Why Culture Matters?

Culture is the ultimate long-duration intangible asset.

Everyone knows it is important, but few really know how to measure it. It is hard to measure, difficult to quantify, tends to be overlooked & undervalued.

Culture is beloved by all, but valued by none.

“Culture might not drive short-term results, but it definitely is one of the key drivers of long-term results.”

Because we are long-term long-only investors, we are always focused on understanding the drivers of long-term business outperformance, which will eventually drives long-term share price appreciation, and accordingly long-term portfolio outperformance.

Which is also why management and culture is so important, and it is one of the key qualities we look out in all our investments.

We are investing in people. And it is people that drives businesses forward.”

“Customers will never love a company until the employees love it first.” – Simon Sinek

“Being a great place to work is the difference between being a good company and a great company.” – Brian Kristofek, President and CEO, Upshot

What Cultures do we look for?

This is best described by Whole Foods Co-founder, John Mackey in Conscious Capitalism. It is a socially responsible economic and political philosophy.

The premise behind Conscious Capitalism is that businesses should operate ethically while they pursue profits. This means they should consider serving all stakeholders involved including their employees, humanity, and the environment — not just their management teams and shareholders.

The four guiding principles are (1) Higher Purpose, (2) Stakeholder Orientation, (3) Conscious Culture and (4) Conscious Leadership.

Higher Purpose is beyond pure profit generation, for the vitality and the sustainability of a business. It is about having an inspirational meaning and purpose. It is one that serves as a guiding light through thick and thin, one that continue to inspire, engage and energises its stakeholders.

Stakeholder Orientation is beyond maximising shareholder investment returns but about creating and optimising value for all stakeholders, creating a win-win proposition, resulting in a durable, sustainable and resilient long-term business ecosystem.

Conscious Culture is building based on clearly articulated values, principles and practices translating into behaviours, fostering a spirit of trust, inclusivity and cooperation among all stakeholders, that is energiing and unifying.

Conscious Leadership is about focusing on the “we” rather than a “me” mentality to drive the business.

This aligns deeply with how we invest at Vision Capital with Vision Investing.

Culture is enduring, but not predestined.

Culture takes a long time time to build, and to deteriorate.

The good thing about culture is that it tends to decay extremely slowly. It retained a strong 45% correlation even after 10 years. That said, while culture can be very stable on average, it is not predestined.

Measuring Culture vs Outperformance?

Wall Street is filled with quantitative analysts and “complicated” & “sophisticated” algorithms trading solely based on financial metrics and price momentum.

But when it comes to qualitative criteria, it’s always hard to get a sense of the culture and leadership of the companies around us.

That brings us to Glassdoor.

Glassdoor is a website where current and former employees anonymously review companies and their management. Once enough reviews have been submitted, companies receive a score out of five stars. Similarly, CEOs receive a score out of 100%.

An example of one Glassdoor’s top 10 CEOs in the US by rating is Shantanu Narayen from Adobe, below is how it typically looks like.

Looking across more companies and longer term.

App Economy Insights did a very thorough analysis by analysing Glassdoor’s top 40 best-ranked public companies each year over the last 5 years:

The top 10 returned ~284%, >6X versus the S&P 500.

The top 40 returned 183%, >4X versus the S&P 500.

Finally, no matter how you slice it, the companies have outperformed the S&P 500 as a group (top 10, 20, 30, 40), over one, two, three, four and five years.

But for the top 30th-40th (see 2nd table), the outperformance is far less significant, returning ~53%, marginally beating the S&P 500’s 43%.

Which emphasises the relevance of power laws, and the best (minority) tends to drive the majority of returns and outperformance.

Focus on finding and investing in the best.

Another Glassdoor study, of taking the top 10 and top 20 best places to work picks for each over 10 years (2009–2018) summarises the following findings:

The top 10 best places to work returned 2.5x the returns of the S&P 500

The top 20 best places to work returned 2.3x the returns of the S&P 500

~63% have been beating the market (i.e. S&P 500)

~90% have delivered positive returns

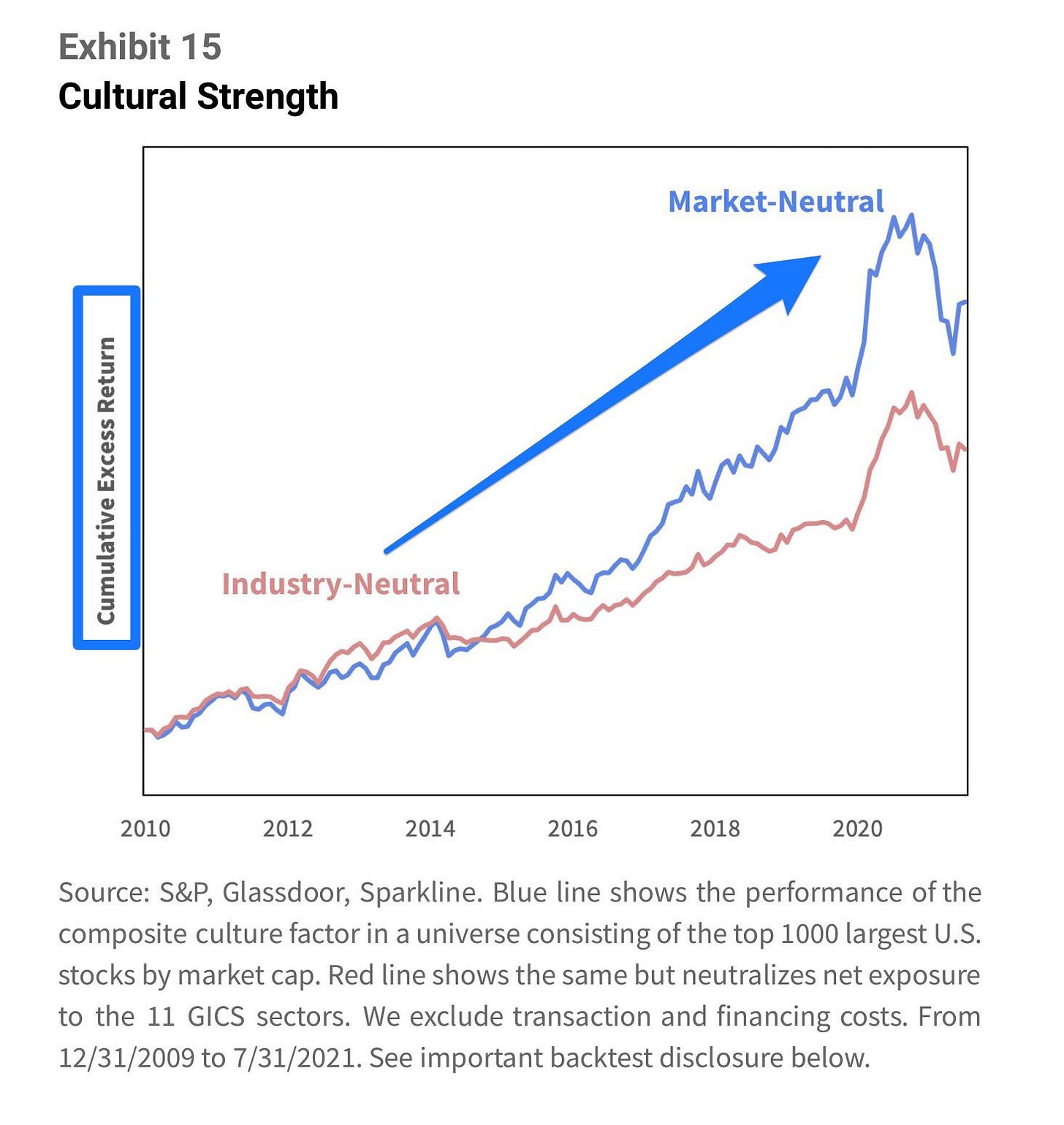

The two analysis presents similar results to Sparkline Capital’s Kai Wu recent analysis that companies with strong cultures have outperformed the stock market over the long-term.

Similarly, companies with toxic cultures have also dramatically underperformed the broader stock market.

Final Words: Why Culture Truly Matters?

Ultimately culture matters, because it is one of the important long-term drivers of business and corresponding share price appreciation & outperformance.

We are focused on swinging all / most of the odds of successful investing in our favour. Truly being able to understand, appreciate culture matters.

That’s why we are focused on investing in the best long-term compounders run by the some of the best management with great cultures.

We look at Glassdoor ratings, trends, reviews, CEO interviews, podcasts, articles, shareholder letters, annual and quarterly reports, earnings call interviews/ transcripts, biographies, employee interview transcripts, etc.

A lot of which is qualitative, not quantitative.

This is why investing is more an art, than a science.

13 Sep 2021 | Eugene Ng | Vision Capital Fund | eugene.ng@visioncapitalfund.co

Find out more about Vision Capital Fund.

You can read my prior Annual Letters for Vision Capital here. If you like to learn more about my new journey with Vision Capital Fund, please email me.

Follow me on Twitter/X @EugeneNg_VCap

Check out our book on Investing, “Vision Investing: How We Beat Wall Street & You Can, Too”. We truly believe the individual investor can beat the market over the long run. The book chronicles our entire investment approach. It explains why we invest the way we do, how we invest, what we look out for in the companies, where we find them, and when we invest in them. It is available for purchase via Amazon, currently available in two formats: Paperback and eBook.

Join my email list for more investing insights. Note that it tends to be ad hoc and infrequent, as we aim to write timeless, not timely, content.