Saying Goodbye: 30 Investing Lessons After 19% CAGR Over 7 Years

Cracking the code, embarking on a quest to become a great individual investor

1 | Being an outsider

I was an outsider of the investing world. I had no investment experience. I didn’t read a single investment book. I had a near-death/paralysis accident over 10 years ago where I broke my neck. Thankfully, I survived it, but my neck still remains broken to this very day. Life is extremely precious, and I want to live my remaining life to the fullest, and positively impact as many people as I can.

2 | Being a living example to show that one can beat the market

1-2 years later, I discovered my life purpose and mission and soon it gave meaning to everything that I was doing. I had quit my job after 8 years with J.P. Morgan in 2020, and published my book on investing a few months later. The book title was “Vision Investing: How We Beat Wall Street & You Can, Too!”. I wanted to be a living example, and show the public that though it is difficult, but it is truly possible to outperform and beat the market over the long-term.

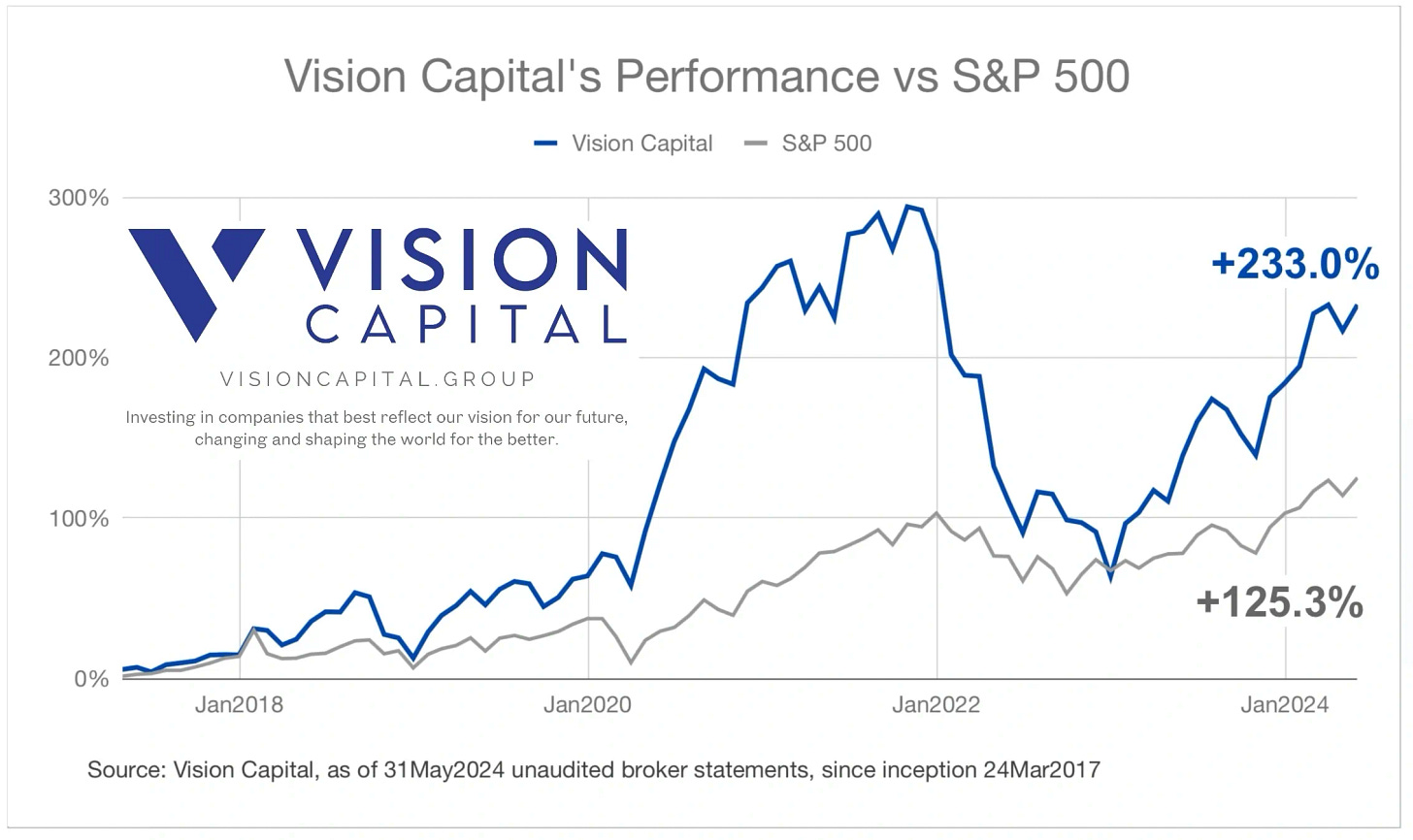

On the side, I have been investing my own capital as professionally as I could via Vision Capital, and being very public about it, constantly sharing my thoughts and write-ups, outside the hours of my full-time job. Over the past 7 years, my investment returns significantly outperformed the S&P 500, achieving +233% compared to +125%, and +18.9% compared to +11.4% annualised returns.

3 | Realising why investing in stocks.

There are many ways to grow your wealth, you one can start a business, invest in property, or invest in companies. You have to realise what works best for you. Surely the path to long term financial freedom is to earn more, spend less, save more, and invest well. One needs to do all 4, and know what is enough.

If you want to invest, but don’t have time to analyse companies, a great way is to passively regularly dollar cost average and index via low cost ETFs over time. But if you want to achieve higher returns that the 7-9% the long-term indexes do, investing in stocks can be a great potential way to do much better.

4 | Going back to first principles

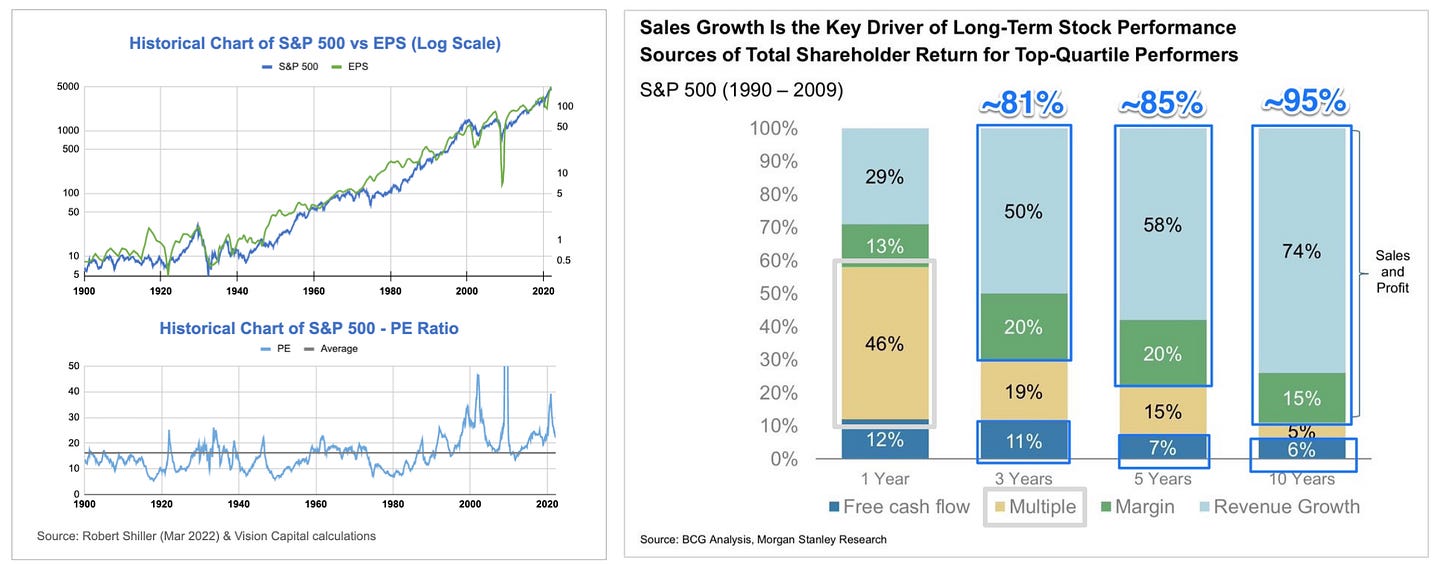

With a degree in economics and finance, and despite working in banking for over 11 years, I was ill-equipped from the onset to invest well. I decided to start from first principles, asking basic questions? What are stocks? Which they are part ownership stakes in business. Why stock prices rise, and eventually how much?

Eventually I came to realise that growth of revenues, profits and free cash flows matter the most over 5-10 years and beyond, not changes in valuation multiples. That’s why my favourite investing saying is where revenues, profits and free cash flows flow, the stock price eventually goes.

Could investing in this stock generate sufficient returns? Once you take the red pill, once the eyes see what truly matters, you can no longer un-see. You have to learn how to say no a lot, say yes very little. keep the bar high, don’t lower it. I lowered it during COVID in 2020-2021, thankfully it didn’t hurt too much.

5 | Mistakes are inevitable, focus on losing less often and less

Mistakes are inevitable, focus on how to reduce the probability of losing, and losing less when you do. Avoiding anything that has an unlimited downside like a Russian Roulette, that’s why I do not short, employ zero use of margin / leverage, selling no option, employ no derivatives, and do no hedging. We don’t trade, or rotate between what companies are going to be hot, the portfolio turnover has stayed consistently low. If a company has no sustainable path to profitability or free cash flows, anything times zero is going to be a zero eventually.

5 | Diversify sufficiently to stay in the game

We sufficiently diversify and not overly concentrate, have more than 10-15 stocks, because sometimes things can go wrong which cannot be expected. You might think you know for sure, but after a while, you realise you never know for sure, so concentration does not get us into trouble. We do not ever want the portfolio to be completely wiped out. Investing well is about being able to continue staying in the game, and never be wiped out.

6 | Focus on avoiding errors of omission rather than errors of commission

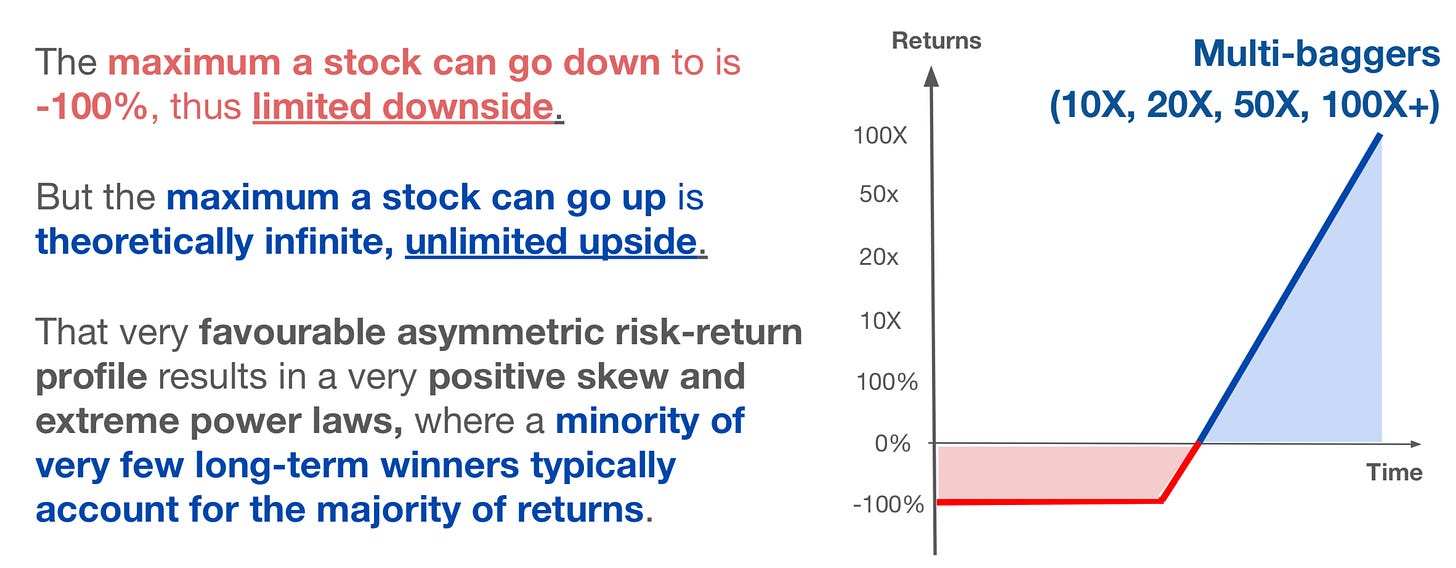

Yes rule no. 1 is not losing money, and rule no. 2 is not forget rule no. 1. Most investors are focused in not making errors of commission, or a Type I error, which is making a bad investment when you think it is a good one.

Instead, I am focused making less errors of omission, or Type II errors, rejecting a good investment when I think it is a bad one. Because the maximum a loser can lose is theoretically limited at 100%, but the maximum upside a missed winner can go higher is theoretically infinite.

Most investing greats, will tell you their biggest mistakes are often errors of omission (not commission) and not buying a certain good company at a certain price, because they thought it was expensive, and eventually missing out the subsequent huge gains that they missed. It is because of our willingness to pay up for quality (but not too much), that we have had few to no errors of omission do far.

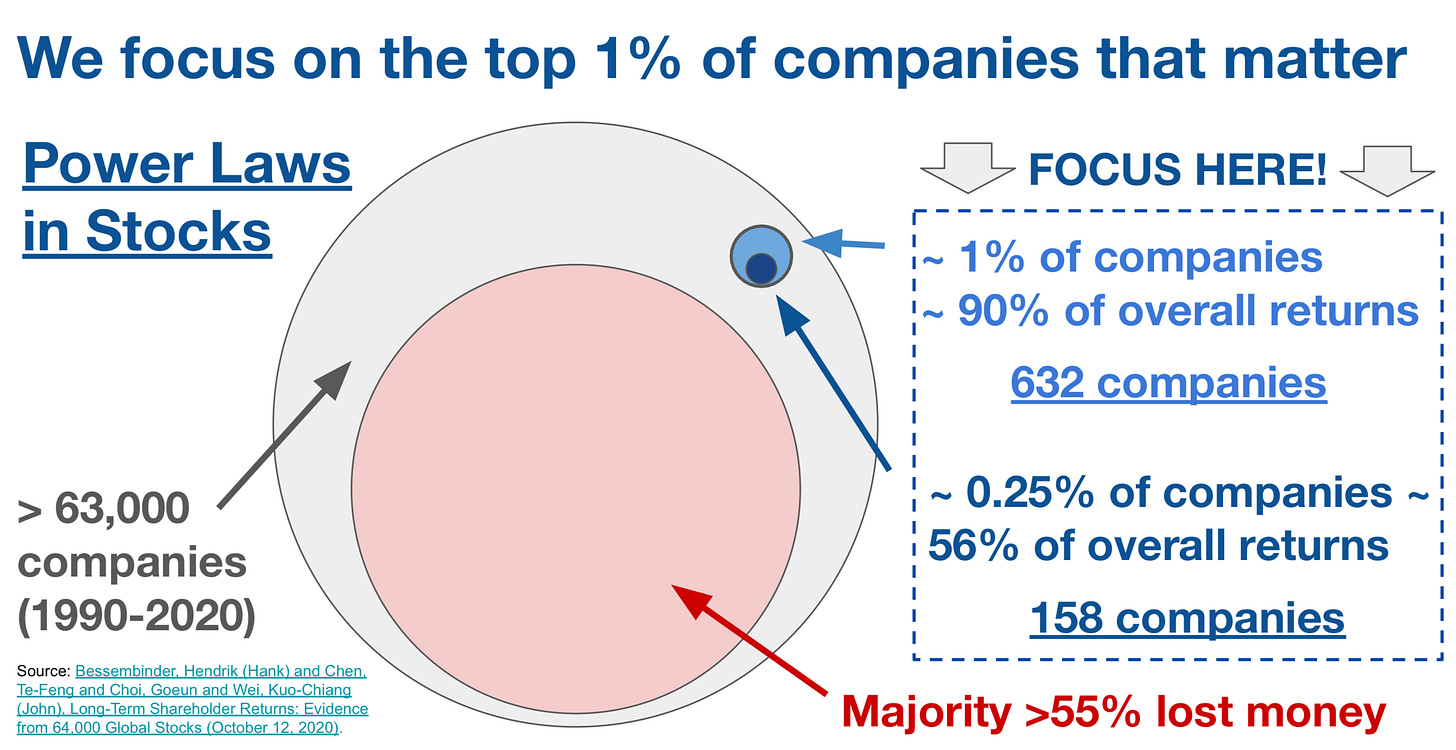

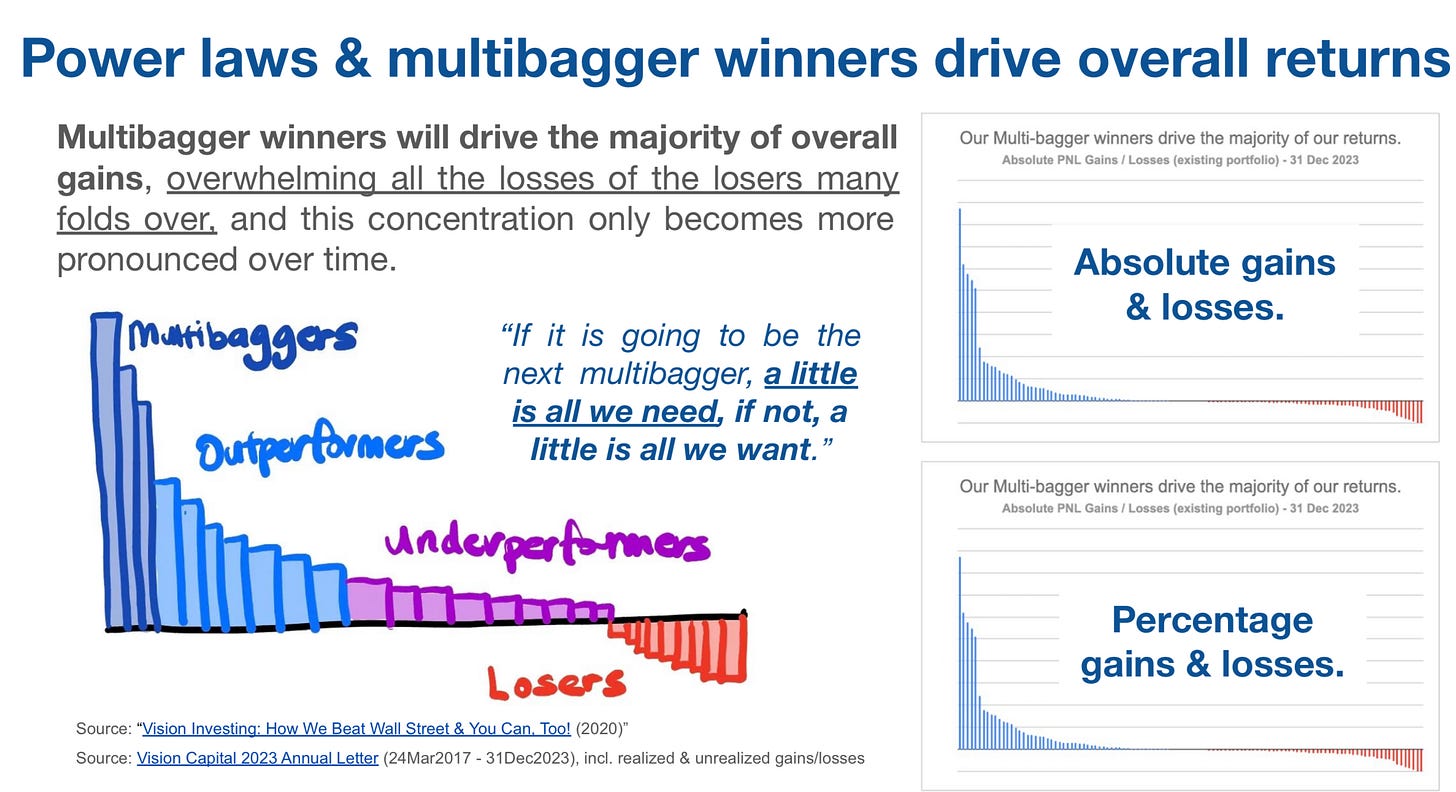

7 | Powers laws drive stock market returns, focus on the top 1%, avoid the 99%

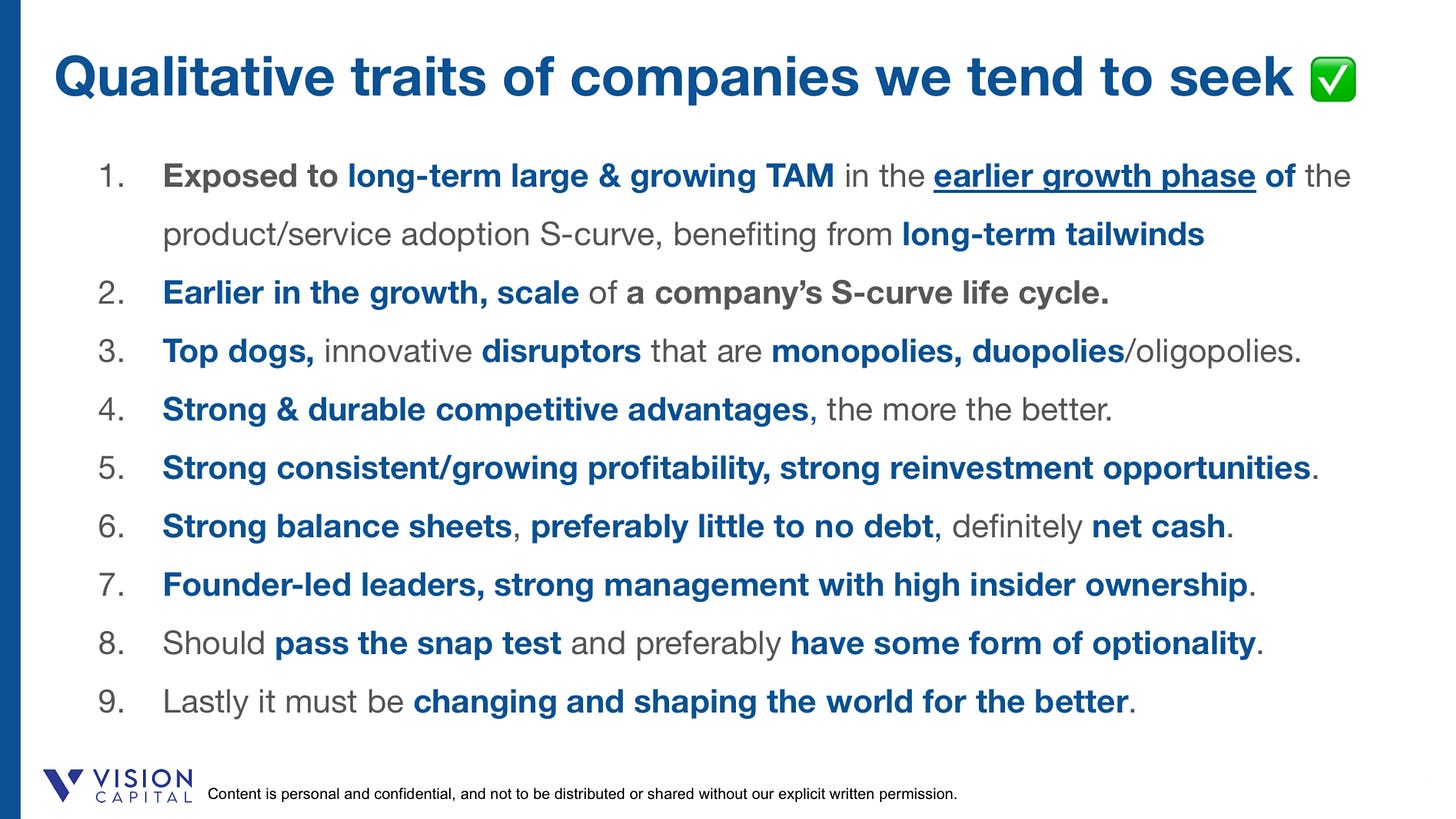

Power laws drive public stocks, the top 1% of companies drive the majority of the 90% of net returns. The unfortunate reality is that most of the companies are not worth investing in. They either go sideways or decline. It is focusing on the companies that can get to the top 1% and what persistent long-term qualitative traits that we can look out for to increase our chance of finding them.

Quality, durability and excellence are the key hallmarks. If we do it right, they will be multi-baggers that can 5X, 10X, 20X, 50X or maybe even 100X over decades.

An additional phenomenon you will experience is multiple spiffy pops, where the 1-day stock price gain exceeds the original price you bought the stock. I am truly grateful to have 23 spiffy pops over the last 7 years.

Below are the traits of businesses that we prefer to seek and avoid, to get us as close to that top 1% of companies as much as possible. I only have a shortlist of less than 100 strong companies that we would ever consider investing in our opinion.

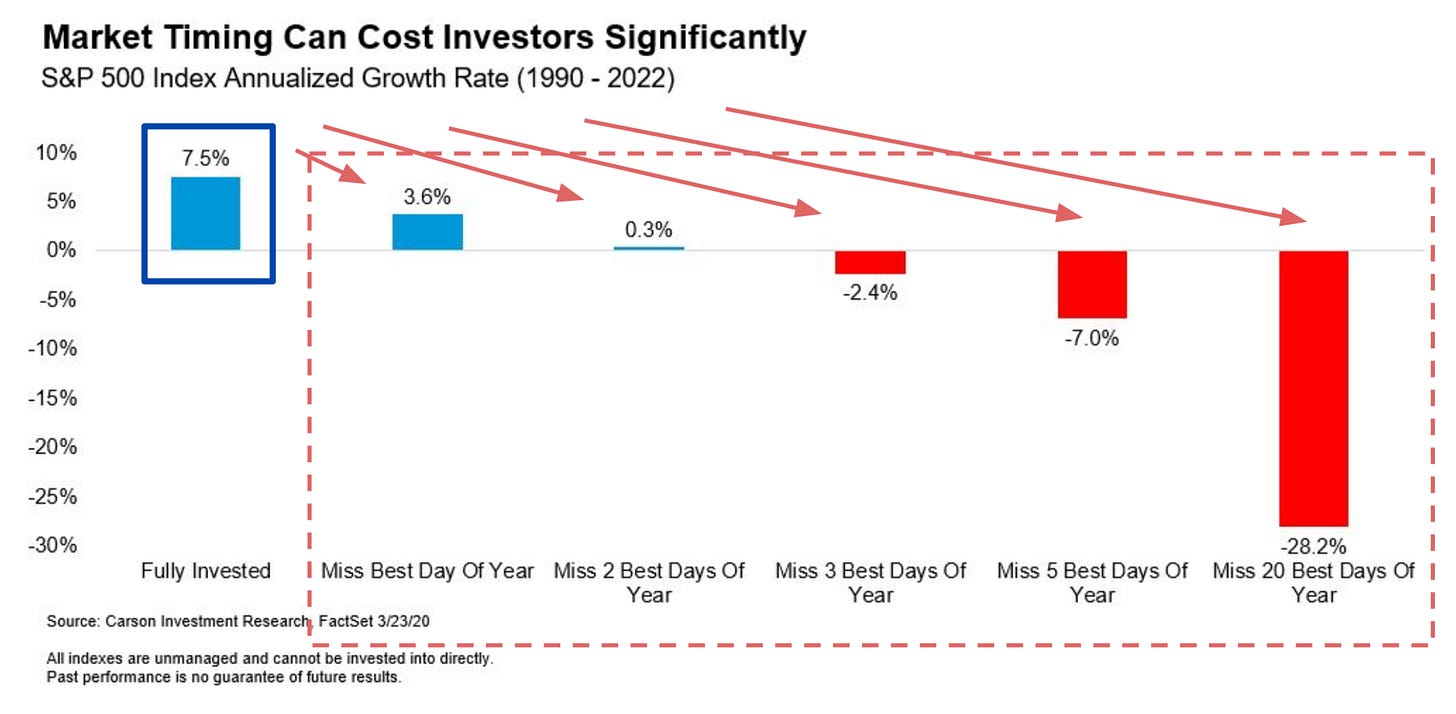

8 | The returns come from holding, not trading

Yet one needs to hold these multi-baggers through multiple price declines. You need to be patient and give them the space, their growth path is often non-linear and comes in zigs and zags, there will be occassional soft and tough times. It is key to not trade them through the ups and downs. Trade and miss the best days, and your returns drop tremendously. It is time in the market, not timing the market.

I try to invest in companies earlier in the S-curve and hold them for as long as I can through to the top of the S-curve, with signs of persistent structural decline, that’s when we tend to exit.

9 | Set your game up to win more often, and win big, lose less often, and lose less

Game selection is crucial, you have to play the right one that will tend to lead to a higher likelihood of winning outcomes and bigger payoffs. The game I play is one of where I tend to lose less often and lose less, and tend to win more often and win really big. Eventually you generate immense asymmetry, which is alpha, and that drives the long-term outperformance.

The gains from your top few winners will drive the majority of the returns of the portfolio, and will overwhelm all the losses from all the losers many folds over. Winners end up comprising a larger percentage of the portfolio over time. Concentration then becomes an outcome, rather than a process.

10 | Price volatility is unavoidable, use it to your advantage

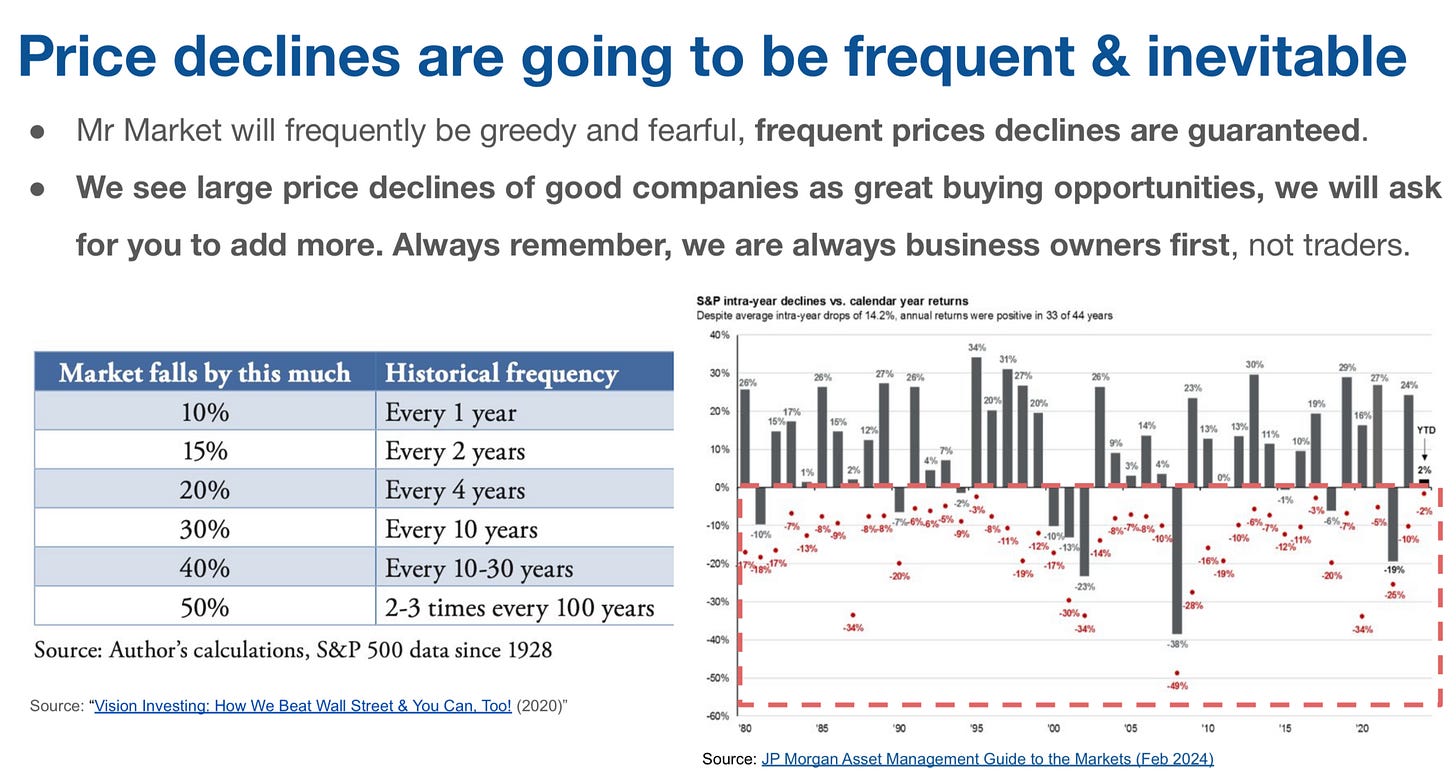

Price volatility is the price we have to pay to play this game; don’t avoid it, embrace it, understand historically how often and how much, and take advantage of it. Mr Market makes a price every minute, every day, but companies only report earnings 4 times a year. Mr Market will throw his tantrums.

Ignore the price narrative, a company doesn’t suddenly become a good or bad business just because its stock price rises or declines. Focus instead on the business narrative, often when the business is still long-term structurally sound, it can undergo huge price declines, and often these can be great buying market opportunities when the market misunderstands and fail to see through it.

11 | Get used to frequent and even larger price declines with time

You need to endure frequent price declines. I have endured more than 25% declines in the portfolio multiple times over the last 7 years, and each time the absolute decline in dollar amount only gets larger and larger as the portfolio grows in size over time.

Know that the absolute declines in dollar amount will only get larger and larger over time. If you cannot bear a $1,000 move, you cannot bear a $10,000 or $100,000 or even $1,000,000 move.

Learnings and realisations after getting there

12 | Being able to invest is a privilege, be thoughtful about what you do with it

Being able to have enough savings and excess capital to invest is a true privilege. I did not let it sit around in low single digit deposit accounts. At 3% for 20 years, it turns $100 to $180, a 1.8X. At 15% for 20 years, it turns $100 to $1,636, a 16.3X.

I also did not give to my bankers to let them constantly switch me around different high-fee paying funds depending on the market theme. Or let them convince me to put on some structure that seemingly have higher returns that come from selling options. When things get bad, which they always do, most get wiped out. It is a recurring theme that never ends.

13 | The best times to invest are during massive selloffs

The best times to invest are often during massive market selloffs, when everyone is fearful and not willing to, not when everyone is excited and FOMO. If the business remains structurally sound and solid, lower prices, a higher margin of safety, and potentially higher prospective returns. Conversely, when prices are too high, the margin of safety is lower, and prospective returns often tends to be lower.

14 | Go with an investment strategy that is repeatable and scalable that suits you

Ultimately, your investing strategy and style is unique to you. It must be comfortable to you, it must suit your personality and your strengths. Everyone’s investment portfolio is going to look different.

Most importantly, you must be able to sleep well at night. After some time, you will come to realise if your strategy is truly repeatable and scalable over the long-term.

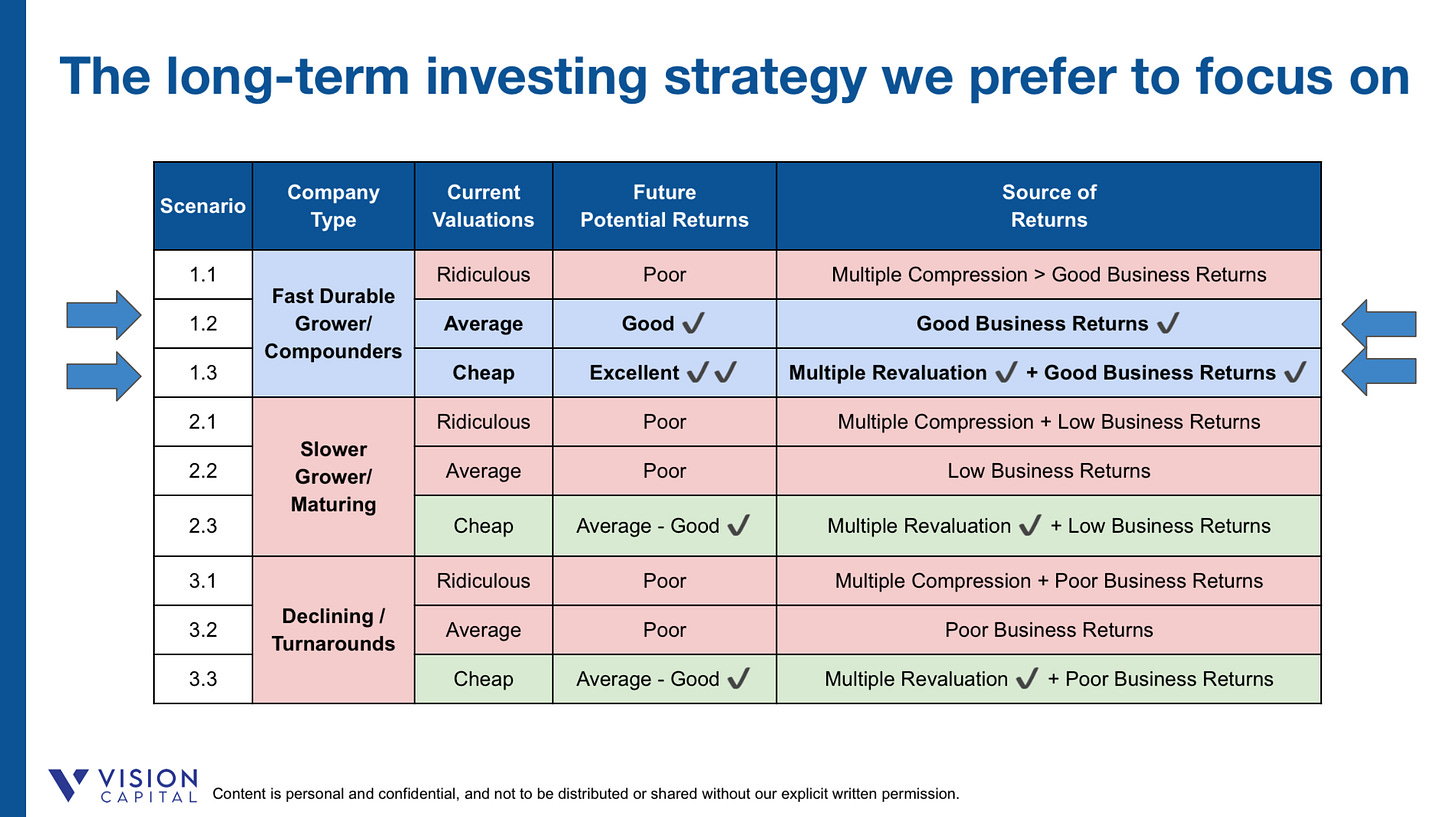

Below is the long-term investing strategy I prefer to focus on.

15 | Price matters much more in the short-term, less in the long-term

Price matters, great business, high price, poor returns, great business, fair/slightly expensive and you can still get a very good return. All intelligent investing is value investing. Price drives most of the returns in the short-term, but business returns really drive the majority of returns over the long run. The long term is the only term that counts.

16 | Companies are expensive and cheap for a reason

Valuation multiples are not the same, it depends on the quality of the companies and the growth profile. Slower growth, lower profitability, lower multiples. Faster revenue growth, higher profitability, longer runway of growth, higher multiples.

17 | Think in DCF, you don’t need to do one

Modelling Discounted Cash Flow (DCF) valuations are a waste of time. Yes the present intrinsic value of a company should be the sum of the discounted future cash flows. But because one needs to insert multiple inputs and assumptions into DCF valuations, the calculated price targets are going to be precisely wrong.

For great businesses, it is the persistence underestimation of the runway of growth that continues to elude the Market, few can expect how big the market can become.

18 | Certainty is important, seek higher predictability

If you cannot approximately get a rough sense of the business growth, and the range of expected returns over the next 3-5 years, it is probably not going to be a right investment anyways. Always think in ranges and distributions, not specific numbers. It is far better to be approximately right, than to be constantly precisely wrong.

19 | Know what game you and others are playing

Knowing what game you are playing matters, and whoever you are learning from. There are many ways to make money in the stock market. You need to differentiate if you are trading based on technicals, on investing based on fundamentals. If you don’t know, you are probably the patsy, and others are playing you.

For me, when markets go down, we will go down more and faster than the market, but when the market goes up, we should go a lot more. That’s our game, what’s yours?

20 | To do well, you have to be different and right, and work hard

To do well in investing, you have to be different and right over the long term. If you do what everyone else is doing, you will get similar returns to everyone else. If you want to beat the index, what you own has to be different from the index, with a higher allocation to higher quality, faster growth and preferably at a cheaper price. It is hard work.

You have to work hard and smart, I wake up early on weekdays typically around 4.30-5.30am, so I can get in more hours doing my investing work daily before my job starts. When you have put in the hard work and thousands of hours, something magical starts to happen.

21 | Work within your core competencies first, expand over time

Focus on what you know, what you are comfortable with. Know your core competencies. I was familiar with payments, finance, e-commerce, technology, All I was interested was trying to buy some of the best companies available to me as early as I can, and hold them through long periods of time.

22 | Investing in stocks is having some of the best CEOs working for you

Investing in stocks is investing in businesses, and having some of the best CEOs running some of the best companies in the world with their employees working for you 24/7. When you view it that way, it changes your perspective in life.

23 | Investing is a skill worth learning, and it gets easier over time

The two skills one needs to learn, how to make money, and how to invest money. Investing is a skill worth living for to constantly learn, clarify, and refine. It is a continuous process for life. It is both a science and an art. The more you do, the better you. The more annual reports you read, the more interviews you watch, the more patterns you recognise, the more links you connect, and the faster, and better it goes.

It took very long initially, I remembered taking over 1 month to finish my first annual report, and now I can probably speed read through one in 1-3 hours depending on its complexity and get a rough ~70-80% read if it’s even worth spending tens if not hundreds of hours to deep dive further.

24 | Compounding is very powerful especially when you get to experience it

Compounding is a very powerful tool, if you do it right, the size of the portfolio will only keep getting larger over time. There have been a few years, when my portfolio gains exceed my total annual income. If you start early and can do it well for decades, it will be life changing, and you really don’t have to worry about retirement planning.

If you can invest and compound between 15-25%+ CAGR for 20-40 years, and provided you keep your own expectations low, you are going to have sufficient wealth to do what you want, where you want, with who you want, and when you want. I started very late at age 33, it is perfectly okay. The best time to start investing was yesterday, but the next best time is today.

Re-figuring out (how to become a great professional investor)

25 | Stepping into it and living life without regrets

I just turned 40 late last year. I know if I don’t do it now, and fast forward if I am on my deathbed, I will deeply regret not having doing tried. I have been preparing for this very day for the last 4 years, getting sufficient savings and preparing my mindset for this.

Investing is my Ikigai, what I truly love, what the world needs, what I think I am good at, and what I think can be paid (if I do well). I know it, I want to live it, and breathe it everyday for the rest of my life.

Throughout my journey, from time to time, I always had potential investors ask me if I could invest for them, which I could not. I recently resigned from my full-time job in preparation for this very day. It is the biggest step I have taken in my entire life, to go on the entrepreneurial journey, I want to do this for as long as I can, into my 70-80s and even older if possible. I will keep my body and mind active, healthy and strong everyday for as long as I can, to allow me to keep doing my investing work.

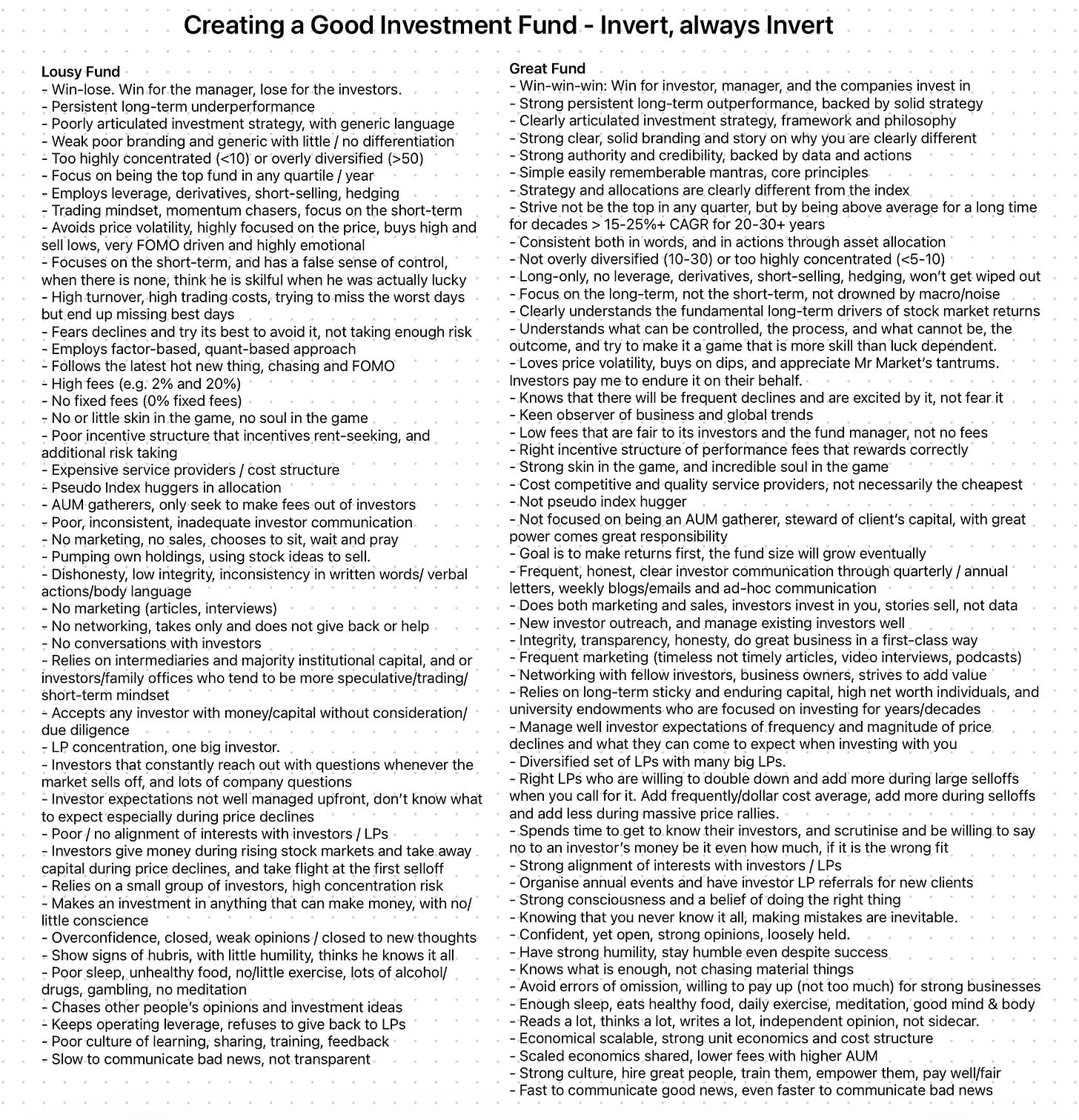

26 | Relearning what it takes to be a good investor and fund manager

I started my investment journey from first principles setting out to prove that an individual investor can beat the market. The next phase of my journey is to be a professional investor investing money for others. The unfortunate truth is that ~80-90% professional investors fail to beat the market too over long periods. Again, I went back to first principles, focused on what a great and poor investment manager is like, and intentionally choosing what works and avoiding what doesn’t.

27 | Being thoughtful and creating an enduring fund that is positioned to do well

I will be looking to start my very own investment fund in the coming months and for the first time accept external capital to invest on behalf of other investors. The philosophy and strategy will continue to remain largely the same. As much I love investing in enduring quality growing and profitable businesses, the fund itself too has to be one. The structure has been well thought through over the last 6 months, and it still represents the most attractive long-term strategy for me to grow my wealth.

28 | Investing significantly alongside my future investors

I will be liquidating my entire portfolio of Vision Capital soon, of which the entire proceeds will be invested alongside all of my future investors. Goodbye Vision Capital.

It is sizeable (for me), it has grown with my own hard-earned savings from investing in stocks substantially. It represents the significant majority of my liquid investable net worth, of which I will be amongst one of the largest investors in the fund.

29 | There will be price declines, need to find the right long-term focused investors

It will not be easy especially for the first few years, there will be zigs and zags, ups and downs, and there will be frequent price declines. Not every investors will be right for us, only a few of will be.

They tend to be truly long-term focused, patient with the capital they let us manage, understand our investment philosophy and strategy, stocks are part ownership stakes of businesses, and if the businesses keep growing profitably well for long periods of time, eventually they will do well, and we should do well too. I am only as strong as my investor base, selecting the right investors are crucial, and be willing to say no if they are not the right fit.

In addition, if I continue to be extremely thoughtful about the decision making on owning quality durable growing profitable companies at reasonable prices, I believe the investment results will eventually show for itself. I do not aim to be the top investor in any given year, but rather do well enough every year, to eventually become one of the top investors over the next few decades.

30 | A long vehicle to grow my investor’s wealth alongside mine for decades

The new investment fund, would be a long-term vehicle to grow all my future investors wealth alongside mine, well for the next few decades by investing in companies that best reflect our vision of the future, changing and shaping the world for the better. We are very thoughtful over the types of companies that we invest in and the right investors to join us early in the journey.

If we do it right over the long-term, our investors and us will get to enjoy the fruits of our labour and pursue the other interests and passions in life that they so desire. This is something that I am truly excited to embark on this new adventure and journey ahead as a long-term steward of capital.

Final Thoughts

One can be an outsider, but if one is willing to put in the hard work, go back to first principles, focus on what matters most, adopt what works, invert and avoid what doesn’t, you can rinse and repeat each time, and get you close to what you want.

Yet it is not going to be easy, there will be ups and downs, be patient and have grit. If you structure your own game right, you should be able to do well over the long-term eventually, where most are plain focused on the short-term.

Personal Story

Wanted to share a personal story where we recently had a pair of olive-backed sunbirds building their hanging nest on our olive tree, at our balcony in our home in Singapore. We were delighted to welcome them to our home. It was an untidy nest, and our balcony floor was littered with fallen nest materials, but we didn’t mind.

Eggs have been laid, and the female sunbird has been incubating on and off during the day and full time at night over the last week. We are looking forward to see the eggs hatch in the coming week, hear the chicks chirp for the first time, watch them get older and fledge, and then get ready to take flight and leave the nest.

It was amazing to see how timely and beautiful this was, as it reminded me deeply of the journey that I am going to embark on with a new beginning.

09 June 2024 | Eugene Ng | Vision Capital Fund | eugene.ng@visioncapitalfund.co

Find out more about Vision Capital Fund.

You can read my prior Annual Letters for Vision Capital here. If you like to learn more about my new journey with Vision Capital Fund, please email me.

Follow me on Twitter/X @EugeneNg_VCap

Check out our book on Investing, “Vision Investing: How We Beat Wall Street & You Can, Too”. We truly believe the individual investor can beat the market over the long run. The book chronicles our entire investment approach. It explains why we invest the way we do, how we invest, what we look out for in the companies, where we find them, and when we invest in them. It is available for purchase via Amazon, currently available in two formats: Paperback and eBook.

Join my email list for more investing insights. Note that it tends to be ad hoc and infrequent, as we aim to write timeless, not timely, content.

All the best Eugene ! Rooting for you

It is very perceptive and well written. Thank you from France. John