My 12 Biggest Key Investing Takeaways from “Antifragile” by Nassim Taleb

How to make our investment portfolio less fragile, and perhaps more antifragile.

Antifragility is a concept that we have been thinking deeply the first time we heard of it, and have been employing it as a desired outcome in our investing strategy. But we have never got down to reading “Antifragile: Things That Gain from Disorder - by Nassim Nicholas Taleb”. I took time over the last few weeks to read the book , and the outlined concepts were surprisingly close to what we have been doing. Thus we decided to share our top learnings from the book, and its continued applicability for us as to how we invest in public stock markets.

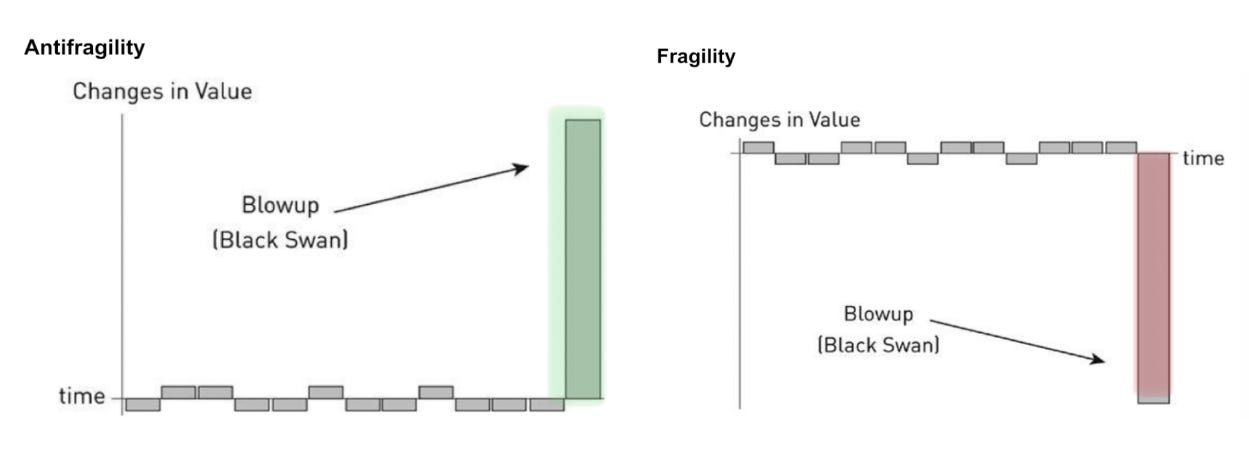

1 | Focus on asymmetry

Asymmetry is where there is more upside than downside, where the positive payoff is significantly larger if you are right (you “earn big time”) than the negative payoff if you are wrong (you “lose small”).

Antifragility arises from asymmetry of more upside than downside, where one tends not to be permanently wiped out, and tends to gain from (1) volatility, (2) randomness, (3) errors, (4) uncertainty, (5) stressors, and (6) time.

Fragility is where there is more downside than upside, where one tends to be eventually permanently wiped out, and tends to lose from (1) volatility, (2) randomness, (3) errors, (4) uncertainty, (5) stressors, and (6) time.

Seek to be timeless, not timely. Focus on the long-term, not the short-term. Time will position the antifragile well, and the fragile poorly.

➡️ This is why we choose not to employ any use of leverage, short-selling, or use derivatives. In particular, is the selling of naked call options. Surviving is the only thing that first matters. We don’t think we can ever be wiped out as long as we continue to stick broadly to our philosophy and framework of long-term buy and hold investing strategy consistently over time.

2 | Detecting Antifragility or Fragility via Asymmetry

It is important not to mistake absence of evidence of harm for evidence of absence. Bad news that does not show easily, does not mean there will be no bad news. Crucial to distinguish between true and manufactured antifragility.

One can almost always detect antifragility (and fragility), by a simple test of asymmetry.

Antifragility is anything that has more upside than downside from random events (or certain shocks).

Fragility is the reverse, anything that has more downside than upside.

What is fragile will eventually break over time, so being able to tell what is fragile helps. Positive black swans are more unpredictable than negative black swans. Focus more on removing all negative black swans, and then position for positive black swans, and the eventual process will take care of the outcome.

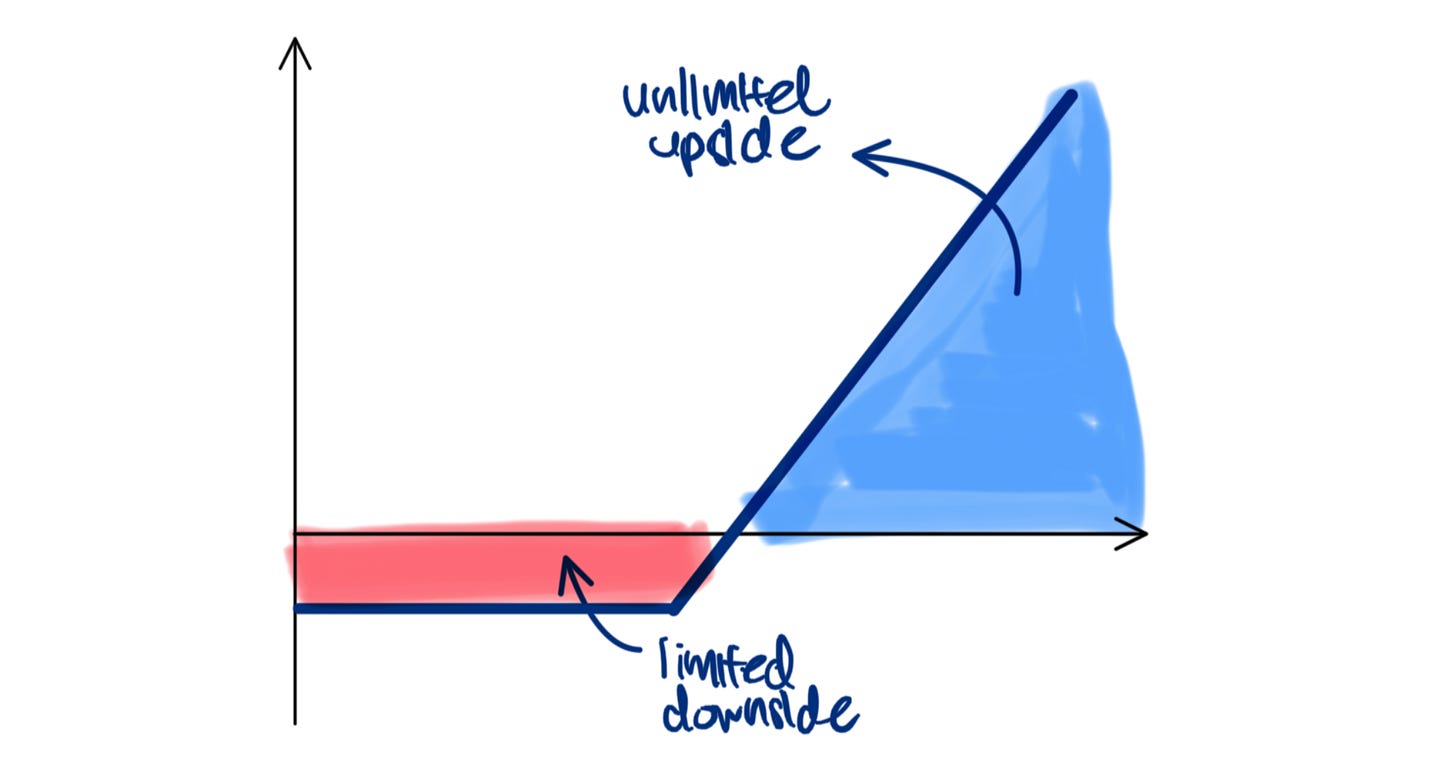

➡️ Our portfolio is built to be highly asymmetric, we focus on buying and holding long-term multi-baggers that go 5X, 10X, 20X, 50X, and knowing that our losers can at best go to zero (though none have so far).

Instead of buying options, we think of every long-only stock investment as a long call option with limited downside (thin left tails) but unlimited upside (right fat tails). It is investing in stronger, growing, quality and profitable companies, that we view our entire portfolio as a weighted average of a very long call option (thick right tails). And if we do it right, its asymmetric property should become more evident and pronounced over time (i.e antifragile).

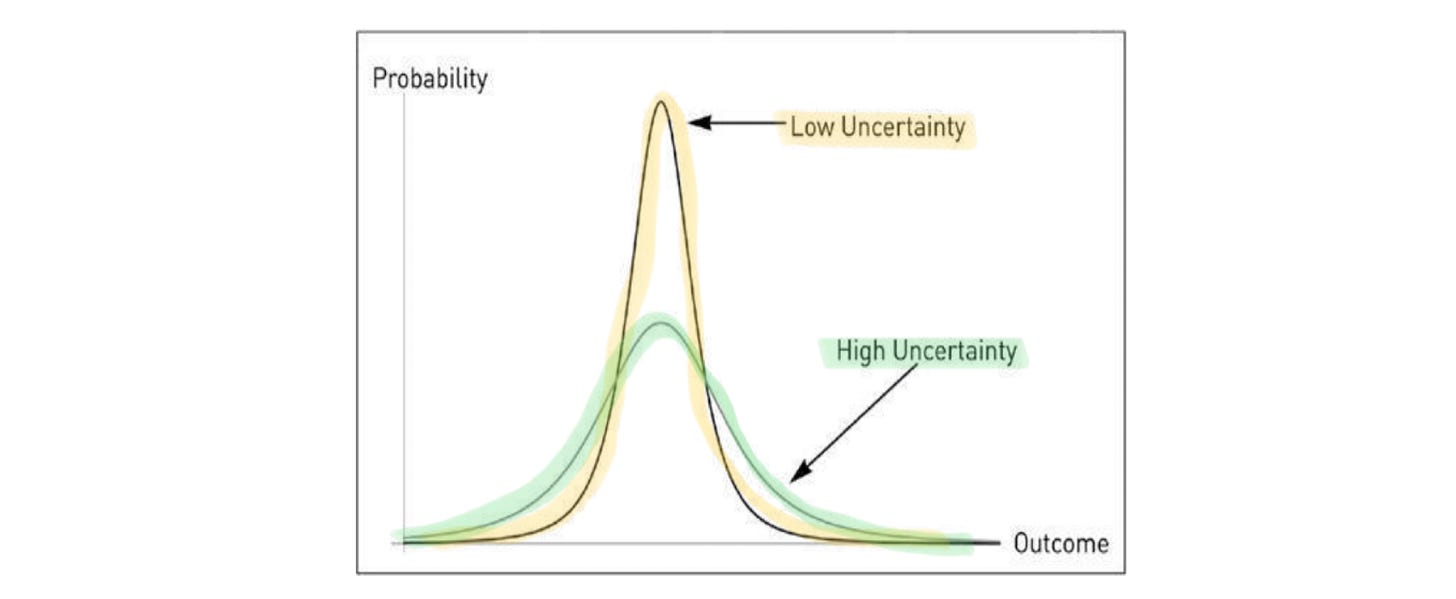

3 | Desiring volatility

Everything gains or loses from volatility. Higher uncertainty moves a bell distribution curve from a narrow possible spate of outcomes with higher peak, to one with a lower peak but more spread out. This causes an increase of both positive and negative surprises, both positive and negative black swans.

Fragility hates, fears and loses from volatility and uncertainty.

Antifragility loves, thrives and gains from volatility and uncertainty.

Antifragility needs stress, volatility and randomness, or else they will weaken.

➡️ We love volatility, and don’t think of price volatility as risk. The only risk is the permanent loss of capital. Our portfolio tends to move down more than the market which is ~1/3 of the time, but also tends to move up even much more than the market, which is ~2/3 of the time. That’s how we think we tend to generate our alpha and outperformance over the long-term.

And as we experience more and more market selloffs, our mental mindset becomes even stronger (less fragile). Because of this right mentality and mindset, during down moves, we thrive because when the market is acting in fear, we are not afraid to still be holding on to our companies, and instead be daring to keep buying more of our highest conviction / under-allocated ideas, as we have done so multiple times, and will continue to do so.

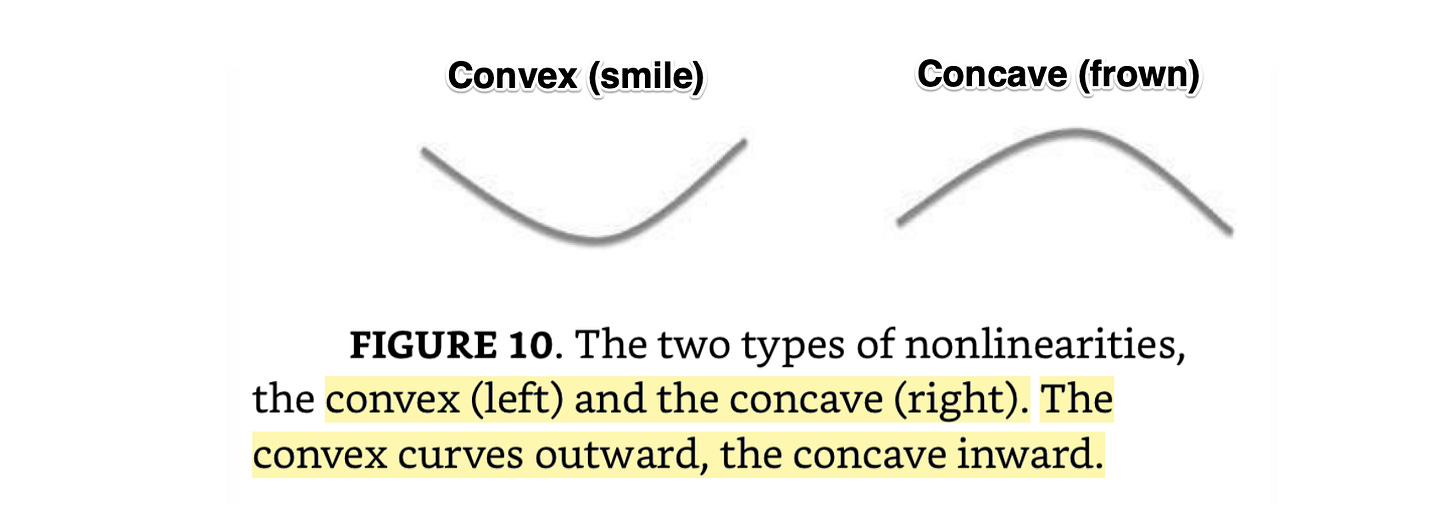

4 | Non-Linearity: Convex and Concave

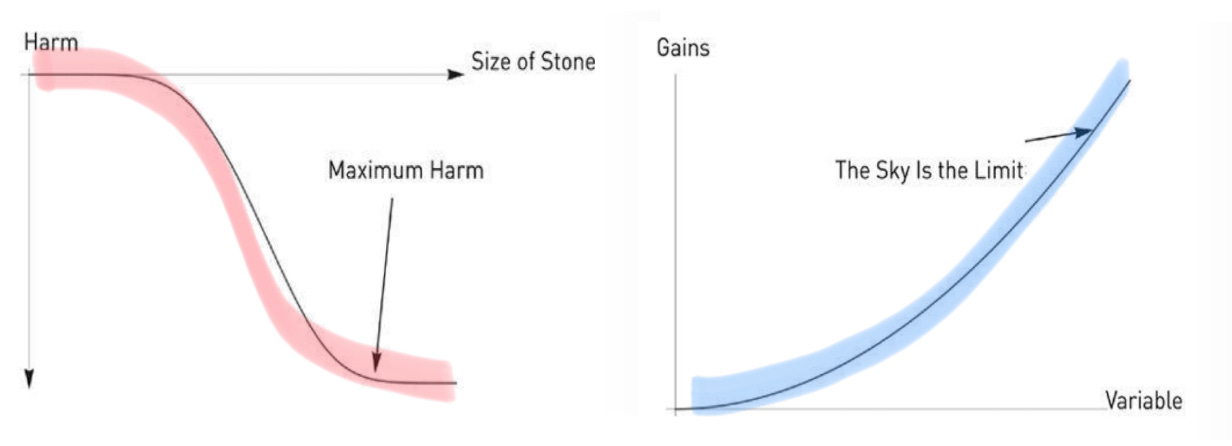

🟢 Antifragility = Convex = Smile = Positive convexity effects = More upside than downside = Likes volatility = Earn more than you lose from fluctuations

🔴 Fragility = Concave = Frown = Negative convexity effects = More downside than upside when something bad happens = Hates volatility = Loses more from fluctuations

Everything nonlinear is convex or concave, or both, depending on the intensity of the stressor. Convexity and antifragility likes volatility, and concavity and fragility hates volatility. So everything likes or hates volatility up to a point. Everything.

➡️ We do not want inherent fragility, and to be bidding our time with a poor strategy that might generate steady outcomes but is waiting to wipe us out permanently. What instead we seek, is antifragility, convex non-linearities, high asymmetric outcomes, unlimited upside and limited downside.

Not fragility, concave non-linearities, and unlimited downside, limited upside outcomes. That’s why we typically don’t invest in companies with poor financials, poor profitability, poor unit economics, weak balance sheets, lousy management, unhappy employees, and hope for a turnaround. Most of the time, turnarounds don’t turn.

Knowing what to exclude to limit our downside, we can then focus on our upside, on quality growing companies supported by long-term tailwinds, strong unit economics, already strong / improving profitability, strong unit economics, solid balance sheet, impressive management, happy employees, and high insider ownership.

5 | The degree of convexity and concavity matters.

Fragility is concave, more shocks bring more higher harm and its intensity increases at a faster rate, up to a certain level. It is hurt a lot more by extreme events than a succession of smaller ones.

Antifragility is convex, more shocks bring higher benefit and its intensity increases at a faster rate.

Important to distinguish if something is highly convex, mildly convex, mildly concave or highly concave, or if it starts off convex and ends up concave.

➡️ More convexity is what we desire. The power of compounding in investing, and being able to hold winners and add to them, increases the degree of convexity. Being not highly concentrated, allows us to let our winners run, and not having to continuous trim them when they are outsized, to allocate to our next best ideas. Being largely invested most of the time, also allows for maximum convexity. Conversely, constantly trading in and out of winners, missing the best days (not the worst days), poor market timing, coupled with large fluctuations in one’s cash balances, tends to reduce one’s overall convexity, which is what we want to avoid.

6 | Employing a Barbell Approach

It is a dual strategy of playing it safe in some areas (robust to negative black swans), and taking a lot of smaller risks in others (open to positive black swans), hence achieving antifragility.

Because of its construction, it reduces downside risk, and eliminates the risk of ruin.

➡️ This is also why we own a strong combination of more mature, but still growing profitable larger companies, coupled with slightly younger and growing faster, but still largely also profitable smaller companies, and in between, own largely nothing else.

7 | Distributions are not normal, they are power law

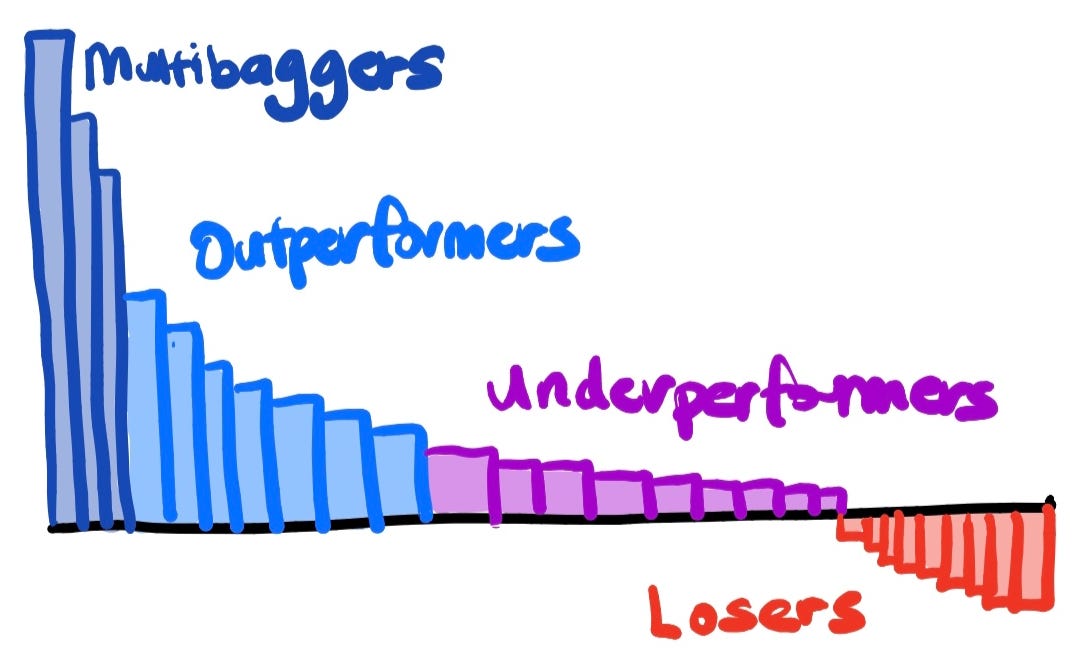

Statistics assume normal distributions, but most are not. Power laws drive venture capital returns, and so does public equities investing.

Most investments don’t do well, a small number tend to do very well, and their gains often eventually overwhelm all the losses from the losers combined many folds over.

Identify and focus on what matters that tend to do well, and ignore the rest that don’t.

➡️ That is why we focus on a very small selection of companies that are highly selective, rejecting the vast majority of the investments (public and private) that we come across. We are highly focused on the future, not the past, and trying to skewing our distribution outcomes to the right, allowing for the thin left tails to not hurt us, and the fat right tails to thrive, to do as well and for as long as they can.

8 | Taking advantage of Jensen’s Inequality with respect to non-linearity

mean(f(x)) >= f(mean(x)), for convex f()

mean(f(x)) <= f(mean(x)), for concave f()

The mean of a convex function of a variable is always greater than the function of the mean variable.

The mean of a concave function of a variable is always lower than the function of the mean variable.

➡️ We are taught that concentration (<10, or even up to 10+) is good, but concentration is less convex, and can be even concave. Our investing style of longer-term holding periods, lower turnover, adding to winners and less concentrated, allows for more compounding, resulting in higher degree of convexity (with 10X, 20X, 50X, 100X+ multi-baggers), and higher non-linear return functions than a typically more concentrated investing strategy (3-10X+).

9 | Optionality does not require a very high batting average

With optionality and a likelihood of asymmetric outcomes, you don’t have to be too right too often.

The edge from optionality is in the high convexity, and the larger payoff when you are right, which makes it unnecessary to be right too often.

This helps, because more often we think we know, but sometimes we really don’t know for sure.

We need to know (what matters), but we don’t need to know a lot (everything). Strangely, if one needs to know a lot to do well, one is fragile, instead of antifragile.

➡️ The additional benefit is that we can be wrong more often (though we think we are still batting slightly better than average), and when we are, it doesn’t hurt and we can still end up performing. Whereas for a highly concentrated / less convex style of investing, one has to be more right / and have a higher batting average.

10 | Via Negativa - Avoid all downside, and the upside will take care of itself

In addition, true optionality does not require intelligence, all it requires is to not be stupid and having the wisdom to avoid and not do unintelligent things to hurt yourself. The pros win first by not losing (then winning), we aim to do so as well. We want to play the game for as long as we can without being wiped out.

Via Negativa lists what is not, and proceeds by process of elimination. E.g. Michelangelo on the carving of the statue of David, the masterpiece of all masterpieces. His answer was: “It’s simple. I just remove everything that is not David.”

Negative knowledge (what is wrong, what does not work) is more robust to error than positive knowledge (what is right, what works). So knowledge grows by subtraction much more than by addition.

Focus on negativa first, then positiva, but ensure that positiva never has negativa.

➡️ Which is why we tend to avoid businesses with negative optionality, e.g. airlines, banking, restaurants, energy/commodity companies, etc.

11 | Investing is not gambling

Casino bets and lottery tickets unsurprisingly have a high but known maximum upside.

In investing, with multi-baggers, the sky is often the limit, thus theoretically unlimited upside, until they mature and decline (of course).

True optionality has unlimited (not limited) upside, and limited downside.

➡️ Investing in ourselves and in companies that do well over time, can allow for true unlimited upside, and that’s why we look to keep doing so for as long as we can. It is also why we want to let our winners run for as long as possible, rather than to trim or sell them due to high valuations. One of the biggest mistakes of most top investors is selling out their winners too early, and that’s what we want to avoid as much as possible.

12 | Skin and Soul in the Game

Assign little/zero value to what anyone says or writes, if they have no skin in the game, as being wrong costs nothing to them.

Even more so, be wary of theories or anyone who speaks only for fees, with no skin in the game, or worse still, using their circle of influence to pump their own holdings, and benefit themselves. The first is bad, the second is the worst. In addition, be wary of others, who trade fragility of others for their own antifragility.

Skin in the game matters. Mistakes are costly, not free, and being right brings real rewards. Soul in the game brings it to a whole new higher level, committing to a belief, and having something to lose, if wrong.

Soul in the game is when you love what you do, your work stops being work and it becomes a craft; and no matter what it is, you do it with pride, love, and care, seeking to constantly strive for improvement in your craft, eventually it becomes a net positive for society. That’s worth living for.

➡️ Skin the game and soul in the game matters. We are practitioners first, teachers second sharing our wisdom. We practice what we preach, what we think, say, and write is absolutely consistent throughout what we do, and invest in, most importantly where the majority of our capital is in. It is also what we hope to do, when we start our own fund and be open to managing external capital, and be equally accountable to our partners as to ourselves. That’s truly what we see as most fulfilling and meaningful.

PS: This is our best interpretation of the book, and of the concepts that we found most insightful and highly applicable to investing. And as always, any errors are ours.

23 July 2023 | Eugene Ng | Vision Capital Fund | eugene.ng@visioncapitalfund.co

Find out more about Vision Capital Fund.

You can read my prior Annual Letters for Vision Capital here. If you like to learn more about my new journey with Vision Capital Fund, please email me.

Follow me on Twitter/X @EugeneNg_VCap

Check out our book on Investing, “Vision Investing: How We Beat Wall Street & You Can, Too”. We truly believe the individual investor can beat the market over the long run. The book chronicles our entire investment approach. It explains why we invest the way we do, how we invest, what we look out for in the companies, where we find them, and when we invest in them. It is available for purchase via Amazon, currently available in two formats: Paperback and eBook.

Join my email list for more investing insights. Note that it tends to be ad hoc and infrequent, as we aim to write timeless, not timely, content.