Why don't we invest in bonds but all in stocks instead?

It is far less static and more nuanced than one would think.

After reading Jeremy Siegel’s “Stocks for the Long Run 5/E: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies”, I wanted to share my key takeaways from this stock investing classic.

Specifically I wanted to share why we don’t invest in bonds, but instead in 100% in stocks.

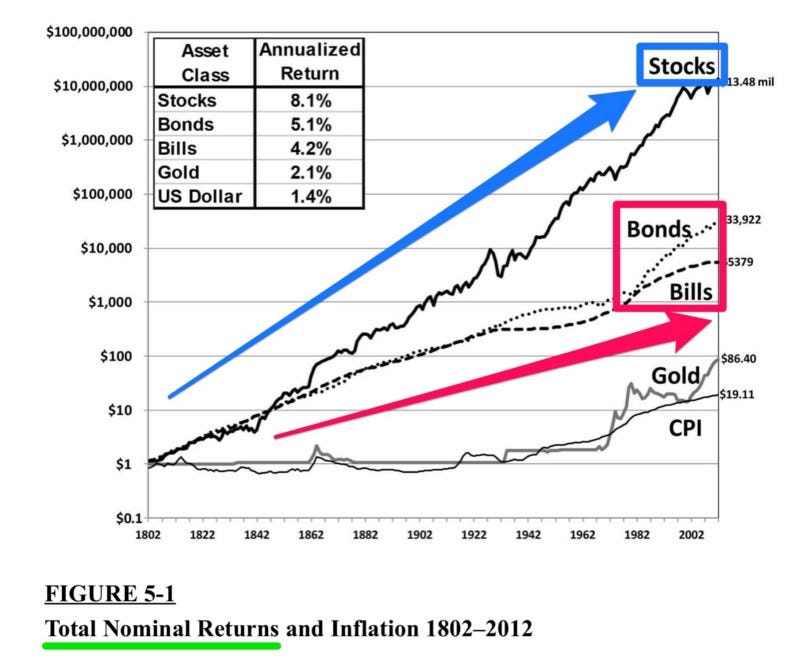

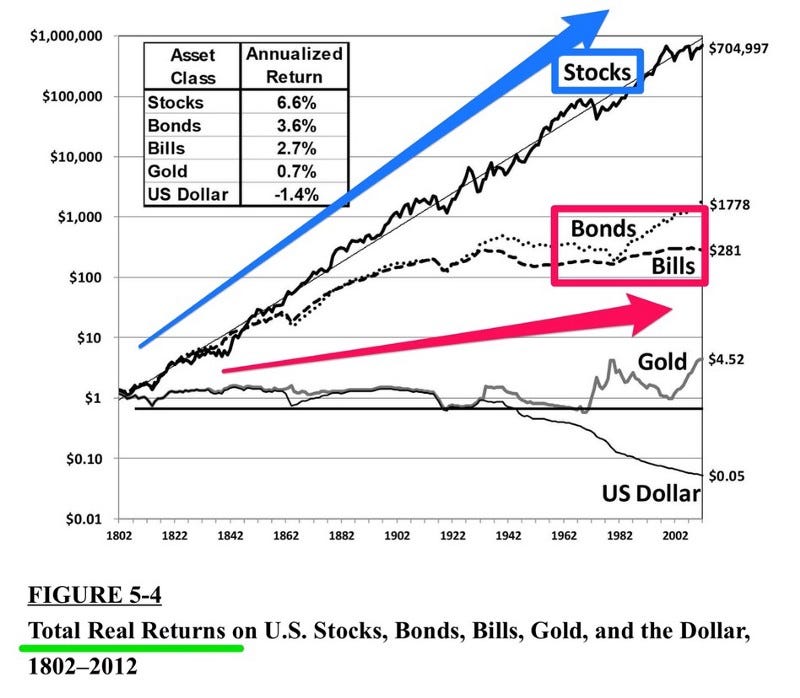

Bonds fail to beat Stocks over the Long-Run

Stocks have provided much more superior returns than Bonds, Bills, Gold and the US Dollar over the very long-run. In fact, stocks returned 8.1% and 6.6% on a nominal and real annualised basis over the last 210 years, from 1802–2012. Both Bonds and Bills returned much lower than Stocks at 5.1%/3.6% p.a. and 4.2%/2.7% p.a. on a nominal and real basis.

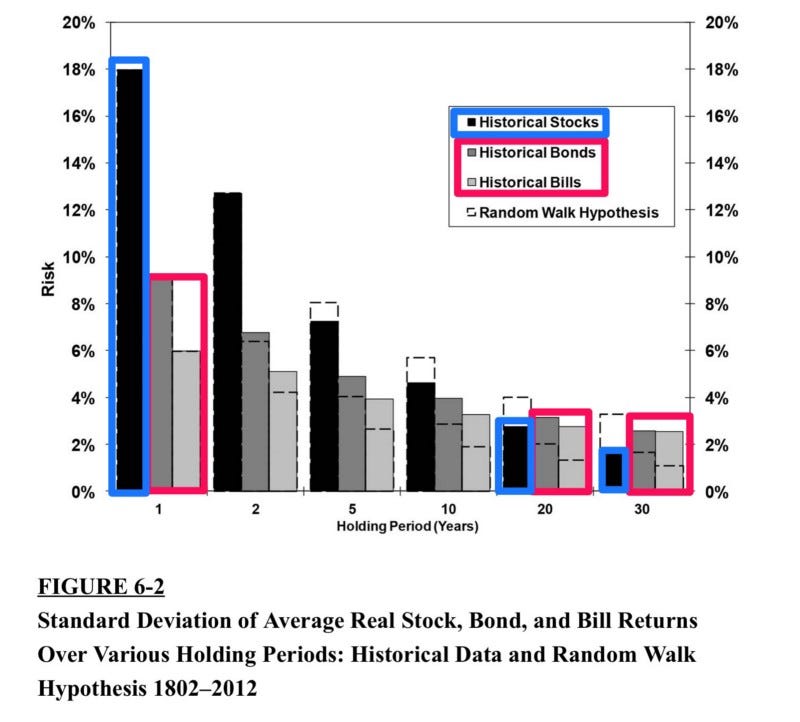

Bonds are actually more volatile in the Long-Term

Contrary to popular financial teachings, there is no doubt that bonds are less volatile in the short-term (1, 2, 5 years). But when the holding period is much longer (10, 20, 30 years), bonds & bills still retain the probability of much higher negative returns than stocks. Looking at the 20 year holding period for example, the max/min of real returns of bonds and bills are -3.1% to + 8.8% and -3.0% to +8.3%, this is compared to stocks at +1.0% to +12.6%.

This is also illustrated in the following chart below where the risk (measured by standard deviation) of bonds and bills fail to fall further and end up being higher than stocks for the longer term in 20 and 30 year holding periods.

Bond Yields are at All Time Historical Lows

With interest rates declining over the long-term to at all time historical lows, it is also another reason why Bonds no longer make sense to be held in an investment portfolio, and at least for mine.

An Optimal Mix of Bonds & Stocks?

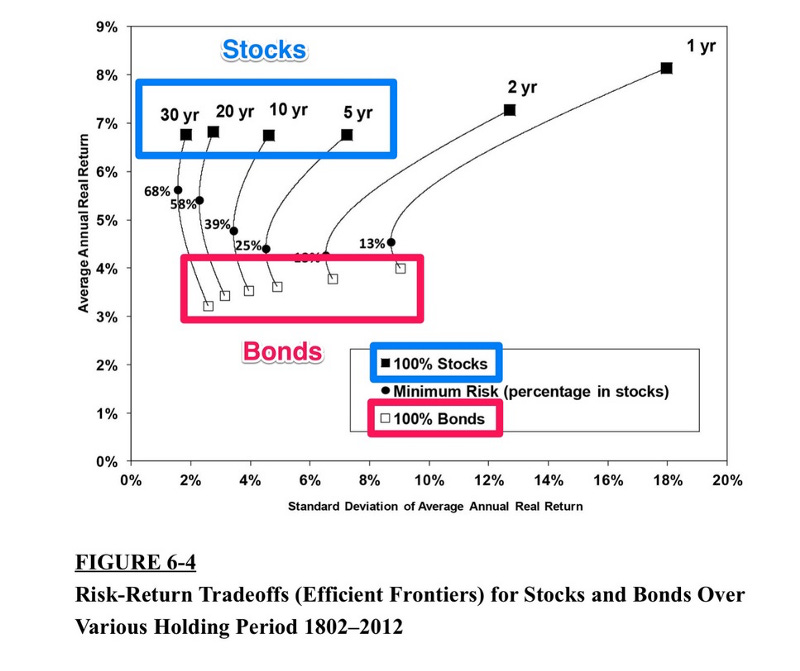

Modern Portfolio Theory and the Efficient Frontier tells you that for every individual’s risk-return profile, there should be an optimal portfolio consisting of a “sweet spot” mix of split allocation between Bonds and Stocks.

But this is a static approach that fails to consider investing holding periods.

Bonds Reduce Returns much more Significantly

If you are only investing for the long-term (10, 20, 30 year holding periods), then perhaps we should be holding 100% all stocks and 0% bonds investment portfolios. Because the efficient frontier for longer holding periods look more like vertical lines than protruded curves, any portfolio allocation to Bonds significantly reduces the average expected annual returns (i.e. money you make). This is versus the barely incremental lower volatility that you will stand to gain.

In short, you are giving up much more, for what you stand to gain.

Volatility for Stocks & Market Declines is Inevitable

If you can master your mindset and psychology to stomach the short-term day-to-day, week-to-week, month-to-month, quarter-to-quarter noise (i.e. volatility) in the stock market, knowing that volatility is the price of admission for higher returns and experiencing market declines is inevitable, then perhaps any allocation to Bonds to reduce short-term volatility, is then not required.

Stock Market Rises over the very Long Run.

In the short-term, the market can go down faster than it goes up. But over the long-term, the market goes up more than it goes down. The long run is the only term that counts and matters to us.

That is why we invest only in stocks and for the long-term.

This article was earlier published on 28 Dec 2020 on Medium.

22 Aug 2021 | Eugene Ng | Vision Capital Fund | eugene.ng@visioncapitalfund.co

Find out more about Vision Capital Fund.

You can read my prior Annual Letters for Vision Capital here. If you like to learn more about my new journey with Vision Capital Fund, please email me.

Follow me on Twitter/X @EugeneNg_VCap

Check out our book on Investing, “Vision Investing: How We Beat Wall Street & You Can, Too”. We truly believe the individual investor can beat the market over the long run. The book chronicles our entire investment approach. It explains why we invest the way we do, how we invest, what we look out for in the companies, where we find them, and when we invest in them. It is available for purchase via Amazon, currently available in two formats: Paperback and eBook.

Join my email list for more investing insights. Note that it tends to be ad hoc and infrequent, as we aim to write timeless, not timely, content.