Batting average versus slugging average in investing.

It is not just how often you win, but how big when you win.

In investing, it is not just probabilities, i.e. how often one is right versus when they are wrong, but the payoffs also matter, i.e. also how well do they do when they get it right, versus how badly they do when they get it wrong.

From Baseball…

Let’s expand this to the concept of batting average and slugging average in baseball. In baseball, the batting average is the number of hits divided by the number of bats. This number is typically between 0 and 1.

In Major League Baseball (MLB), the league-wide batting average typically hovers around 0.250 for example. The average baseball player gets one hit out of every 4 bats. The best baseball players tend to hit a little better than a 0.300 batting average.

A 0.400 baseball batting average is the holy grail that has not been achieved since Boston Red Sox’s Ted Williams last did it in 1941, who is arguably one of the greatest baseball batter of all time.

Like in baseball, not all hits are equal. With such a low success rate, what a baseball player does with each at-bat is extremely important. This is where the slugging percentage comes in.

"Everybody knows how to hit - but very few really do." - Ted Williams

Slugging percentage measures a hitter’s batting productivity, and it differs from batting average because it values hits differently by weighing them differently. A single is worth one base, whereas a home run is worth four bases.

The total bases is the sum of Singles + (2 x Doubles) + (3 x Triples) + (4 x Home Runs). Slugging percentage is the total bases divided by the number of at-bats for a player, ranging from 0.00 to 4.00.

So, if a player wants a high slugging percentage, they must hit doubles, triples, and home runs fairly often. A high slugging percentage tends to lead to more scoring runs and to more winning games.

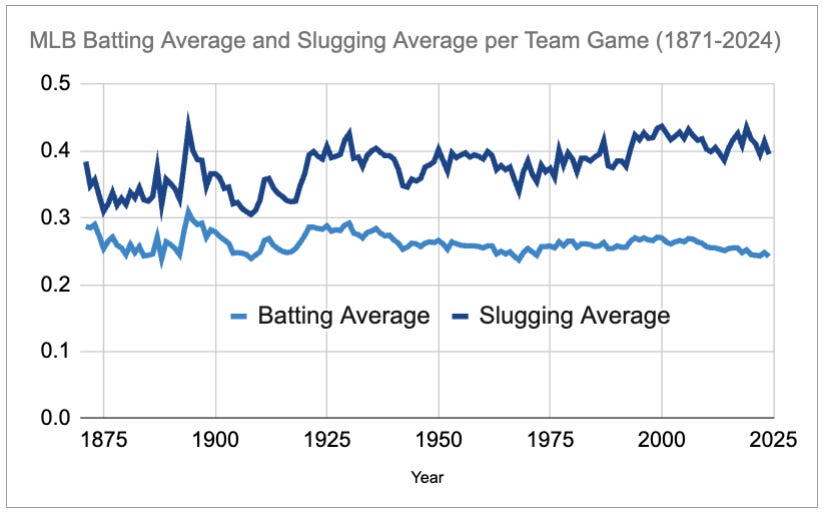

4.00 is nearly impossible because that means a player not only hits all bats, and all hits are home runs. The historical MLB slugging average (per team game) was around 0.42 for the last 20 years or so (see chart below).

Unfortunately, baseball pitchers are smart. They do not throw a ball that comes right in a baseball hitter’s perfect strike zone. Baseball hitters don’t consistently get all the balls they want. There will be all kinds of pitches, from fastballs, curveballs, sliders, knuckleballs, spitballs, and the worst being bad balls.

“But the greatest hitter living can’t hit bad balls good.” - Ted Williams

Hitters just have to be patient and wait for the right swing close enough in their strike zone to come their way.

To investing…

Let’s bring baseball’s batting average and slugging average into our world of investing and consider its implications, and how do we think about it.

For starters, let’s use the definitions from Michael Mauboussin’s “Dispersion and Alpha Conversion (April 2020)”

The batting average is the number (i.e., count) of investments that make money as a percentage of total investments made.

The slugging average (or slugging ratio) is the average absolute gains for successful investments divided by the average losses for unsuccessful ones (both realized and unrealized).

Before we move on, what is your investing batting average and slugging ratio?

What does baseball’s batting average and slugging average have to do with investing?

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong” - George Soros

One might think that the success rate (batting average) in investing is important, which means picking more winners is better. Yes, it is important, but it does not show the complete picture.

But what matters even more is how much your winners make compared to how much your losers lose. In other words, while your batting average cannot be too poor if you have a high enough slugging average, you can still blow it out of the park and do very well in investing.

The key to investment success is ensuring when you have winning ideas, they are big positions generating outsized returns (e.g., doubles, triples, or home runs), and when you have losing positions, the positions become smaller. Your losses are minimised and don’t matter.

This really happens when you have multi-bagger winners that go 5X, 10X, 20X, 50X, 100X and more, and your winners are allowed to continue to run, and you don’t keep rebalancing and trimming them too much to reallocate to other positions.

Below is the table of the Information Ratio (IR) across different batting averages and slugging ratios, assuming breadth is 50 and a constant of 1.6, which assumes a normal distribution. The Information Ratio measures the excess return rate per unit of active risk.

One of the key insights from the table above, is that an investor can be correct much less than half of the time, and can still deliver a high Information Ratio if the slugging ratio is sufficiently high enough.

Using an example, for the same Information Ratio of 0.75, a batting average of 70% would have a slugging ratio of ~0.58 versus half a batting average of 35% and a much higher slugging ratio of ~2.52.

It is not just how often you are right that matters, it is how much money you make when you are right versus how much money you lose when you’re wrong.

If you look at the green portion of the table above where the batting averages are below 50%, despite the managers of these portfolios being wrong more often than they are right, but they make a lot more money when they are right.

For context, as of 8 July 2024, Vision Capital, which I have been running with my own capital for over 7 years as an individual investor, has a batting average of 48%, a slugging ratio of 6.08, an information coefficient of 0.55, and an information ratio of 3.86 across all our individual stock positions.

The two charts below illustrate our batting average and slugging ratio graphically.

Below are the 27 multi-baggers that we have owned (as of 8 Jul 2024):

The difference between Baseball and Investing?

Baseball is a finite game. There are no official ties, and the games continue into extra innings until there is a winner. Thus, in baseball, each game has a definite ending, where someone has to win or lose.

Conversely, investing in the public stock markets is a nearly infinite game, where each investor can keep playing indefinitely for as long as possible as they want, for years, decades, and perhaps even for centuries (for endowments and foundations).

With this context, what then differs is that the slugging ratios in finite games like baseball are typically well-capped (see first chart ).

Whereas in near infinite games like long-only public stock market investing, where power laws are exhibited in long-term stock market returns, and if done right, one’s slugging ratios should keep increasing over time, where a few winners typically drive the majority of one’s returns, skewing the portfolio to ever growing concentration.

How about batting average vs slugging ratios?

My working hypothesis is that batting averages and slugging ratios are inversely correlated. While there can be exceptions to this for highly skilled investors, one could increase both their batting and slugging averages slightly, but a significant increase in either would have to be offset by another. In other words, one can’t have their cake (i.e., higher batting average) and eat it (i.e., higher slugging ratio).

If one wants a high batting average, one would have to pick sure-win titans; size would be the enemy to growth and eventually returns, and one’s slugging ratio magnitude would naturally have to be directionally lower.

Conversely, if an investor wants a higher slugging ratio, his batting average would have to be directionally lower, as it would mean that he would typically own the companies earlier and at much smaller market caps. This could also mean more mistakes in which the thesis might not pan out.

Obviously I am simplifying things a lot here, and there can be a lot of exceptions to this. But broadly I think this captures the vast majority of what most investors try to do.

Can one have a very high batting average and slugging ratio over a very long time? The investor would be near God-like. While I do not know of any, please let me know if you do.

Know what type of game you want to play

Ultimately, you have to know what type of game you are playing and, most likely, what kind of batting average and slugging ratios you should be aiming for. You can be like Warren Buffett with a higher batting average or be like George Soros with a lower batting average, but when Soros hits one, he blows it out of the park.

We know exactly what kind of game we are playing. We prefer to own a portfolio of fast, durable, growing, profitable compounders earlier in their S-curves, supported by long-term tailwinds, bought at not-too-expensive forward valuations, where we believe their business returns will drive the majority of future stock returns.

While we can get some wrong due to our earlier position in the game, hopefully, our batting averages will still be okay, and our ever-increasing slugging ratios, over time, will more than make up for it, especially for the new investment fund that I am going to start in the coming months.

From Baseball to Tennis: Winner’s Game vs Loser’s Game

Simon Ramo, in his 1970 tennis book Extraordinary Tennis for the Ordinary Tennis Player, explained the difference between amateur and professional tennis, writing that they are two different types of games.

Charles D. Ellis also wrote a masterpiece in 1975, “The Losers’s Game,” linking the winner’s and loser’s game in tennis back to investing and how money management has become a loser’s game.

Amateur tennis is a Loser's Game: 80% of points are lost on unforced errors, the ball is often hit into the net or out of bounds, and double faults at service are not uncommon. The amateur seldom beats its opponent, but he always beats himself. The victor gets a higher score because his opponent loses even more points. His effort to win more points will, unfortunately for him, only increase his error rate. The strategy for amateurs in a Loser’s Game is to lose less. Avoid trying too hard, avoid errors, be conservative, keep the ball in court, and wait for your opponent to make mistakes and blunder his way to defeat. In short, the outcome is determined by the activities of the loser; by focusing on improving the batting average by losing less, the amateur becomes the eventual victor.

Professional tennis is a Winner's Game: 80% of points are won on incredible shots. Professionals win points and make few unforced errors, whereas amateurs lose points. The strategy for professionals to win in a Winner’s Game is to win more. Professional tennis players stroke the ball with strong, well-aimed shots through long and exciting rallies until one player is able to drive the ball just beyond the reach of his opponent. Professionals win by hitting incredible shots. In a Winner’s Game, the ultimate outcome is determined by the actions of the winner hitting winners, winning more points than the opponent.

You need to know what investing game you are playing, if you are an amateur who is a winner playing the Loser’s Game, or a professional who is a winner playing a Winner’s Game.

The professional playing a Winner’s Game will be able to explain exactly what he is going to do, and why it is going to work very well eventually.

In a Winner’s Game, 90% of all research is focused on the buying decisions because the winners matter, and the slugging ratio matters much more.

In a Loser’s Game, 90% of their time should be focused on making sell decisions because the focus is on trying not to lose as much.

Both are different games, and everyone has a different skill level and experience. The more you understand which game you are playing, the better you will become at making decisions around it.

While the batting averages and not losing matter much more for Loser’s Games, the slugging ratios and the winners matter much more for Infinite Games and the Winner’s Games.

In summary: From baseball to tennis, to investing

From Baseball:

Batting average matters, especially for Finite Games.

Slugging average matters even more, especially for Infinite Games.

To Tennis:

Amateurs play the Loser’s Game, which is focused on not losing.

Professionals play the Winner’s Game, which is focused on winning.

To Investing:

Focus on playing the Infinite Game, and learning how to play the Winner’s Game.

12 July 2024 | Eugene Ng | Vision Capital Fund | eugene.ng@visioncapitalfund.co

Find out more about Vision Capital Fund.

You can read my prior Annual Letters for Vision Capital here. If you like to learn more about my new journey with Vision Capital Fund, please email me.

Follow me on Twitter/X @EugeneNg_VCap

Check out our book on Investing, “Vision Investing: How We Beat Wall Street & You Can, Too”. We truly believe the individual investor can beat the market over the long run. The book chronicles our entire investment approach. It explains why we invest the way we do, how we invest, what we look out for in the companies, where we find them, and when we invest in them. It is available for purchase via Amazon, currently available in two formats: Paperback and eBook.

Join my email list for more investing insights. Note that it tends to be ad hoc and infrequent, as we aim to write timeless, not timely, content.

Great article! Yet, looking at your table.. for me the conclusion is different. As demonstrated by the numbers it makes more sense to focus on not loosing money, meaning to have as many winners as possible, rather than focusing on having big winners (like you said, what Buffet did). From a logical point of view there are not many home-run investments and if you are lucky enough to find one it is often not well predictable. A lot of people nowadays are looking for multibaggers rather than focusing on dead-boring cheap companies who return above average with a high chance.