Timing the Markets

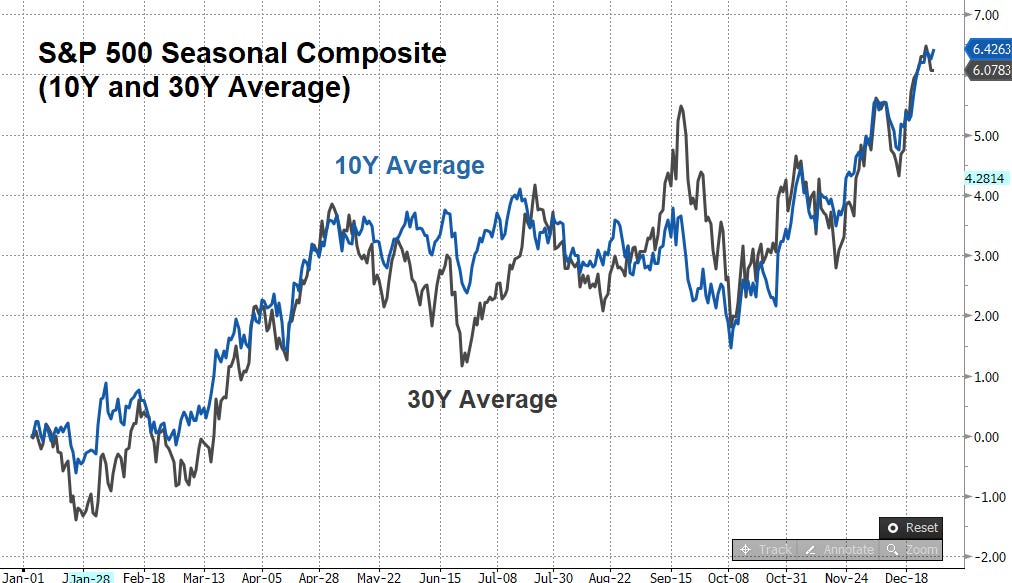

Looking at the long-term seasonality chart of the S&P 500 Stock Index below, below are some of our observations and reflections on investing in general with respect to expectations and timing.

(1) Expect the market to be volatile.

It is clear that within any given year, the stock market tends to be very volatile. There are fairly large price movements, up and down either way throughout the year. But generally, the down moves tend to be faster and sharper than the up moves.

(2) Know the market tends to go up on average.

The stock market tends to go up over the long-run, and returns on average about 6% p.a. over the long-run.

The most recent 10 year and 30 year average annual returns are at 6.1% and 6.4% respectively.

“Stocks always go down faster than they go up, but they always go up more than they go down.” — David Gardner, The Motley Fool

(3) Know that there are good and bad months.

Apparently there are some seemingly seasonal monthly trends in the stock market (e.g. January effect, Summer effect), where for some months during the year, it tends to either (1) go up, (2) go down and (3) go sideways, but our intention is not to discuss that.

A short-term foolish investor who loves to time the market will say that the best months to invest are “January, March, April, June, August, October, November, December, then February, May, July and then September”.

A long-term Foolish investor will instead say that the best months to invest are “January, February, March, April, May, June, July, August, September, October, November and then December”.

(4) Do not be a fool to time the markets.

Trying to perfectly time the market to buy and sell is extremely difficult to do. Till date, we are not aware of any trader/investor that manages to perfectly time all of their buys and sells at the low and highs respectively, consistently every time for a long time.

Missing out the best days while trying to time the market is far worse. The analysis from JPMorgan clearly shows that just missing out on the 10 and 20 best days of each year, significantly reduces the average annual returns from 6.1%, more than halving it to 2.4% and even worse to a meagre 0.1% respectively.

Parting Thoughts…

With that I would like to end with a quote:

“The best time to invest was yesterday. The next time best to invest is now, not tomorrow, neither in one week, nor in one month, in one year or even later.

Neither is it January, March, April, June, August, October, November, December, then February, May, July then September.

But instead January, February, March, April, May, June, July, August, September, October, November and December throughout the year.”

14 Aug 2021 | Eugene Ng | Vision Capital Fund | eugene.ng@visioncapitalfund.co

Find out more about Vision Capital Fund.

You can read my prior Annual Letters for Vision Capital here. If you like to learn more about my new journey with Vision Capital Fund, please email me.

Follow me on Twitter/X @EugeneNg_VCap

Check out our book on Investing, “Vision Investing: How We Beat Wall Street & You Can, Too”. We truly believe the individual investor can beat the market over the long run. The book chronicles our entire investment approach. It explains why we invest the way we do, how we invest, what we look out for in the companies, where we find them, and when we invest in them. It is available for purchase via Amazon, currently available in two formats: Paperback and eBook.

Join my email list for more investing insights. Note that it tends to be ad hoc and infrequent, as we aim to write timeless, not timely, content.

This article is solely for informational purposes and is not an offer or solicitation for the purchase or sale of any security, nor is it to be construed as legal or tax advice. References to securities and strategies are for illustrative purposes only and do not constitute buy or sell recommendations. The information in this report should not be used as the basis for any investment decisions.

We make no representation or warranty as to the accuracy or completeness of the information contained in this report, including third-party data sources. The views expressed are as of the publication date and subject to change at any time.

Hypothetical performance has many significant limitations and no representation is being made that such performance is achievable in the future. Past performance is no guarantee of future performance.