The Evolution from Value to Growth to Vision

From Value 1.0 to 2.0 to 3.0: Employing Vision Investing to do good and do well

Last month, I had the opportunity to share our Vision Investing philosophy at MOI Global's 2025 Zurich Project. I wanted to share these prepared remarks and presentation slides with you as they capture my personal journey and our approach at Vision Capital Fund. I hope you find value in these shared insights.

I stood at a crossroads at age 30, over a decade ago. After years of studying economics and finance in Singapore and working 70-hour weeks at two major US investment banks (Citi and JP Morgan), I faced a sobering reality. The 2008 global financial crisis marked the end of the banking industry's golden era.

Ironically, despite my finance career, I had never read an investing book nor purchased a single stock or ETF. Except for buying Citi shares at over $10 during my first week working there in late 2008, only to watch the stock price collapse by 80% to below $2. That hardly qualifies as investing.

I knew nothing of Benjamin Graham, Warren Buffett, or Charlie Munger. I was not a child prodigy, nor did I have parents who taught me business. My parents divorced during my early teenage years after my father accumulated massive gambling debts. My younger brother and I grew up in public housing where loan sharks regularly plastered our corridors with threats and red paint. My mother was trying to make ends meet to raise my brother and me.

Recovery from a near-death accident pivots to investing

Life changed drastically on Christmas Eve twelve years ago. After too many drinks at a beach club, I foolishly attempted a somersault into a shallow swimming pool. My head hit the bottom of the pool, and I instantly knew I had broken my neck. By some miracle, I avoided near death and paralysis.

While my broken C1 vertebra has partially fused, it still remains broken to this very day. After my recovery, this life-changing experience became the pivot point in my life. I needed to do something meaningful with my life. I decided to choose investing as my lifelong pursuit.

The growth of a business drives long-term returns

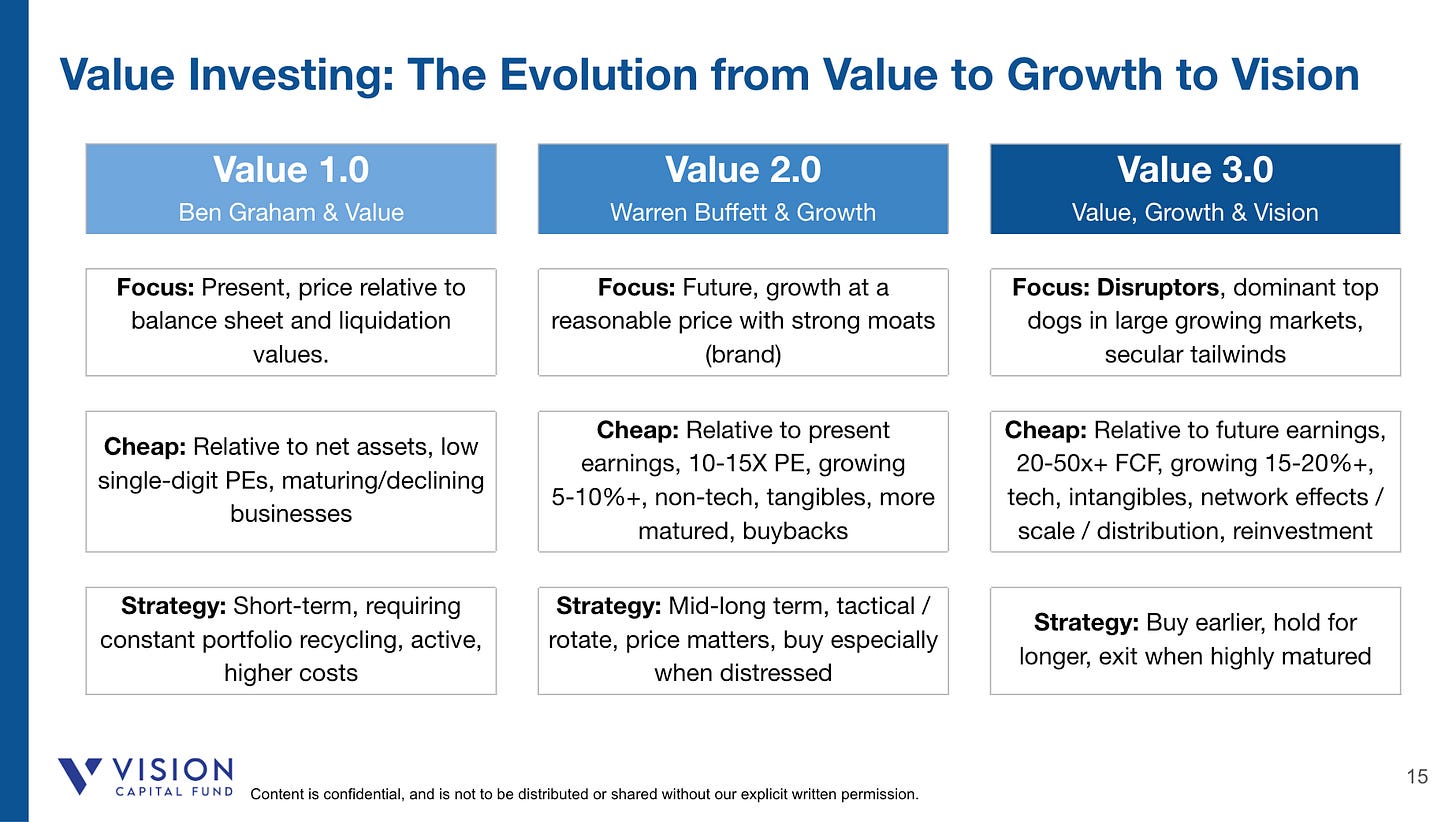

With zero investing knowledge beyond reading financial statements and understanding basic concepts, I enrolled in a three-day Buffett-influenced Value Investing course to accelerate my learning. The principles made immediate sense: buy good businesses at cheap prices with a high margin of safety. We were trying to buy $1 coins for $ 0.60 to $0.70. While value seemed critical, something still felt incomplete.

I returned to first principles and asked myself: What drives long-term rising stock prices? The answer was clear: As you can see in the leftmost chart, where revenues, profits, and free cash flows go, the stock price eventually follows.

On the right-most chart, while the change in valuation multiples primarily drives short-term returns (i.e., 46% in any given year), long-term stock returns largely come from the growth of revenues, profits, and FCF (~85-95% over 5-10 years).

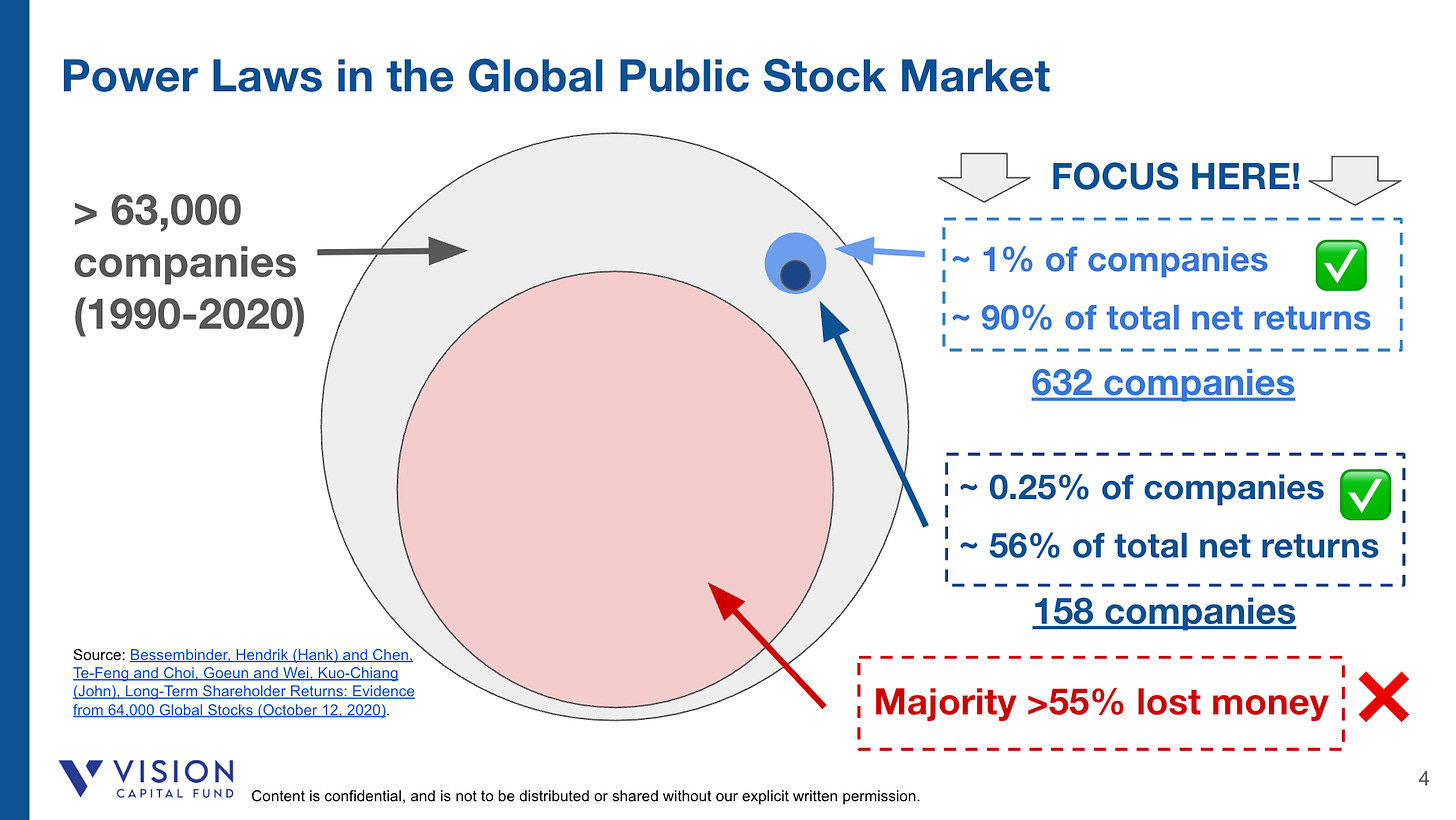

Power laws drive long-term global stock market returns

Power laws exist not just in venture capital but also in public equities. Here is a startling fact: researcher Hendrik Bessembinder found that from 1990 to 2020, just 1% of stocks globally accounted for 90% of total net returns. Think about that: 99% of companies added little to no value. The implications were clear. Success in investing is not about spreading bets evenly. It is about finding, holding, and adding to that exceptional 1%. We must fish in a tiny pond, not the vast ocean.

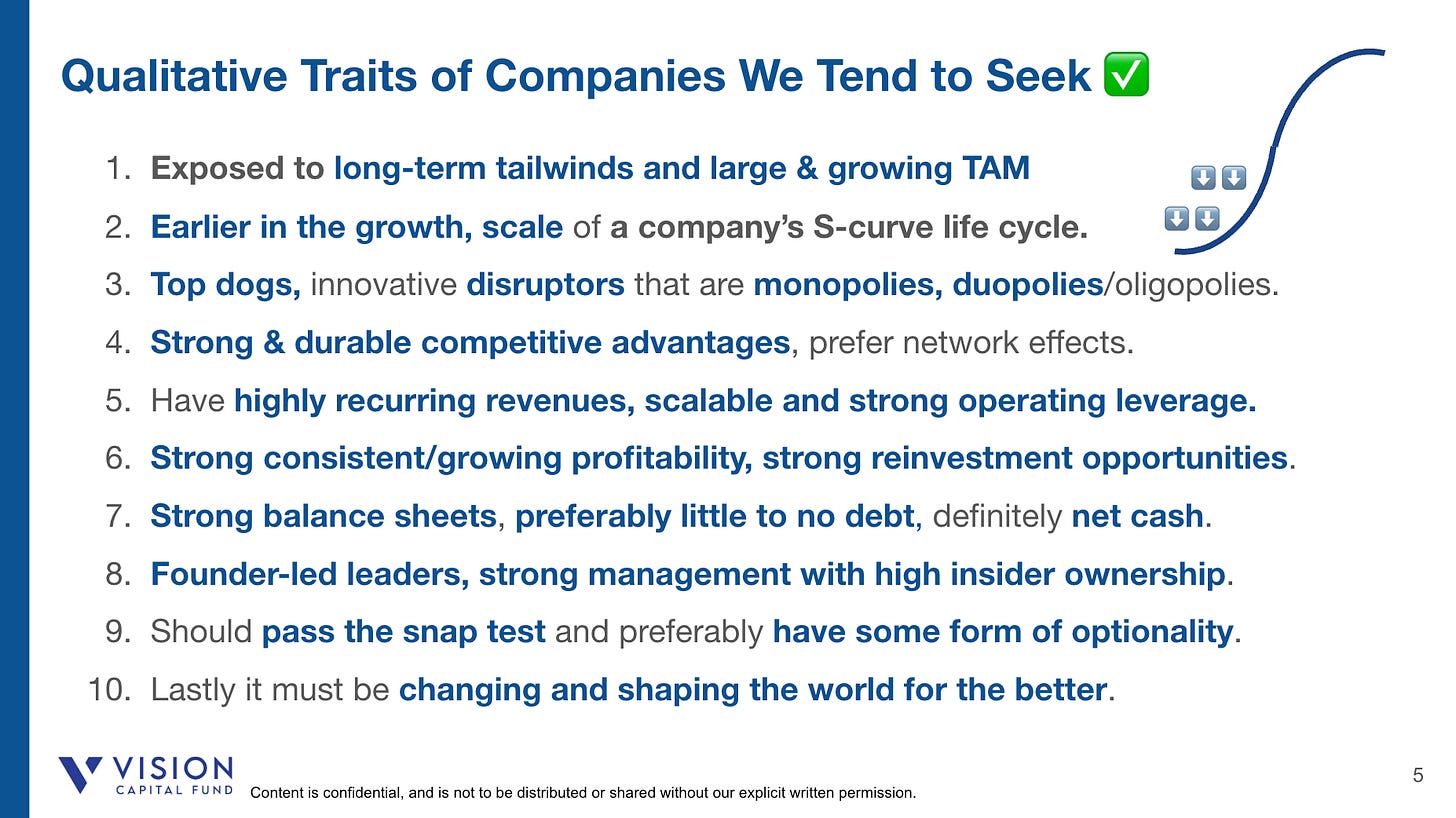

Knowing what we tend to seek

We aimed to identify the qualitative traits of exceptional businesses to get closer to the 1% of winners. We discovered that companies with these positive characteristics tend to outperform consistently. Today, these form our evaluation framework, and we monitor a dynamic list of less than 80 companies globally that fit our criteria.

We seek businesses riding powerful tailwinds, emerging as category leaders, disrupting incumbents, and competing in industries that tend toward monopolies, duopolies, or oligopolies, where it often becomes a case of winners taking most markets, allowing them to grow faster for longer and make more profits for longer.

Quality becomes a critical trait that we rigorously assess: the market opportunity and how a company innovates to win customer share, how efficiently it converts investments into profits, whether it can deploy more capital profitably as it grows, and whether its management teams think like owners. These quality markers separate sustainable compounders from fleeting growth stories.

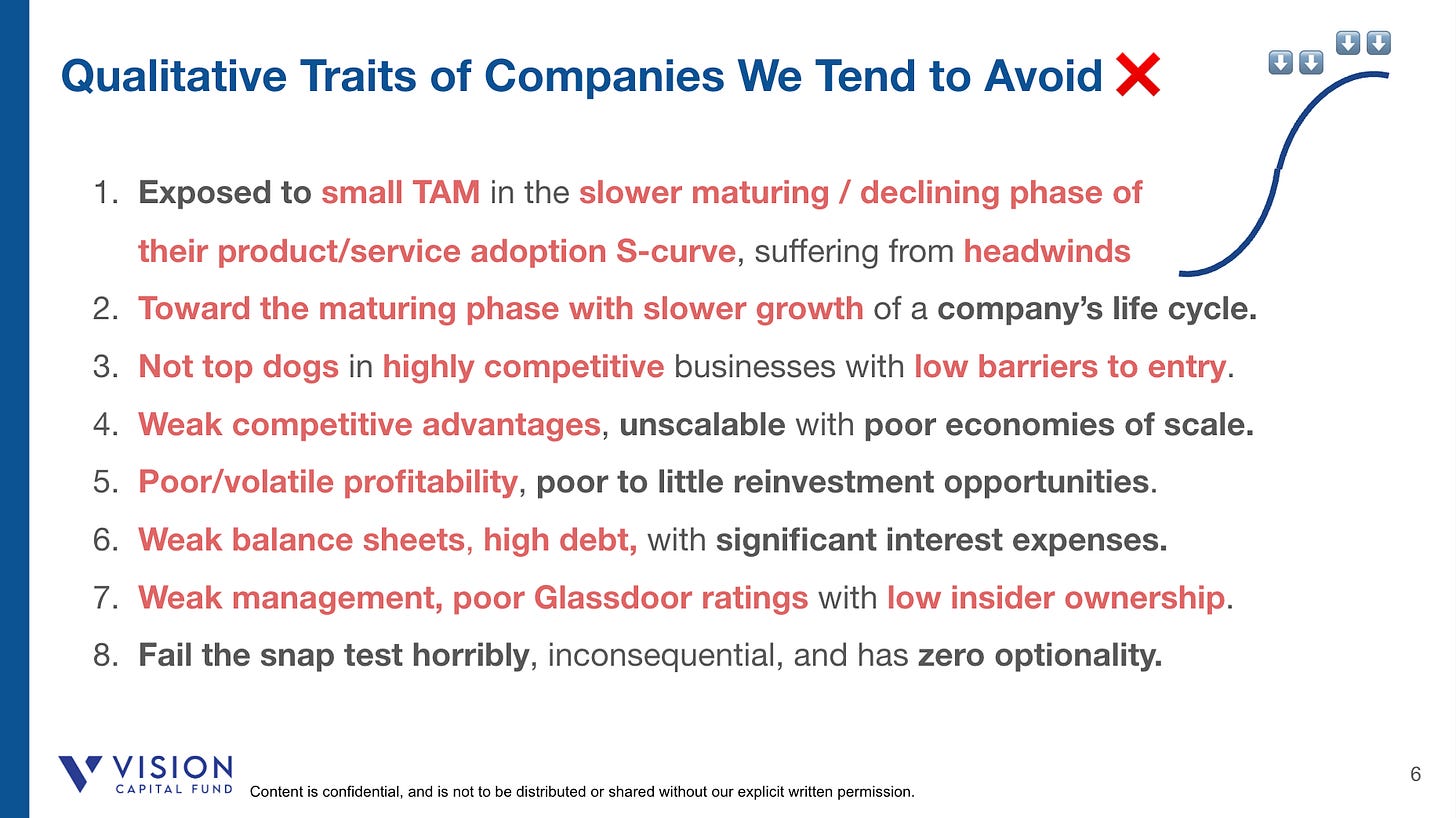

Knowing what we tend to avoid

Inverting all, if not most, of the traits in the previous slide, gets us to the list of traits that we prefer to avoid. They are usually very niche businesses in small markets, typically in the slower-maturing or declining phase of their S-curve, suffering much more from headwinds than riding tailwinds.

They typically have weak competitive advantages, face intense competition, and exhibit poor unit economics and profitability, as well as limited reinvestment opportunities. They are usually highly leveraged, with high net debt, often run by weak management, have poor Glassdoor ratings, and have unhappy, frustrated employees.

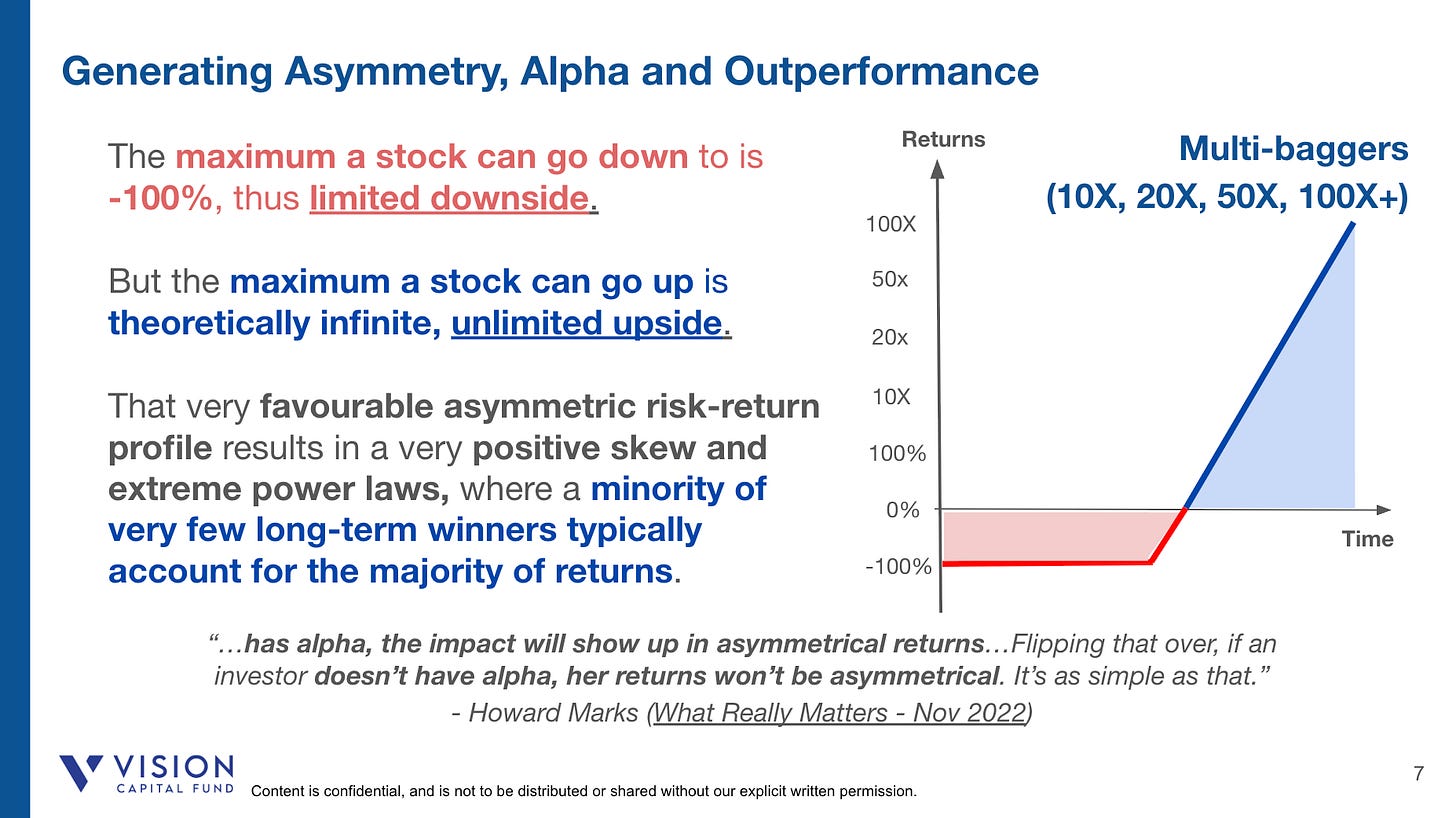

Generating asymmetry, alpha, and outperformance

When these winners win, they win extraordinarily. These are the multi-baggers —companies that increase in value by 10x, 20x, 50x, or even 100x. These are not investments where we aim to capture a modest 20-40% return and then move on to the next opportunity, repeating the process. With such compounders, one must resist the temptation to trim winners to fund losers. Patience becomes a competitive advantage. We have learned to let our winners run high.

The risk-reward asymmetry is compelling. When buying a stock, the downside is capped at 100%, but the upside is theoretically unlimited, with potential returns of 10x, 20x, or 50x. Each position functions like a long call option, and a portfolio of stocks effectively resembles a giant long call option payoff.

Asymmetry is the holy grail in investing, where over a long time, in heads, you don’t lose a lot, and in tails, you win increasingly more time.

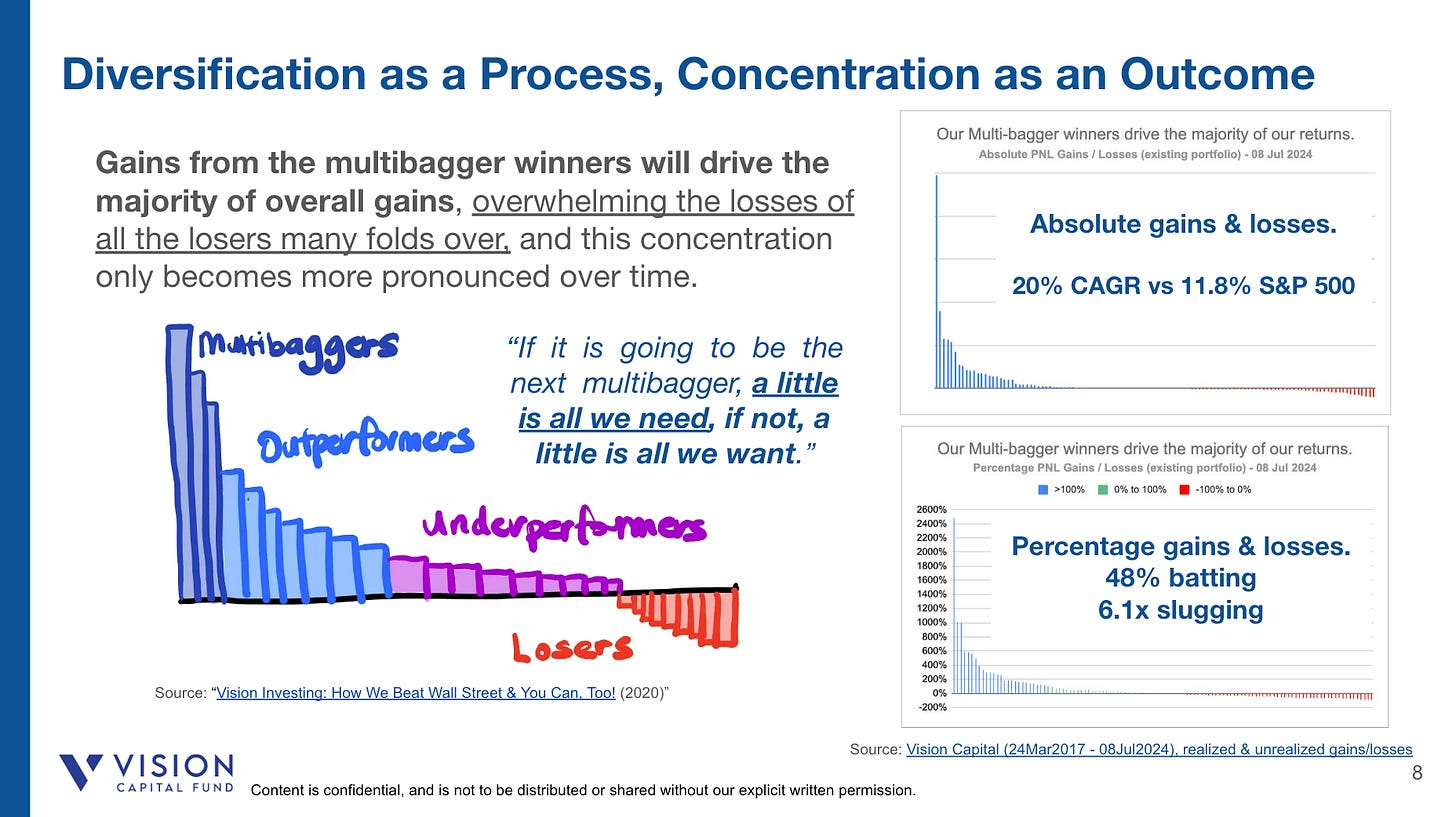

Diversification as a process, concentration as an outcome

In this approach, a few winners will drive the majority of returns, with their gains vastly outweighing losses from the losers many times over. Batting average, which is how often we win, matters, but slugging percentage, which is the ratio of gains from winners relative to the losses from the losers, matters far more. While diversification is the process, concentration becomes the outcome as winners earn the right to grow to become outsized allocations over time.

Swinging the probabilities and payoffs in your favor

Great investing is about swinging the probabilities and payoffs in our favor. First, we want to lose less often and try to avoid most of the losers, and we know what to avoid.

Second, we want to minimize losses so that the losses incurred by others do not harm us. We avoid anything that results in unlimited downside, from short-selling, leverage, derivatives, or hedging. We never want to be playing a game of Russian Roulette with a bullet in the chamber, constantly spinning the barrel and firing, and be permanently wiped out, no matter how attractive the winning payoff might be.

Third, we aim to win more often and improve our batting average to identify winners. We know what to seek, yet we don’t want the batting average to be too high, which means we are playing it too safe. We want to be long-term investors to increase our probability of not losing rather than a day trader playing a game of coin toss.

Lastly, we want to win big and much more. The compounding of gains from multi-baggers over long periods will result in highly asymmetric returns relative to losses, leading to growing concentration over time and ultimately driving eventual long-term outperformance.

Focusing on the long-term drivers of total stock returns

There are four main long-term drivers of stock market returns: (1) growth of free cash flows, (2) change in valuation multiples (if there is expansion or contraction, usually we assume contraction), (3) free cash flow yields, which stems from the price paid and lastly (4) any dilution that comes from stock-based compensation.

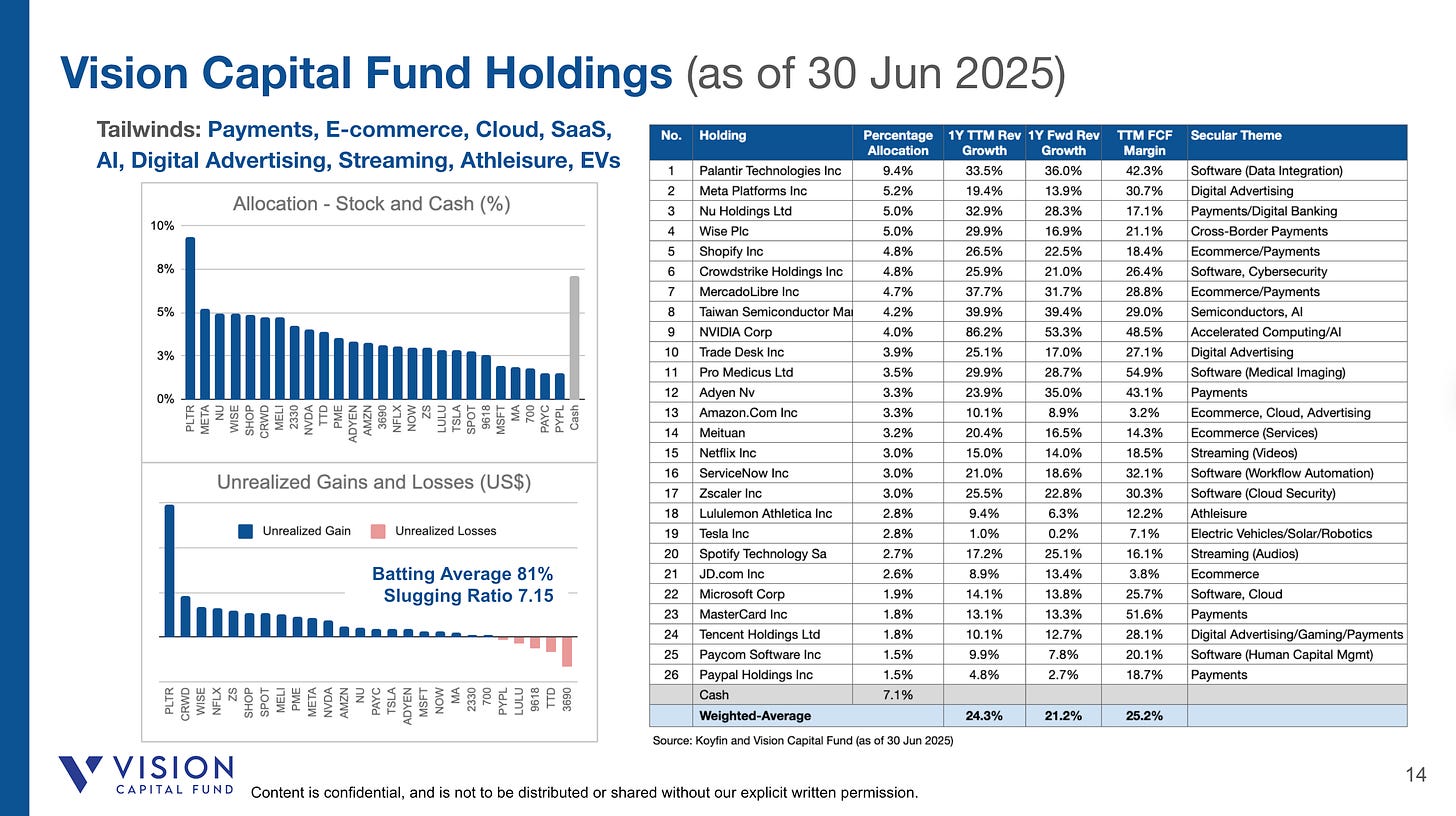

Our portfolio has grown at a weighted annual rate of ~24%, driven by faster revenue growth rates. We believe our holdings have high growth endurance and can continue to grow at a 15-20%+ CAGR for the next 3-5+ years. The weighted average free cash flow (FCF) margins are ~25%, which reflects the high quality of the holdings.

All of the companies have high operating leverage, and we expect FCF margins to continue expanding. This implies that FCF would likely grow faster than 20-25%+ on a blended basis.

FCF yields are typically around 2-3%+, which means they are not cheap relative to current free cash flows. But suppose they can continue to grow, and we can underwrite their growth with a high degree of certainty, even assuming a modest valuation multiple and considering potential contractions and dilution. In that case, we believe that over the long term, the portfolio would have a high likelihood of returning 15-25%+ on a gross basis, primarily driven by the growth of our underlying businesses.

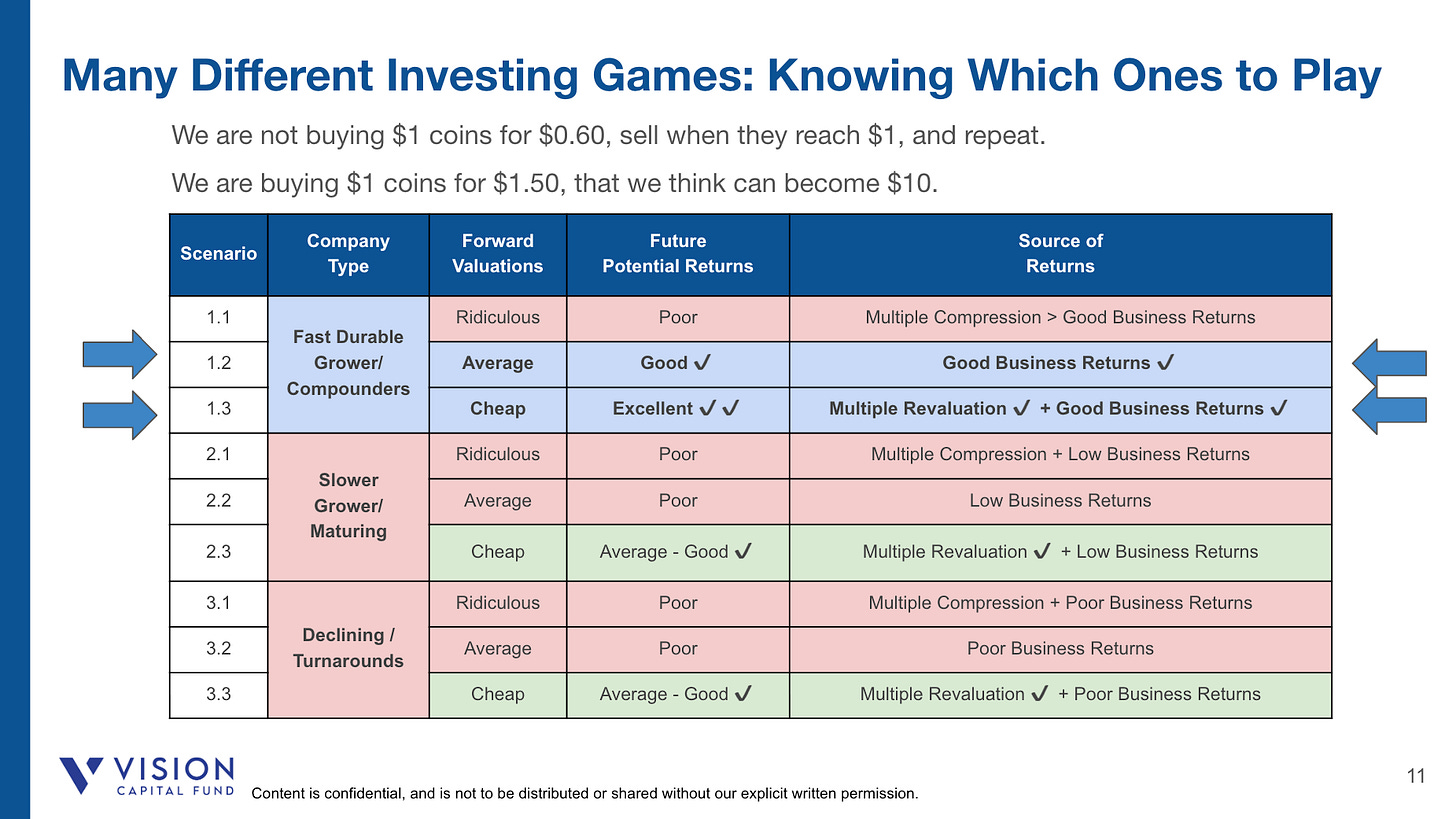

Different Investing Games: Knowing Which Ones to Play

There are many games in investing. Knowing which one we are playing is crucial. We are trying to buy $1 coins with a high probability of becoming $10. We are comfortable paying seemingly "expensive" prices of $1.50 when identifying companies capable of sustaining highly profitable growth rates over extended periods. What is expensive to others on a current basis can be cheap to us on a forward basis.

Bringing vision into everything we do

As I began studying successful investors, one quote from David Gardner of The Motley Fool resonated with me differently. He said, "Make your portfolio reflect your best vision for our future.” Suddenly, investing was not just about the numbers. It was about backing the future I wanted to live in.

That was when everything clicked. After my accident, I gained a new perspective on the brevity of life. Why spend it chasing returns in businesses that made the world worse? This realization gave birth to Vision Investing and Vision Capital, where I invested my capital for over seven years, driving investment towards its highest expression of purpose and impact. And now, with Vision Capital Fund, which we just started eight months ago, we manage external capital for individuals and families.

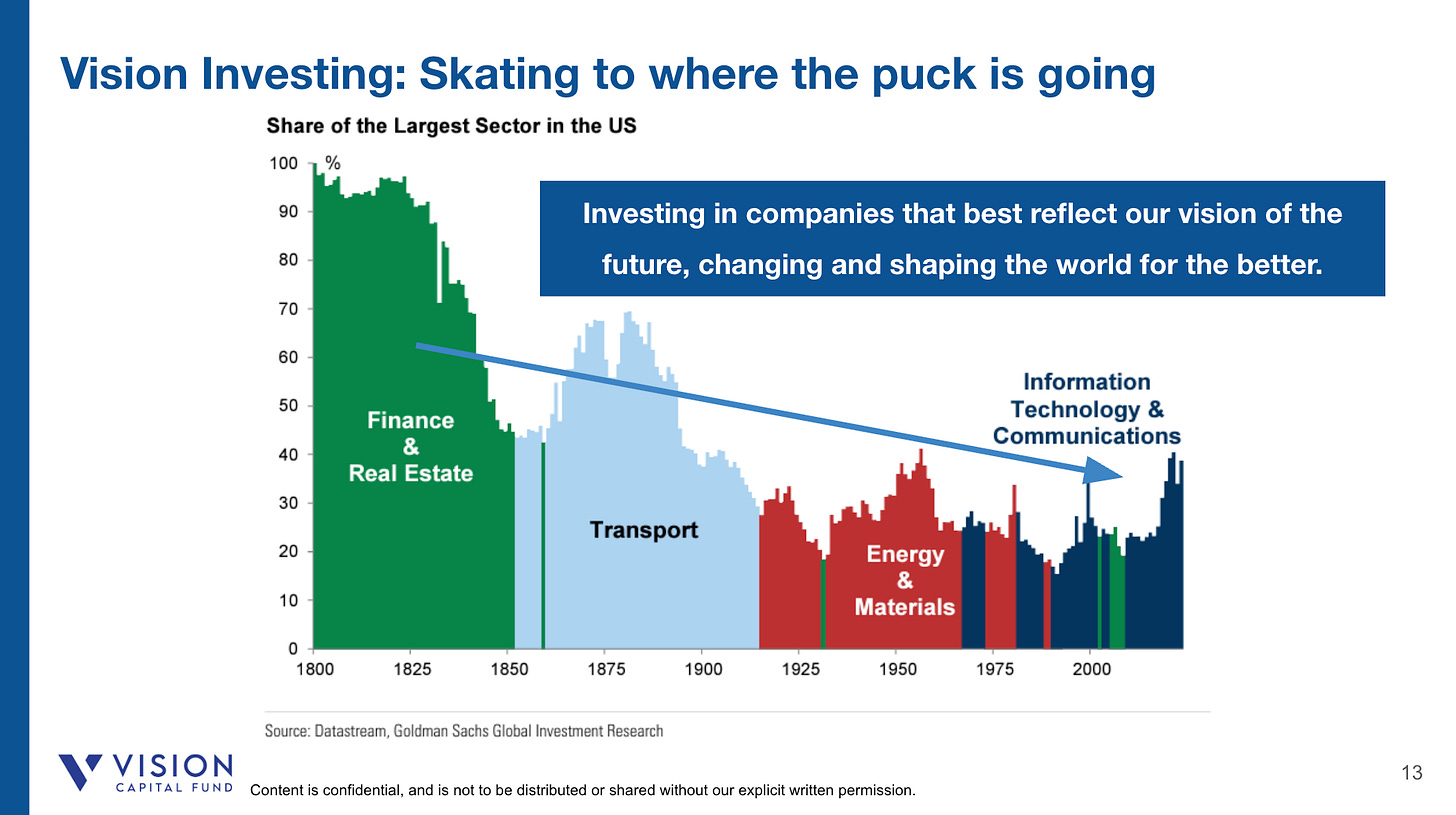

Seeking out top dogs in long-term secular trends

We employ the concept of “Vision” in our investment philosophy in two ways. While we are bottom-up stock pickers, we are also top-down aware of broader secular trends. We continually focus on identifying top dogs and first movers riding long-term tailwinds in large, important, and emerging industries. We are constantly trying to understand what the big picture would look like. We think big, not small. We want to skate to where the puck is going, not where it has been. After all, investing is all about the future, not the past.

Our holdings reveal our philosophy, convictions, and vision

We are conscious capitalists. We want to invest in companies that, if they prosper, will make us feel great about the future. Our investments must align with our values and reflect our best vision for our future, changing and shaping the world for the better. We are willing to reject opportunities that do not align with our vision and values, regardless of how lucrative they may be. We want to do well and do good in the long term.

Looking back at that Christmas Eve twelve years ago, I see it as a blessing in disguise. That near-death experience did not just save my life. It redirected it toward something meaningful. Today, when we evaluate investments, we ask not just, "Will this make money?” but “If this company succeeds, will the world be better?” Vision Investing is not just our philosophy; it's our way of life. It is our way of generating strong returns in parallel and deploying capital to create the future we want to live in.

From value 1.0 to value 2.0 to value 3.0, with vision

Investing transcends traditional value, growth, or quality frameworks. Value matters. Growth matters. “Vision” increasingly complements all these in generating sustainable, exceptional long-term returns, identifying companies that transform industries and improve lives. That’s what we want to keep doing for a long time. We hope more investors will incorporate their unique variant of “Vision” in their investment framework and philosophy.

Thank you to the MOI Team and John Mihaljevic

Thank you to John Mihaljevic for organizing the fantastic and intimate MOI Zurich Project, featuring many high-quality presentations from the participants. It is an event that I thoroughly enjoy and highly recommend. It has allowed me to form many new friendships and strengthen existing ones. I look forward to returning.

The information contained in this article is for general informational purposes only. While every effort has been made to ensure the accuracy and reliability of the content, errors or omissions may occur. The author and publisher do not assume any responsibility or liability for any errors, inaccuracies, or omissions in the content, nor for any actions taken based on the information provided. Readers are encouraged to verify any information before relying on it and to seek professional advice as needed.

5 July 2025 | Eugene Ng | Vision Capital Fund | eugene.ng@visioncapitalfund.co

Find out more about Vision Capital Fund.

You can read our annual letters for Vision Capital Fund.

Check out our book on Investing, Vision Investing: How We Beat Wall Street & You Can, Too. We believe that individual investors can outperform the market over the long term. The book chronicles our entire investment approach. It explains why we invest the way we do, how we invest, what we look out for in companies, where we find them, and when we invest in them. It is available via Amazon in two formats: paperback and eBook.

Join our email list for more investing insights. Our emails tend to be ad hoc and infrequent, as we aim to write timeless, not timely, content.

The most important thing is to never lose confidence in yourself and to stay optimistic. Wishing you the best of luck, Eugene, on your investment journey.