Rethinking Investing in light of Rising Intangible Assets

Real life implications for investors.

As long-term investors in individual stocks, our task is clear. It is to comb through financial statements, reports, presentations, interviews, videos, conference calls to arrive at an investment thesis. Specifically, if the company can keep improving their profitability and continuously grow earnings over the long-run.

Understanding this would require a history lesson first…

The First Three Industrial Revolutions

The first three industrial revolutions had radically transformed our modern society over the past two centuries. With each of these three advancements — (1) the steam engine, (2) the age of science and mass production, and (3) the rise of digital technology — the world around us fundamentally changed, and arguably was shaped for the better each time.

The first wave of the steam engine powered machine tools, steamships and railroads, revolutionised how people got from A to B. That started the shift of our society from a largely agrarian to an urbanised one, and factories soon became the new center of community life.

With the second wave of mass production, scientific principles were brought right into the factories, most notably, the assembly line when Henry Ford started mass producing the groundbreaking Ford Model T. That further sparked further urbanisation and rise in factory jobs. Inventions such as electric lighting, radio, and telephones transformed the way people lived and communicated.

The digital revolution brought semiconductors, mainframe computing, personal computing, and the Internet. More specifically, we moved from antenna (analog) to digital, that dramatically disrupted industries. Production became more automated and supply chains more global.

The move from analog electronic and mechanical devices to pervasive digital technology dramatically disrupted industries, especially global communications and energy. Electronics and information technology began to automate production and take supply chains global.

The Fourth Industrial Revolution

And right now, it’s happening again, for a fourth time.

And so here we are, all of us together, poised at the beginning of the Fourth Industrial Revolution. But this time, the revolution is powered by the cloud, social, mobile, the Internet of things (IoT) and artificial intelligence (AI), along with increasing computing power and data.

The Dominance of Technology in Businesses Today

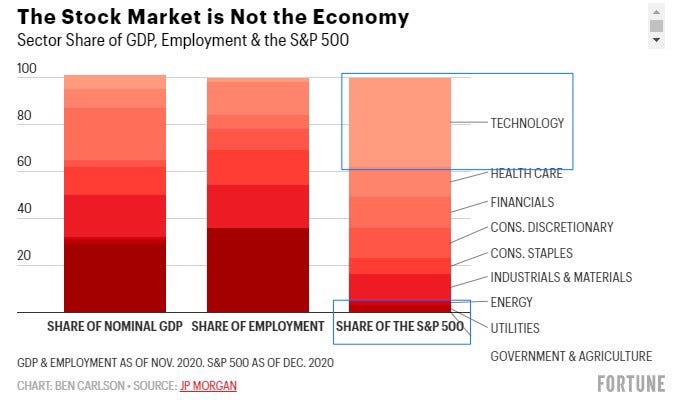

Thus, one should not be surprised that the Information Technology (IT) & Communications is now the biggest sector in the the US.

The Rise of Intangible Assets

The modern economy today is no longer driven by the need to have lots of capital and physical assets (think railroads, steel mills, factories, land, properties, plant, equipment, machinery, buildings and inventories, etc) to produce earnings.

With technology, the modern economy today is asset-light, not asset-heavy. It is increasingly driven by intangible assets, such as intellectual property, patents, copyrights, trademarks, brands, software, customer data and networks.

“The four largest companies today by market value do not need any net tangible assets. They are not like AT&T, GM, or Exxon Mobil, requiring lots of capital to produce earnings. We have become an asset-light economy.” — Warren Buffett (2018)

The following two charts illustrate the rise of intangible assets and the decline of tangible assets especially over the last few decades.

The longer-term decline in tangibles and the continued increase in intangibles coincided with the start of the third industrial revolution in the 1970s.

On a stock basis, intangible assets comprise almost half of the capital stock and their importance continues to grow even more each year. One should not be surprised that the stock of intangible capital in the economy could eventually overtake that of tangible capital in the coming years.

On a percentage split basis, it becomes even clearer than intangible assets now make up close to the majority of ~90% of S&P 500 assets.

Types of Intangible Assets

An investment is a cost today that creates an asset that is expected to provide a benefit measured by the present value of future free cash flow. The net present value of an investment is positive when the benefit is greater than the cost.

Investments can be in tangible or intangible assets.

Tangible assets are physical items, such as a machine, truck, or factory. Intangible assets are not physical. They can be customer relationships, product design, or instructions for how to manufacture a drug.

Intangible assets are non-physical items, ranging from patents, copyrights, trademarks, brands, network effects, goodwill, etc.

The Rise in Intellectual Property & Patents

Investing in R&D is necessary to have a shot at creating valuable intellectual property. However, effort alone doesn’t guarantee a successful ex-post outcome. Innovation is extremely unpredictable. While there is no perfect metric, patents provide a useful way to analyse the value of companies’ inventions.

Patents are important because they grant their owners a legal business & economic monopoly on the temporary exclusive use of a new invention for a defined period of time in exchange for public disclosure.

In line with the growth of the intangible economy, patent activity (via applications & grants) have surged over the past two decades in particular.

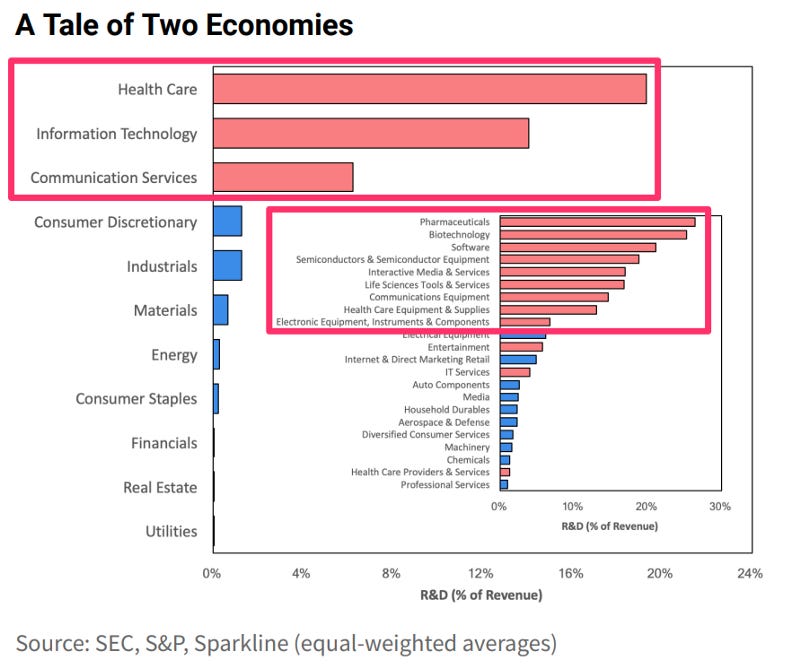

The importance of patents varies widely by industry & businesses. In the US, it is no surprise that patents are most prevalent in the health care and information technology industries.

R&D (i.e. intangible investments/assets) varies extremely widely by industry, sector and business. Pharma and biotech companies are the highest and invest ~25–27% of their revenue in R&D. Software companies invest ~21–22%. On the other hand, ~62% of industries invest less than ~1% of their revenue in R&D. What is clear is that the “new economy” (red) sectors and industries are spending far more in R&D relative to the “old economy” (blue), which should be no surprise.

What do we like about Intangible Assets?

(1) Optionality not Uncertainty.

An investment in intangible assets produces far more variable outcomes than that in tangible assets.

A $10 million R&D project could turn out to be worth $1 billion or $0. (e.g. Amazon with AWS, etc). This very skewed positive payoffs vs limited downside presents a “real option” is often difficult to quantify and measure, and is often not captured in accounting and financial numbers.

But this can provide great long-term advantages to the investor who is able to “see” this and recognise these patterns and incorporate into their investment due diligence process and decision framework.

(2) Scalability & Network Effects

Intangible assets are much more scalable than tangible assets. They tend to have high upfront fixed costs and zero marginal costs. Once the source code is written, producing additional units of software costs nothing. The tendency for intangibles to have network effects further amplifies these economies of scale (discussed later).

The greater synergies inherent in intangibles also fuels the winner-take-all dynamic. Inventions are often more valuable when combined with other inventions. However, the dynamics of intangibles are clearly anything but linear.

Intangibles & Current Accounting Standards

The world changes over time. One of the most profound changes we have seen in the corporate world is in the form of investment. Unfortunately. accounting standards have struggled to adapt. Current accounting standards do a poor job of reflecting the rise of intangible investments.

Tangible investments or the purchase of intangible investments (such as patents from another business) on the hand, are capitalisedas an asset on the balance sheet, then depreciated / amortised over time, which typically lead to higher earnings and invested capital.

On the other hand, internally developed intangibles investments are expensed entirely upfront on the income statement, reducing earnings and can even lead to losses. This is often a short-term occurrence, but eventually if the company can pull it off, supernormal earnings and profit margins could well materialise much later.

Thus a technology company pursuing an innovation strategy with high internally generated intangibles is likely have much higher P/B and P/E ratios than traditional brick & mortar industrial companies.

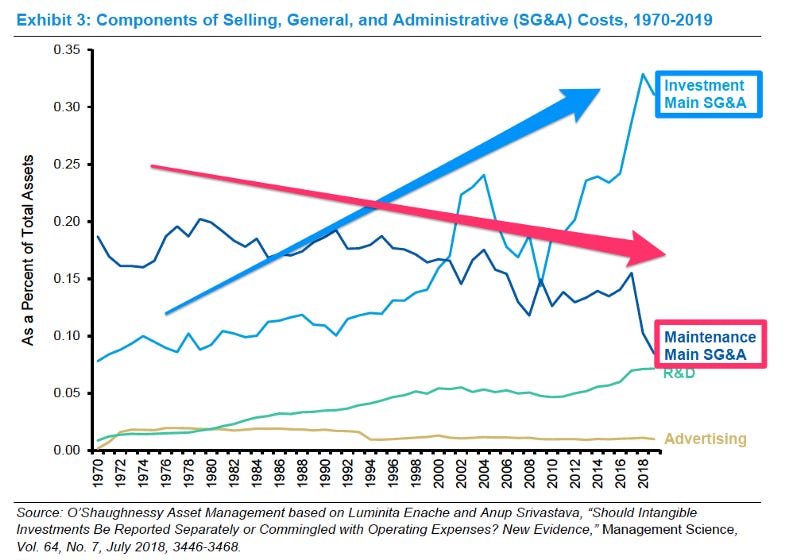

Composition of SG&A Expenses are changing

Investment Main SG&AExpenses (Sales, General & Administrative) that reflects spending that seeks to build organisational assets and includes employee training, customer acquisition costs, and software development have soared over time. This is while Maintenance Main SG&A that is necessary to maintain the business, like office and warehouse rents, customer delivery costs, and sales commissions, have declined in a similar fashion.

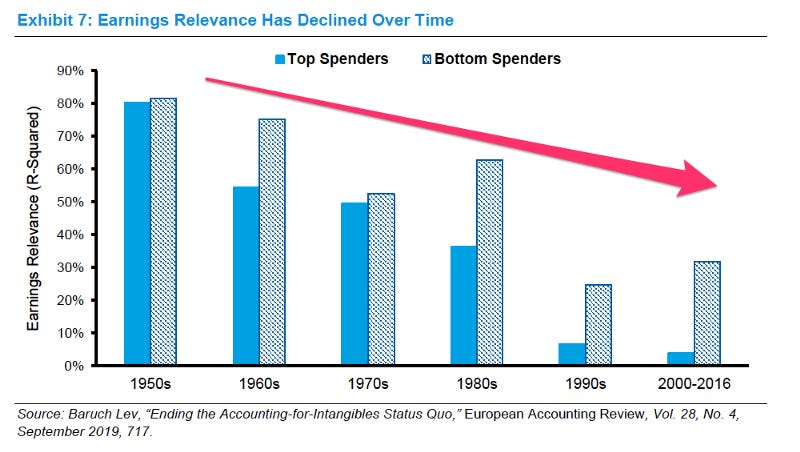

Decreasing Relevance of Earnings

Earnings have become less relevant for investors today than in the past.

This is because of the rise of intangibles and the increase in non-recurring, or ancillary, items reported in earnings. As investors seeking to understand value, we must thoughtfully deal with both.

Implications of the Rise in Intangibles for Investors

Traditional value investing had traditionally been synonymous with buying stocks with low price-to-book (P/B) or price-to-earnings (P/E) valuation multiples and correspondingly avoiding or shorting those with high multiples.

Earnings and book value clearly no longer mean what they are used to.

Tangible assets (such as properties, plant and equipment) were the foundation of business value in Benjamin Graham’s time. Yet intangible investments, such as R&D has been rising for decades and looks set to continue to outpace tangible investments in the years to come.

We must understand that accounting standards have yet to catch up. Which means accounting is the language of the old (physical) business, not the new (digital) business, at least not yet.

Noteworthy is that free cash flows remain unaffected by these different accounting treatments. There is a reason why Software SaaS companies typically have lower profitability (especially in the early stages) but exhibit much higher profitability later on, have stronger FCF margins, and tend to have high P/B and P/E ratios.

Comparing today’s valuations to those of the past using similar metrics such as a price-to-earnings or price-to-book multiples can lead to significant misleading or faulty conclusions, where profitability is understated, and P/B and P/E ratios overstated.

Technology together with intangible assets have also had a much likely longer-term impact on stock market valuations. Average long-term valuations (i.e. higher CAPE ratios, similar to P/E ratios but like a 10Y moving average of historical earnings, rather than current or forward) have slowly moved upward over time as technology has become a bigger piece of the pie:

It does not mean we should or should not invest in high P/B or P/E companies. But rather we should not apply a blanket judgement.

Choose instead to understand the business and focus on what truly is relevant, revenues, earnings and cash flows. Understand not just the numbers that are provided to us, and but what truly is going on, and hopefully that will shape us to be better investors for the longer-run.

13 Feb 2020 | Eugene Ng | Vision Capital Fund | eugene.ng@visioncapitalfund.co

Find out more about Vision Capital Fund.

You can read my prior Annual Letters for Vision Capital here. If you like to learn more about my new journey with Vision Capital Fund, please email me.

Follow me on Twitter/X @EugeneNg_VCap

Check out our book on Investing, “Vision Investing: How We Beat Wall Street & You Can, Too”. We truly believe the individual investor can beat the market over the long run. The book chronicles our entire investment approach. It explains why we invest the way we do, how we invest, what we look out for in the companies, where we find them, and when we invest in them. It is available for purchase via Amazon, currently available in two formats: Paperback and eBook.

Join my email list for more investing insights. Note that it tends to be ad hoc and infrequent, as we aim to write timeless, not timely, content.

This article is solely for informational purposes and is not an offer or solicitation for the purchase or sale of any security, nor is it to be construed as legal or tax advice. References to securities and strategies are for illustrative purposes only and do not constitute buy or sell recommendations. The information in this report should not be used as the basis for any investment decisions.

We make no representation or warranty as to the accuracy or completeness of the information contained in this report, including third-party data sources. The views expressed are as of the publication date and subject to change at any time.

Hypothetical performance has many significant limitations and no representation is being made that such performance is achievable in the future. Past performance is no guarantee of future performance.