Learning from one of the world’s best investor few heard of - Shelby Cullom Davis (23% CAGR over 47 years)

A tale of time, patience, and focus.

Sharing my key takeaways from “The Davis Dynasty - Fifty Years of Successful Investing on Wall Street (2001) by John Rothchild”, on Shelby Cullom Davis (1909-1994). It was a lovely tale of investing, how Shelby Davis the investor became, and how he his children and grandchildren were raised well but via a very difficult approach, but eventually they all came back together as a family via investing. It was a book I thoroughly enjoyed and would recommend reading.

We constantly seek to learn from the best investing greats, to seek why and what they did to have resulted in them doing well. So that we can adopt what works for us, and avoid what they have done less well yet constantly considering its relevance to the overall and current historical context.

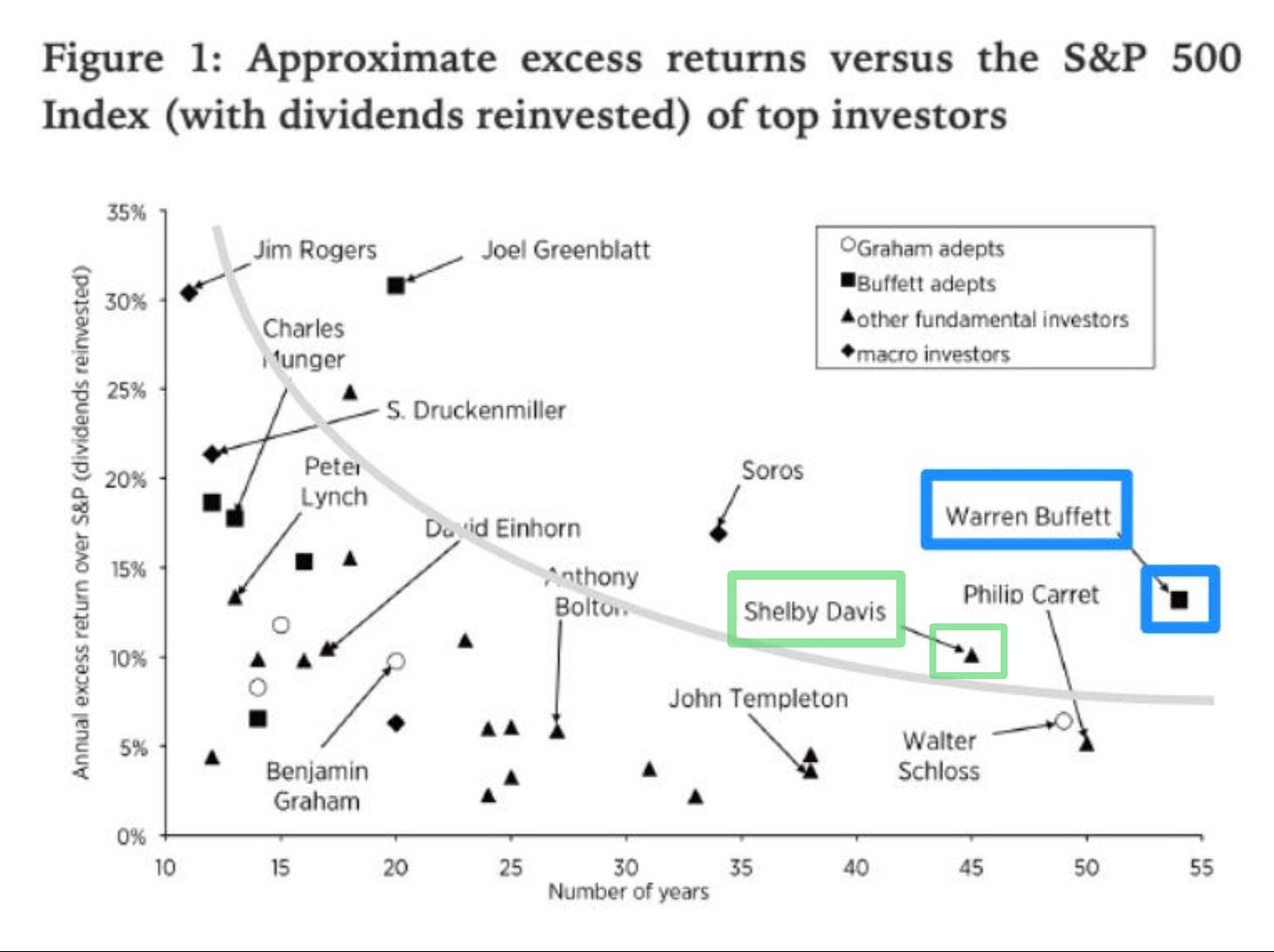

Shelby Davis is clearly amongst the top investors in the world, up there with Warren Buffett and Berkshire Hathaway, and more importantly he did it for so long.

All compounding is returns to the power of time, and time is the exponent. Thus Shelby Davis’s ability to do well over such long periods of time of close of almost five decades, really got us excited to want to find out more about what he did differently.

My 24 Key Take-aways from the Book

1 | He started fairly late, and did it all with his own capital

Shelby Davis quits at age 38 in 1947 with $50,000 seed capital from his wife Kathryn Wasserman, and turned $50k into $900m over 47 years at 23% CAGR.

It is far better to start late, than not at all, and more importantly, to do it well over long periods of time.

2 | He invested for the long term.

He never lost faith in Edgar Lawrence Smith's credo that, stocks pay off in the long run.

He is in the market for the long pull and temporary setbacks do not discourage him.

Stocks may be risky for one, three, or even five years, but not 10 or 15 years.

3 | He knew what drove long-term stock prices - earnings.

Stock prices ride on a company's earnings. Eventually, earnings, or the lack of same, determine whether the shareholder wins or loses.

4 | He invested through all kinds of markets

Along the way, Davis invested through two lengthy bull markets, 25 corrections, two savage bear markets, one crash, seven mild bear markets, and nine recessions; three major wars; one presidential assassination, one resignation, resignation, and one impeachment; 34 years of rising interest rates and 18 years of falling interest rates.

He sat through mild bear markets and severe bear markets, crashes, and corrections. He sat through scores of analysts' upgrades and downgrades, technical sell signals, and fundamental blips. As long as he believed in the strength of the leadership and the company's continual ability to compound, he held.

5 | He held through bear markets

Davis was panic-proof. Wall Street's daily, weekly, monthly, and yearly ups and downs didn't alter his strategy. He held on to shares through demoralizing declines, knowing that the market had misjudged the true attractiveness of the contents of his portfolio. Bear markets didn't rattle him.

You make most of your money in a bear market, you just don't realize it at the time.

6 | He only focused investing in stocks, not bonds.

History has shown that equities are the best way to build long-term wealth.

Davis became an antibond maverick. He realised for maximum compounding, stocks can be held indefinitely, while bonds outperform intermittently.

Stocks were superior wealth producers. A stock was a slice of corporate ownership, and, if the company thrived, its upside was unlimited.

A bondholder's reward getting his money back, plus interest, which was limited, no matter how well a company fared.

7 | He mostly bought and held, sold some

Davis's portfolio had the constancy of a dowager's living room. If a company he owned failed to meet his expectations, he disposed of it. If it merged with or was acquired by a larger company, he'd sometimes take his profit and invest elsewhere. But these were exceptional cases. Mostly, he bought and held.

8 | He avoided cheap and expensive stocks

Avoid cheap stocks. Most cheap stocks deserve to be cheap because they're attached to dud companies. Chances are, a dud company will stay that way.

Avoid expensive stocks. No business is attractive at any price. He was willing to wait until the price is right. When you like a company but not the price tag, wait for a chance to pay less.

9 | He refused to overpay.

Buying stingy became a Davis hallmark. Buying good businesses at cheap prices.

Your chances of picking the bottom of the market are very slim, but if you're within five or ten percent, your gains can be extraordinary.

10 | His favourite double play - Earnings and Higher Multiple

Davis called this sort of lucrative transformation "Davis Double Play." As a company's earnings advanced, giving the stock an initial boost, investors put a higher price tag on the earnings, giving the stock a second boost. The advantages of investing in low key companies that can deliver steady, if unspectacular earnings at a modest price.

11 | He had two sources of gains

One was slow-growth industries (steady but less spectacular 10-15% growers) where expectations were low and profits lacklustre.

The other was great growth companies priced for mediocrity (or Growth as a Reasonable Price - GARP).

We buy at a bargain price we can live with for a long time. Eventually, we hope to see the stock sell at `fair value,' and once it reaches that point, we tend to keep it as long as earnings continue to rise. We like to buy at a value price but we want to end up with growth companies.

12 | He was different and independent.

Great investing requires an independent spirit, and the courage to acquire assets the crowd disdains. Disdain creates bargains.

He zigged when others zagged, buying when others avoid. He was fearful when others are greedy, and was greedy when others are fearful.

12 | He focused on his expertise - Insurance

He was the Deputy Superintendent of Insurance for State for New York, and he used his insurance expertise (which also coincided with the rise in insurance industry) and focused on investing in insurance stocks.

Some insiders began calling him "the dean of American insurance”.

Davis was a walking Rolodex or Who's Who of industry notables; an almanac of underwriters small and large; an encyclopaedia of actuarial trivia; a database on earnings, assets, and liabilities; an appendix of footnotes and sources.

13 | He focused on buying cheap insurance companies that were undervalued

Davis realised many insurance companies were sitting on hidden assets their stock prices didn't begin to reflect, hidding their true profitability,

Davis bought when insurers were cheap, especially the mom-and-pop kind in his original portfolio. When these small companies were acquired by bigger companies, Davis reaped a windfall. All the names in his original portfolio were gone. After six years of jockeying and maneuvering, he'd found companies he felt comfortable owning for extended periods.

He didn't buy insurers indiscriminately. He made sure it was profitable and its portfolio solid (not junk bonds).

14 | He swung to buying low cost, high profit, well managed compounders.

The insurance industry was an inferior one, his approach similar to Buffett was to buy the low-cost operators. Both sought high-profit, well-managed insurers with minimal overhead, like GEICO and AIG. Inspired leadership was paramount

He caught the post WWII boom in home, auto and life insurance, avoiding chronic underachievers, sought out sought out aggressive, low-cost compounding machines like the Japanese insurers, Berkshire Hathaway, and AIG, which steadily enhanced shareholder value for decades.

Seven US insurance stocks gave him the kind of liftoff that today's investors might associate with high-tech names.

15 | Building a global portfolio of insurance stocks

Before long, Davis had assembled a United Nations of insurance stocks: 35 Dutch, German, French, and Italian holdings were purchased to complement his Japanese holdings.

16 | Insurance was the tailwind that Davis had during his time

Invest in a theme / tailwinds. "Bottoms-up" stockpickers invest in companies that have favorable attributes. Be top down and bottoms up. Before putting new cash to work, looks for "themes." Most of the time, themes are obvious.

Important to look out for long-term themes and tailwinds, and find the winners that have shown signs and are likely to emerge as top dogs, and invest in them early, hold them through long periods of time.

17 | He did not fight progress, stayed open

Shelby chose his tech stocks carefully, but he didn't avoid them entirely, as two well-known technophobes, Buffett and Peter Lynch, had done. As long as he could find reasonably priced companies with real earnings and established franchises, he was eager to invite technology into his portfolio.

18 | Not letting emotions sway investing decisions - Lessons from GEICO

Davis was 52 when he discovered GEICO in the early 1960s. His research led him to the same lode Warren Buffett and Benjamin Graham had already worked.

GEICO was a cash cow on speed, and Davis took a sizable chunk of the ownership. GEICO put Davis on the board.

Through 1974 to 1975, the company lied about its problems to the press and to its own board, including Davis. As the biggest shareholder, Davis was the biggest loser. Benjamin Graham wasn't far behind.

GEICO was still a low-cost operator; Byrne said it was. Byrne insisted that if the company survived, its legendary profitability would return. Based on these assurances, Buffett bought 500,000 shares at $21/8 and left a standing order to buy millions more.

Davis stormed out of the meeting, returned to his office, and promptly sold his entire GEICO stake. Customarily, Davis never let his emotions sway his investing, but this time he was too angry to admire GEICO's future profitability and Buffett's million-dollar vote of confidence.

To the end of his life, Davis regretted selling. Davis called Byrne and said, "if I'd known you were going to reverse the dilution, I wouldn't have sold."

19 | He took smart leverage, ran his own capital, not external

He first paid cash for his house, used the leverage instead with stocks, margin kept him focused.

He was running his own capital, not external, so all he needed was managing his own expectations versus the increased volatility as a result of margin.

His NYSE seat could allow his to borrow more than an individual investor, and paid lower interest rate on the margin loans, and the interest was tax-deductible.

Davis’s investing style had a good margin of safety which allowed him to use leverage wisely, and diversification and with Japan helped.

The leverage that Davis employed through the margin loans was not excessive, around ~50% or 2X, not an insane 10X, 50X, 100X which is bound to wipe most out in a matter of time.

20 | Buying everything, from 30-50 names into the hundreds / thousands later on.

In the late innings of his career, Davis strayed from his favorite industry and started buying everything.

Many CEOs he had befriended had retired, and he didn't necessarily trust the information he got from secondary sources in investor relations departments.

Sensing he was out of the loop, and lacking the confidence to make big bets, he made hundreds of small bets.

For three decades, his portfolio had contained only 30 to 50 names; now, the roster grew into the hundreds.

21 | Diversified, never concentrated did not wipe him out even with margin

Thankfully he had Japan. Yet, given Davis's appetite for margin, his 60% loss (from $50 million to $20 million) was well contained.

Without Japan and without changing the mix in his portfolio, 1973 to 1974 might have wiped him out.

22 | Power laws - The minority accounted for the majority of returns

Three-quarters (75%) of Shelby Davis's assets (1992) were riding on 100 insurers worldwide; the rest were scattered among 1,500 companies of all stripes and sizes.

Davis Dozen-12 stocks (AIG, Tokio Marine & Fire, , Sumitomo Marine & Fire, and Yasuda Fire and Marine, Berkshire Hathaway, Torchmark, AON, Chubb, Capital Holdings, and Progressive, and Fannie Mae).

The bottom line on this portfolio is: A few big winners are what count in a lifetime of investing, and these winners need many years to appreciate. All of the Davis Dozen had been parked in his portfolio since the mid-1970s.

23 | Losers didn’t matter.

On the minus side of the ledger, Shelby and Chris found an ample assortment of flops, bombs, and wealth busters-or whatever other name fits stocks investors wish they'd never met.

His portfolio proved once again that, over a lifetime of investing, a handful of high achievers' ideas can support a multitude of ne'er-do-wells.

24 | Not selling the winners

The prize required a 50-year waiting period to accumulate, but Davis lived comfortably on small, anticipatory withdrawals along the way. Once he'd bought winning companies, his best decisions were never to sell.

10 Tenets of Davis Strategy

Avoid cheap stocks.

Avoid expensive stocks.

Buy moderately priced stocks in companies that grow moderately fast.

Wait until the price is right.

Don't fight progress.

Invest in a theme / tailwinds.

Let your winners ride.

Bet on superior management.

Ignore the rear-view mirror.

Stay the course.

New York Venture Fund Stock Checklist

Our best bear protection is buying companies with strong balance sheets, low debt, real earnings, and powerful franchises.

First-class management with a proven record of keeping its word.

Does innovative research and uses technology to maximum advantage.

Sells products or services that don't become obsolete.

Insiders own a large chunk of shares and have a personal stake in the company's success.

Company deliver strong returns on investors' capital, and managers are committed to rewarding investors.

Expenses are kept to a minimum, which makes the company a low-cost producer.

Company enjoys a dominant or a growing share in a growing market.

Company is adept at acquiring competitors and making them more profitable.

Company has a strong balance sheet

My 8 personal key takeaways

Investing for the long-term. One can start late, and can still do very well if done for a long period of time. Need to stay invested through all kinds of market conditions, and be patient and have the fortitude.

Still not taking leverage. Leverage can kill, and the stress is unnecessary. He could do it because he was only running his own capital, not external capital and with his strategy of not overpaying allowing for a margin of safety. If we choose to overpay a little sometimes, and have larger volatility, then leverage is absolutely not the right strategy for us.

Diversification as a process, concentration as an outcome. Eventually power laws will become increasingly evident over time. The gains from the multi-bagger winners will overwhelm all the losses from the losers combined. There will be losers, but they are not going to matter.

Need to be open to new businesses. At Davis time, it was insurance stocks, not necessarily now. One needs to be aware of the current long-term themes / tailwinds, and seek out the best companies that are likely to dominate and benefit as a result.

Traits of winning companies. The traits that both Shelby Davis (old and young) both seek are very similar to what we look out for as well.

Not overpaying ridiculously. It is crucial. It is okay to overpay a little, but not insanely till it compromises negatively on future returns. The sweet spot of growth versus reasonable price makes a lot of sense.

Important to be frugal, but not overkill. Frugality is good. But it is also okay to occasionally enjoy from time to time, don’t wait until you are old, and cannot longer do the things that you wanted to do.

Having a supportive wife / family helps. Shelby Davis had a very supportive wife throughout over 60+ years. He raised his kids well, but gave them really tough love during their childhood.

12 Nov 2023 | Eugene Ng | Vision Capital Fund | eugene.ng@visioncapitalfund.co

Find out more about Vision Capital Fund.

You can read my prior Annual Letters for Vision Capital here. If you like to learn more about my new journey with Vision Capital Fund, please email me.

Follow me on Twitter/X @EugeneNg_VCap

Check out our book on Investing, “Vision Investing: How We Beat Wall Street & You Can, Too”. We truly believe the individual investor can beat the market over the long run. The book chronicles our entire investment approach. It explains why we invest the way we do, how we invest, what we look out for in the companies, where we find them, and when we invest in them. It is available for purchase via Amazon, currently available in two formats: Paperback and eBook.

Join my email list for more investing insights. Note that it tends to be ad hoc and infrequent, as we aim to write timeless, not timely, content.