not the median, especially over longer time frames.

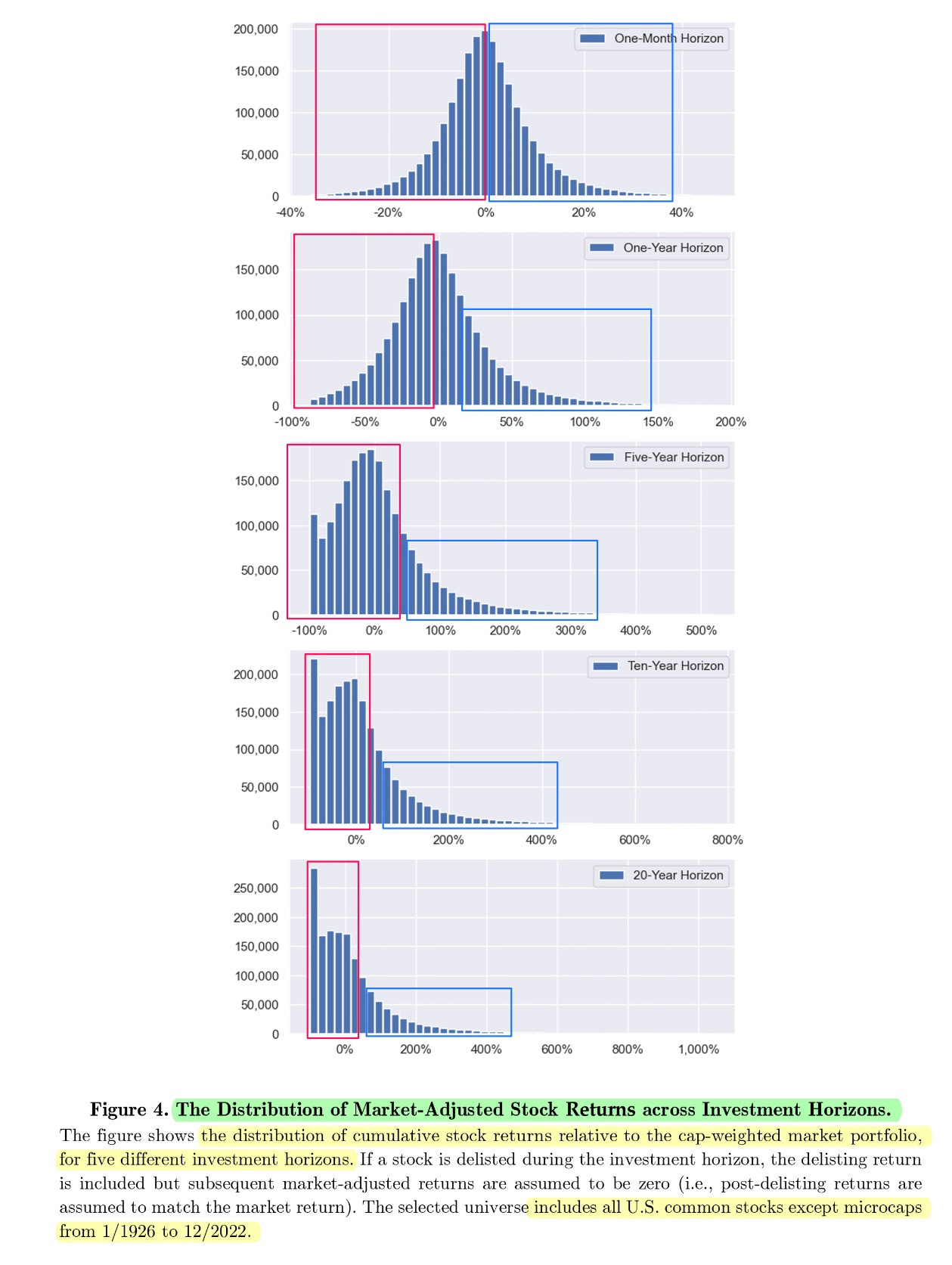

Over a short-term time frame of 1 month or 1 year, if you randomly invest in a single stock for 1 month or 1 year, it is like a coin toss with a 50/50 chance of losing money, with a seemingly symmetrical distribution.

But increase the time frame longer to 5, 10, 20 years, and it is no longer a 50/50 coin toss, the probability of losing money increases significantly, and it only becomes more and more asymmetric.

Distribution of Individual Stock Returns (1926 - 2022)

Why can one still have overall net positive returns despite most stocks not doing well?

Most stocks underperform the market as a whole over the long term, and this arises from positive skewness in the pattern of long-term stock returns.

This is because stock declines are limited to the downside of –100%, a few stocks can have extremely large positive returns, or theoretically unlimited upside (e.g. 10X, 20X, 50X, 100X+).

Positive skewness raises the mean/average stock return above the median, and leaves a majority of stocks underperforming the market as a whole.

This results in power laws, where the majority do not contribute to the returns, and a minority contributes to the overwhelming majority of returns.

Stocks might follow a well-behaved lognormal distribution over the short-term (1M, 1Y), but positive skewness increases significantly over long horizons (5Y, 10Y, 20Y).

The mean/average is not the same as the median. If you randomly pick stocks in any given sector, your most likely outcome with a very high probability, is that you would have lost money after 10-20 years.

That’s why we spend a lot of time focusing on how to avoid the left tails, left side of the distribution first, so we can then focus on skewing our holdings towards the right side of the distribution and the right tails.

That’s why we don’t advocate high concentration of 5-15 stocks. It sounds very smart to be able to do so, but I am not aware of many who have done so holding the same ones for a long time and doing well. Diversify enough in at least 20-30 stocks, but don’t over-diversify into 100-200+ stocks.

Let concentration be the outcome, not the process. Your winners will over time eventually become your biggest positions, and your losers really don’t matter. A little is all you need, and a little if all you want.

We do our best to find those winners, but sometimes as much we think we know for sure they could be, sometimes they just end up ain’t being so, and sometimes others become so.

06 Nov 2023 | Eugene Ng | Vision Capital Fund | eugene.ng@visioncapitalfund.co

Find out more about Vision Capital Fund.

You can read my prior Annual Letters for Vision Capital here. If you like to learn more about my new journey with Vision Capital Fund, please email me.

Follow me on Twitter/X @EugeneNg_VCap

Check out our book on Investing, “Vision Investing: How We Beat Wall Street & You Can, Too”. We truly believe the individual investor can beat the market over the long run. The book chronicles our entire investment approach. It explains why we invest the way we do, how we invest, what we look out for in the companies, where we find them, and when we invest in them. It is available for purchase via Amazon, currently available in two formats: Paperback and eBook.

Join my email list for more investing insights. Note that it tends to be ad hoc and infrequent, as we aim to write timeless, not timely, content.