Why the Focus on Finding Winners in Investing?

Because winners win.

Why the Focus on Finding Winners in Investing?

Different Styles of Investing

There are many different approaches to investing, from different types of investors with different mindsets, philosophy, frameworks, to demanding different return vs risk profiles.

Ultimately understand that is no one investing style that suits everyone, but rather what uniquely suits you.

Finding Winners

We at Vision Capital are long-term investors, focused on finding winners, buying winners, holding to winners, not selling winners and adding to winners.

With Hendrik Bessembinder latest paper on “Long-Term Shareholder Returns: Evidence from 64,000 Global Stocks” (2020), we wanted to take the opportunity to utilise some of the key findings from the paper and explain why and how we invest, particularly in winners.

A small minority of stocks account for the majority of overall stock market returns.

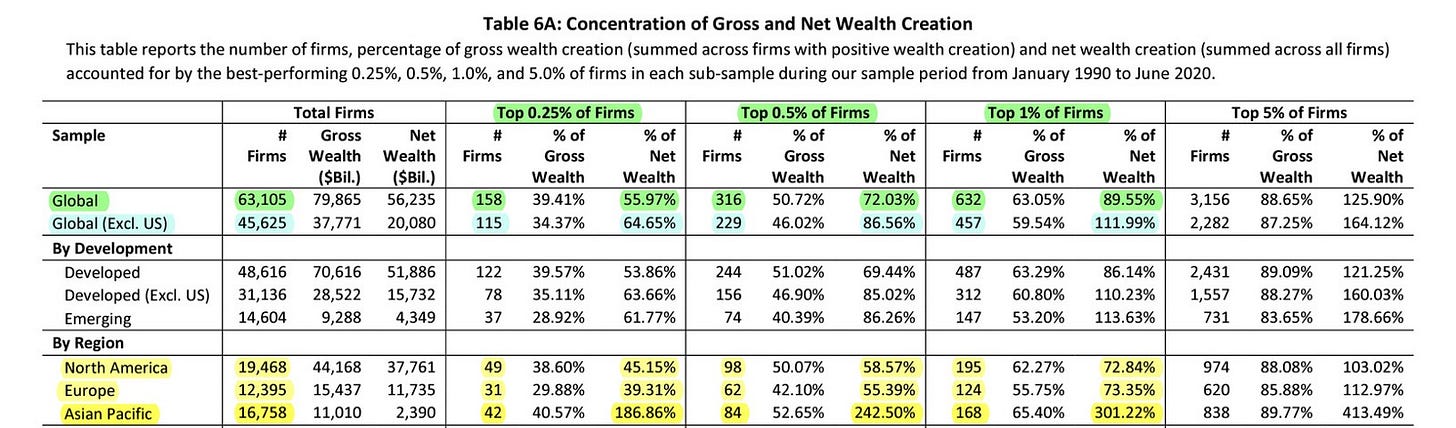

Hendrik Bessembinder’s 2020 study covered 63,105 stocks globally over 42 countries for almost 30 years from January 1990 to June 2020.

Very few stocks accounted for the majority of global stock market returns (i.e. net wealth creation).

Top 5 (Apple, Microsoft, Amazon, Alphabet and Tencent) ~11%

Top 0.2% (119 firms) ~50%

Top 0.5% (316 firms) ~ 72%

Top 1.0% (632 firms) ~ 90%

Top 1.5% (947 firms) ~100%

Investing to us is really about fishing in a small pond in a big ocean, albeit a very focused one, where we are only looking at finding winners that will win and are likely to keep winning.

Less than 1,000 firms (i.e. 947 firms ~1.5% of total 63,105 firms) of accounted for the majority (~100%) of returns.

There are truly only a handful of companies in the world that are worth investing that generate the majority of returns. One needs to find these winning companies and own them for the long haul.

Globally only a small minority of 0.25%, 0.5% and 1.0% off over 63,000 companies (158, 316 and 632 firms), accounted for the majority 56%, 72% and 90% of overall returns (i.e. net wealth created).

The tails are even more pronounced outside the US and particular in Asia Pacific, where the percentages go up to 65%, 87%, 112% for ex-US and 187%, 243% and 301% for Asia Pacific.

Stocks have Limited Downside but Unlimited Upside, especially for Winners.

The maximum a stock can go down to is -100%, thus limited downside.

But the maximum a stock can go up is theoretically infinite, unlimited upside.

That very favourable asymmetric risk-return profile results in a very positive skew where very few long-term winners typically account for the majority of returns.

The majority, ~55% of stocks generated a negative buy-and-hold return. But the minority ~1.5% of the top stocks returned the majority of returns.

Power laws exist all around us, and similarly with winners in investing. It is the winners that matter, not the losers.

Let your Winners Drive Your Outperformance

When the winners in your investment portfolio keep winning, the gains from all the winners combined, will far outweigh the losses from all the losers combined many folds over.

“Winners become more relevant, and the losers become more irrelevant.”

With time, your investment portfolio could actually start looking hypothetically like this.

And could eventually look like this in reality…

Concluding Words: Unfair Fights

We invest to outperform and beat the market. The market often leaves clues as to how to do so, we just need to be constantly on the lookout for them.

Investing to us, is about (1) increasing the odds of success by finding and investing in winners and(2) reducing the odds of failure, by avoiding losers. Lastly, (3) to allow winners to keep compounding, by having the long-term patience and temperament to hold them, add to them and not sell them.

With winners, we hope we can continue to beat the market, and so can you.

18 July 2021 | Eugene Ng | Vision Capital Fund | eugene.ng@visioncapitalfund.co

Find out more about Vision Capital Fund.

You can read my prior Annual Letters for Vision Capital here. If you like to learn more about my new journey with Vision Capital Fund, please email me.

Follow me on Twitter/X @EugeneNg_VCap

Check out our book on Investing, “Vision Investing: How We Beat Wall Street & You Can, Too”. We truly believe the individual investor can beat the market over the long run. The book chronicles our entire investment approach. It explains why we invest the way we do, how we invest, what we look out for in the companies, where we find them, and when we invest in them. It is available for purchase via Amazon, currently available in two formats: Paperback and eBook.

Join my email list for more investing insights. Note that it tends to be ad hoc and infrequent, as we aim to write timeless, not timely, content.

This article is solely for informational purposes and is not an offer or solicitation for the purchase or sale of any security, nor is it to be construed as legal or tax advice. References to securities and strategies are for illustrative purposes only and do not constitute buy or sell recommendations. The information in this report should not be used as the basis for any investment decisions.

We make no representation or warranty as to the accuracy or completeness of the information contained in this report, including third-party data sources. The views expressed are as of the publication date and subject to change at any time.

Hypothetical performance has many significant limitations and no representation is being made that such performance is achievable in the future. Past performance is no guarantee of future performance.